![]()

Did you know over 2,000 each day visit this room

for trading alerts and education?

Why are you not one of them yet?

The wait is over! Click here to join our real-money, real-time traders and educators breaking down Wall Street’s biggest moving stocks and options.

Here we are, the other side of Fed Day.

It feels like there is a BC and AC when it comes to trading — “before cuts” and “after cuts.”

JPow delivered a bold, half-point cut — the largest in 16 years — which initially tantalized the markets before they quickly sobered and closed somewhat down.

It’s the first easing cycle since the early days of the Covid era in 2020.

Powell played it cool in the presser, but I suspect there’s more desperation in this move than he’s letting on.

Ultimately, though, I think that after an initial wave of selling, the bulls will keep carrying this higher…

And as always, some companies will rise above the rest.

I’ve been nailing my hot stock ideas 🔥 this week, with a 70% jumper on Monday… a 40%’er on Tuesday… and a respectable 35% mover yesterday…

I gotta say, this has been one of the best weeks in ages to follow these small-cap momentum plays.

Just don’t get too attached to them. As quickly as a trend can break out to the upside, it can also break back down.

I’m back at it this morning with another “tactical trading” idea.

This time it is a California-based fintech company with some impressive news lately.

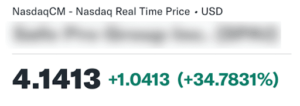

Pull up your favorite chart platform and have a look at AppTech Payments Corp. (APCX).

You’ll see that the stock has had some impressive runups, with a 30% jump in two weeks in July… a 61% spike in less than a week last month… and a 30% runup to start this month.

It started a brand-new Gamma Trigger move yesterday with a fresh “GO” signal, but then dropped nearly 10% right back down after the market tanked…

I think that was a gift from the trading gods, actually.

When a stock starts a move like that, something big is brewing. All stocks can be at the mercy of the broad market, so don’t be fooled by a “fakeout” like yesterday’s action.

With the market making a colossal reversal this morning, I think APCX needs to be on everyone’s radar right now.

Trading at just over half of its high-water mark last month, I think it deserves a good look at this level, and today could be the day we see a big rebound. (In fact, it has already begun bouncing back in the pre-market.)

Keep APCX at the top of your radar today and see if I’m right.

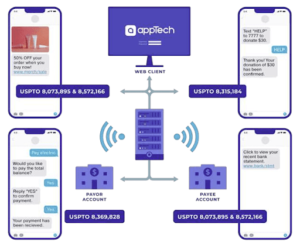

The company itself was established in 2013, and it was an early mover in several critical areas where it has secured 18 total patents.

The first major area is in mobile payments, where it holds “4 mobile technology patents that range from System & Method for Delivering Web Content to a Mobile Device, Computer to Mobile Two-Way Chat System & Method, and Mobile to Mobile payment.”

The second major area is in geolocation technology, where it has “13 patents that are focused on the delivery, purchase, or request of any products or services within specific geolocation and time parameters, provided by a consumer’s mobile phone anywhere in the United States. This portfolio houses the patent that protects all advertising on a mobile phone, including in a store’s mobile application.”

APCX’s patents have been cited by the likes of Google Play, iTunes, PayPal, Venmo, and Amazon, and one of its sources of revenue is licensing its intellectual property.

For instance, the company has licensed four of its patents to PayToMe.co, an award-winning digital-payment platform that started in 2023 but already has more than 100,000 clients.

APCX is a 7.5% stakeholder in PayToMe.co, and CEO Luke D’Angelo says that APCX’s partnership is “a testament to AppTech’s foresight in patent licensing and our commitment to driving progress in Fintech.”

Apart from licensing its intellectual property, the company generates revenue with its own fintech offerings.

Commerse™ is a portal designed to offer independent sales organizations and software vendors (ISO/ISVs) scalable payment solutions, digital banking, and merchant services.

In October 2023, APCX acquired FinZeo™, integrating its payment and banking technologies into the Commerse platform.

The result is a comprehensive fintech stack that provides services such as:

- Standard credit-card processing

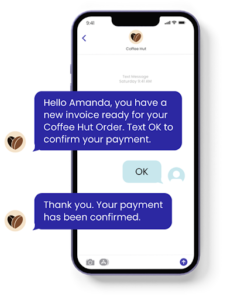

- Text-to-pay technology

Text-to-pay technology in action.

- eChecks

- ACH transactions

- Instant bank verification

- Bank account validation

- Instant funding

- Digital banking

- Interactive Voice Response (IVR)

- Developer API

- Advanced Security

And much more.

The company’s website features testimonials from business leaders such as Patrick Clouden, CEO of Consumer Energy Solutions in Tampa, Florida:

“AppTech has been our payment processing vendor for quite some time now. Their rates and fees were lower in every category than the vendor we were using. Their ability to assist us in both our face-to-face transactions and our e-commerce processing has been extremely helpful. Their attention to detail and willingness to help with any situation that comes up makes them a valuable asset.”

The company says it expects “exponential revenue growth” this year thanks to the FinZeo acquisition and anticipated large contracts with international airports.

The first such contract was signed with Reno-Tahoe International Airport (RNO) in January. APCX boarded RNO onto the FinZeo platform, which “manages a majority of financial transactions within the airport’s facilities.”

The company said in that announcement that RNO is the first of forty such airports it expects to onboard this year, and that it anticipates more than 400 airports to sign on in coming years.

In February, APCX announced that its strategic partner, InstaCash, Inc., was on track to launch its “cutting edge peer-to-peer mobile payments platform.”

It said InstaCash will rival “Venmo, Zelle, and Cash App with lower fees and advanced security protocols.”

In exchange for an equity stake in InstaCash, APCX agreed to “build, develop, launch, and manage InstaCash, Inc.’s mobile-to-mobile payment system” as well as develop “mobile and web-based applications for the contactless payment system, which will feature digital banking services.”

In March, the company signed an agreement to provide its FinZeo™ platform services to a credit union network with more than 2,000 locations.

The company said that, following its launch, “the FinZeo credit union offering is expected to be available to credit unions nationwide, positioning it as the Fintech platform of the future for credit unions and legacy banks.”

Spend time right now doing your own research on the stock, and of course, always approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose. Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: APCX has made some impressive moves in the last few months: 30%… 61%… and another 30% to kick off this month. I think it’s worth taking a good look at it after yesterday’s drop.

APCX has already started bouncing back in the pre-market and should be at the top of your watchlist today.

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Shore Thing Media for advertising AppTech Payments Corp for a one day marketing program on September 19, 2024. This was paid by someone else not connected to AppTech Payments Corp. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into AppTech Payments Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deal.er, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.