*Sponsored by TD Media

With all the chaos unfolding in the Middle East, and the presidential race heating up, the news cycle is getting loud 📣.

The same uncertainty that was there during COVID and the riots that followed makes it feel like fear is really back.

That means emotion is governing the markets. Sober assessments of P/E ratios, balance sheets, and corporate governance are still relevant, but are taking a back seat.

At times like these, it makes sense to narrow our focus…

We don’t want to be going long on positions that leave us exposed to geopolitical winds we can’t possibly predict.

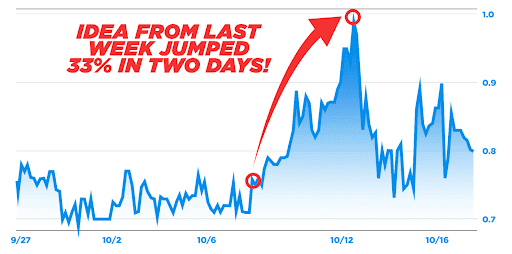

That’s why last week I sent you two “Bright Ideas 💡” that I felt had imminent potential. One of them has traded essentially sideways (I think it’s still just gathering steam)… but the other…

It rocketed 🚀33% within two days of my alert:

I had followed both companies for a while, but as I explained last week, my decision to alert them leaned heavily on the “go/no go” algorithm — a computer-generated indicator that distills over a dozen different momentum indicators to make a best prediction of where a stock is going.

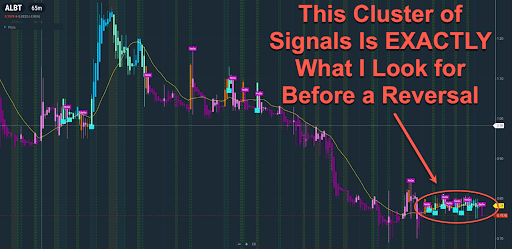

I pointed out that a major green light I look for is “multiple, conflicting go/no-go markers along the trendline just before the chart [legs] up. These mixed signals are a classic indicator I’ve seen play out countless times before reversals.”

Well, folks, yesterday as I was surveying some of my favorite small caps, I came across one that’s flashing green so clearly I knew I had to bring it to your attention…Right now, the only stock you need to have eyes on 👀 is:

Avalon GloboCare Corp (Nasdaq: ALBT)

Have a look at this:

Drawdown ✅… flatline ✅… mixed go/no go signals ✅✅✅✅✅✅…

This is looking like a picture-perfect setup for a reversal.

And take a look at the left side of the chart. Right there, you can see a cluster of mixed go/no go’s that preceded a 35% rally… and that was just a few weeks ago.

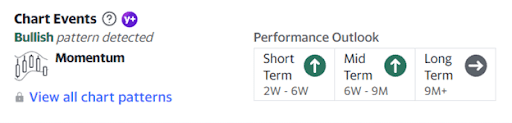

Yahoo! is also confirming things. Flashing green lights in the short- and medium-term:

Digging in further, there I found other reasons for excitement…

Key asset is making “rapid progress toward commercialization”

At its core, ALBT is a medical diagnostics company. This includes in-person testing facilities for drug testing, clinical screening, COVID testing, and so on…

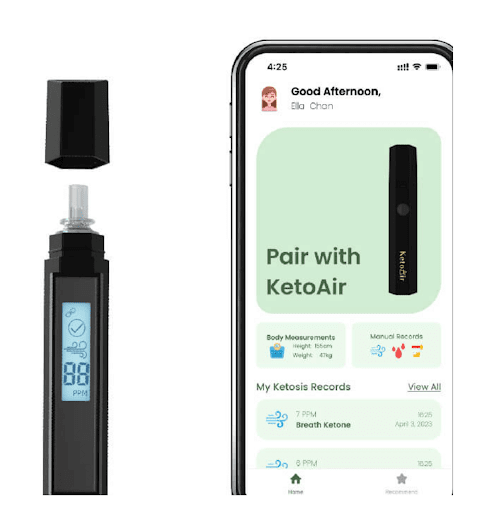

But it also includes a cool system the company is looking to bring to people’s homes.

KetoAir™ is an FDA-registered breathalyzer that monitors ketone levels by quantifying the amount of acetone in the breath.

If you aren’t familiar with ketones, they’re acids your body makes when it burns fat instead of sugar for energy…

Back in my day, low-fat diets were all the rage, but the trendy thing over the past decade or so has been low-carb dieting.

When carbs are cut down very low, the body enters “ketosis” and ketone levels go way up.

But for those practicing “ketogenic” dieting, knowing whether you’re in ketosis or not is pretty much a guessing game. Serious adherents can use “keto strips” to do at-home urinalysis, but for obvious reasons, that’s unappealing, and the results aren’t very clear.

Enter KetoAir™, which allows quick (and sanitary!) ketone readings delivered straight to your smartphone, followed by customized recommendations by an artificial intelligence (AI) nutritionist.

The big news out this month is that the KetoAir™ app is now approved on the Apple App store (it was already on the Google Play store).

The company said back in July that it was making “rapid progress towards commercialization of the KetoAir™ breathalyzer device and related accessories” and that it was “evaluating options for commercialization, including identifying distribution partners or distributing KetoAir™ ourselves.”

The App store news tells me the company is getting closer to achieving this goal.

ALBT only just acquired the distribution rights to KetoAir™ this year, and has its sights set not only on North America, but South America, the United Kingdom, and the European Union as well.

This is a very promising system, and once it starts rolling off assembly lines and into dieters’ hungry hands, it should generate major revenue for ALBT.

New acquisitions

Also earlier this year, ALBT acquired a 40% stake in Laboratory Services MSO (“LSM”), a lab based in Costa Mesa, California, that brought in $14 million in revenue and $6 million in net income in 2022.

But here is the interesting part that not many traders know about. Just last month, LSM acquired Merlin Medical Supply, a “profitable, well-established Home Medical Equipment (“HME”) and Durable Medical Equipment (“DME”) company … in Ventura County, California.”

LSM also acquired a company called Leading Edge Innovations from the same owner as MMS. The importance? “Leading Edge Innovations owns the GeeWhiz External Condom Catheter, a patented, FDA-registered, in-market, male incontinence device.”

For the sake of you, dear reader, I researched GeeWhiz (so you don’t have to!) and was able to find it easily at many medical supply stores online. It even has a Facebook page!

Two months ago, LSM announced its expansion to Arizona, with a new lab called Veritas Laboratories opening in Scottsdale.

I was intrigued to learn that the company had engaged former congressman Barry M. Goldwater, Jr. (the son of the famous presidential nominee) to help expand its footprint in Arizona.

“LSM continues to grow its testing footprint nationwide by expanding to new states and territories,” the ALBT CEO said in a statement.

By expanding its ownership of diagnostics centers, ALBT is shoring up more reliable revenue streams even as it works toward getting KetoAir™ to market…

I like this diversified approach because it blends higher-risk pursuits with lower-risk sources of revenue. I think this bodes well for the company’s future bottom line.

Wrapping up

ALBT is worth your attention right now as a “bottom-bounce play.”

For the past three weeks, the stock has traded sideways — indicating a strong floor of resistance — and the go/no go algorithm is signaling a breakout like we saw on last week’s idea could be imminent.

There are a number of more “fundamental” factors that could add fuel to the breakout, and I like the moves the company is making to expand its revenue streams.

At the very least, I think ALBT merits your attention right now. Just like I said for last week’s idea before it popped 33%, “This is an opportunity that might be gone before you know it.”

Emotion is ruling the day in the markets, yes, but it’s up to us to do our due diligence on these targeted opportunities. Scour the company’s website, study its chart, and decide if ALBT is something that fits your risk appetite.

In the meantime, I’ll keep hunting for small-cap opportunities and hopefully be in touch soon with more choice cuts.

To Your Success,

*This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results.

*PAID ADVERTISEMENT. Raging Bull has currently been paid sixteen thousand dollars from TD Media for advertising Avalon Global Care Corp from a period beginning on October 18 through October 19, 2023. Raging Bull has previously been paid fifteen thousand dollars from Winning Media who was compensated by One Eyed Jack Media for advertising Avalon Global Care Corp from a period beginning on September 4 through September 6, 2023. RagingBull has previously been paid fifteen thousand dollars via ach bank transfer by Lifewater Media for advertising Avalon GloboCare from a period beginning on March thirteenth, 2023 through March fourteenth of the same year. RagingBull has been previously paid ten thousand dollars via ach bank transfer by Lifewater Media for advertising Avalon GloboCare from a period beginning on February thirteenth, 2023 through February fourteenth of the same year. The third party, Company, or their affiliates may own and likely wish to liquidate shares of the Company at or near the time you receive this advertisement, which has the potential to hurt share prices. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, the owners of Raging Bull, do not hold a position in Avalon GloboCare. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Avalon GloboCare, increased trading volume, and possibly an increased share price of the Avalon GloboCare securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in Avalon GloboCare, though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull can guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at

https://www.sec.gov/edgar/searchedgar/companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.

WE MAY HOLD SECURITIES DISCUSSED. Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.