The SPY broke an incredible winning streak yesterday, closing slightly lower ahead of Powell’s speech in Jackson Hole on Friday.

If the index had closed higher yesterday, that would have marked its longest winning streak in nearly 20 years.

The markets seem to think Doomsday is behind us, but the crazy mix of headwinds and tailwinds makes things very hard to predict. As usual, Chair Powell will likely have the final say.

Meanwhile, on that incredibly bloody Monday earlier this month, I alerted you to a small biotech stock that I thought could be on the cusp of a breakout. But even I didn’t expect what happened…

When I wrote to you about it a couple of weeks ago, it was hovering around $3.50. On Monday — very briefly — it hit a whopping $15.00 a share.

If you managed to watch that whole move, it was more than 300% possible without any options. Congratulations!

Right now, I’m looking at another small biotech that I’ve watched churn out one piece of great news after the next, but investors don’t seem to have caught on — until now…

Go ahead and pull up Aclarion, Inc. (ACON) on your platform. Let me explain what I see.

Like I said, we had a slight downturn in the markets yesterday, but even in the face of that, ACON pulled the “Gamma Trigger” and reversed to an uptrend.

If the stock was simply riding the broader market, I probably wouldn’t bring it to your attention, but these “against the flow” moves are really worth paying attention to, especially on the heels of a downtrend.

I’d consider this new uptrend broken if it dips down to $0.22.

On the other hand, the stock recently had big support at $0.28, which could now act as resistance. If ACON breaks that ceiling, we could be looking at a major move higher.

I’ve watched this company for a while because it offers a simple-to-understand medical service that makes a lot of sense, and that could become the standard of care for those suffering from chronic lower back pain.

Like me, I’m sure you know a lot of weekend warriors and also keyboard warriors who suffer from low back pain…

I’ve seen it effectively cripple some people. Sitting down bothers them, but standing up does, too. Their waking lives wind up looking like a painful game of musical chairs.

The trouble is that diagnosing the source of the pain is very difficult.

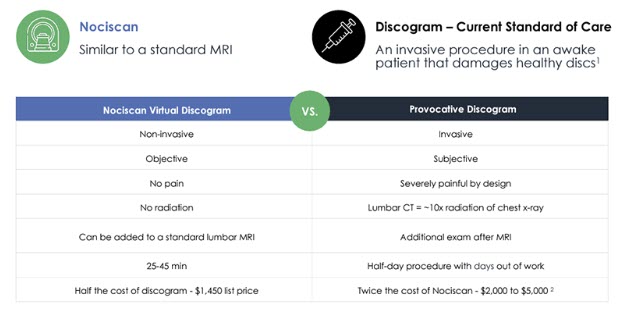

When MRIs and CT scans don’t show a clear source of pain, the gold standard diagnostic procedure is something called “provocative discography,” which involves injecting dye into one or more discs in the spine to determine if a specific disc is causing pain.

The procedure is very expensive, invasive, and by design it causes the patient a lot of pain.

ACON has a different approach. Using a proprietary innovation called Nociscan, the company helps physicians noninvasively assess the source of chronic lower back pain.

Nociscan was developed over the course of a decade at the University of California San Francisco, and ACON now has the exclusive worldwide license.

The Colorado-based company also holds 23 issued U.S. patents and 17 international patents related to the tech.

Allow me to nerd out for a second to explain how it works…

It starts with a regular MRI machine, which, through a sequence called “spectroscopy,” can determine the quantities of certain biomarkers inside a spinal disc.

Those data are sent to ACON in the cloud and Nociscan applies machine-learned and clinically validated algorithms to produce a report on the source of the pain.

The idea is that painful discs are high in certain acids, which leak out and hit nerves, resulting in pain. By comparing levels of these acids to structural integrity measurements, Nociscan helps identify painful discs with great accuracy.

The important thing is that Nociscan is the first platform to use MR spectroscopy for this purpose, and it has clear advantages over provocative discography:

Source: Investor presentation

In 2023, the company published an analysis by an independent PhD healthcare economist that found Nociscan implementation could result in $441 million in annualized cost savings in the U.S. as well as better outcomes for patients.

The analysis was presented at the International Society for the Advancement of Spine Surgery (ISASS), the American Society of Pain and Neuroscience (ASPN), and the Society for Medical Decision Making (SMDM).

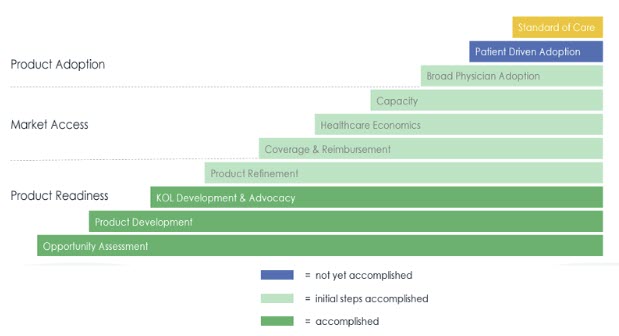

ACON has enrolled more than 10 leading spine surgery Key Opinion Leaders (KOLs) to help further validate Nociscan.

In February, the company announced the initiation of its pivotal “CLARITY” study, which it expects will further demonstrate improved clinical outcomes for surgical patients whose surgeons utilize Nociscan.

Impressively, the study’s principal investigator is Dr. Nicholas Theodore, the Director of the Neurosurgical Spine Center at John Hopkins Medicine.

The company is steadily marching toward its goal of becoming the standard of care:

Source: Investor presentation

Already, as of November, it completed its 1,000th commercial Nociscan, and in June, it expanded its commercial engagement with the prestigious London Clinic to provide Nociscan to its patients.

The London Clinic found “compelling results” with initial patients evaluated with Nociscan, and said it is “convinced this will be a game changer for how we will evaluate and plan treatment for this common and distressing clinical condition.”

An investor presentation released this month notes that “Nociscan is now covered by three of the top four private medical insurers in the UK.”

Just last week, ACON announced a commercial agreement with Sheridan Community Hospital in Michigan, whose CEO Lili Petricevic said, “We are thrilled to engage with Aclarion and bring their innovative solution, Nociscan, to our community. Low back pain affects our community and Nociscan will be a valuable decision support tool when choosing treatment options.”

Right now, ACON is covered by two analysts: Ascendiant Capital which initiated a BUY rating on July 29, and the Maxim Group, which reiterated its BUY rating on May 22…

The average of their forecasts is $1.55, which represents a 567% upside from its current price.

Spend time right now doing your own research on the stock, and of course, always approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

This could be a big day for ACON, so keep it on high alert!

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

👊 Make sure you are getting my mobile text alerts – text “RAGE” to 1-(888) 404-5747 to get all of my latest HOT STOCK ideas delivered right to your phone (make sure you put the “1” at the front!). Don’t miss out!

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received seventeen thousand five hundred dollars (cash) from Interactive Offers for advertising Aclarion, Inc for a one day marketing program on August 21, 2024. This was paid by someone else not connected to Aclarion, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Aclarion, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.