Happy Friday everyone!

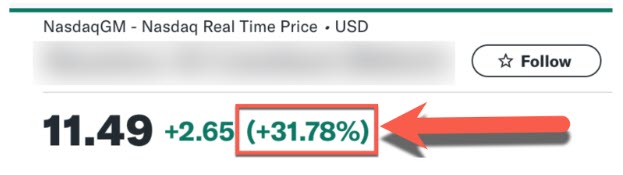

I hope you had an excellent week in the markets, and I especially hope you got a chance to watch the newly-listed AI stock I alerted you to yesterday morning rocket over 35% yesterday, eventually closing up nearly 17% (and is UP another 10% in the pre-market today).

At one point, it was a top ten mover in the entire market.

Most eyes will be on Jerome Powell in Jackson Hole today, but it’s not quite ski season yet so I don’t have much use for Jackson Hole…

As always, the markets will hang on Powell’s every word, but I’m ignoring the noise and looking for individual stocks I think have a great chance of seeing green regardless of what he says.

I’ve found one stock that I think is setting up great technically, and when I looked into the company itself, I think I fell in love.

Let’s dive in…

Take a look right now at American Rebel Holdings (AREB) on your favorite platform.

Right away you’ll see the last two months have been tremendous for the company…

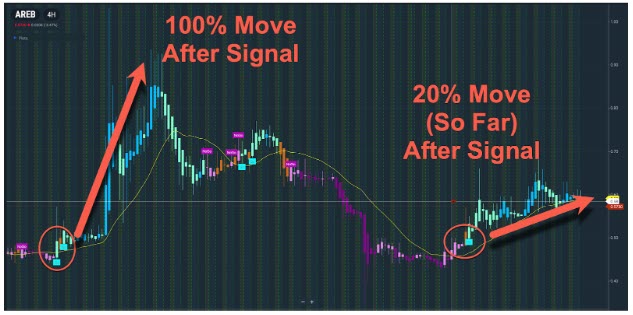

I’ll get into exactly why in a moment but from its low in June, it had a major spike up more than 160%. Then in July, the “go” signals flashed again and it jumped 100%.

In the past two weeks, it came off a solid base to pop 20%. Maybe that’s just the beginning?

I’ll say right away that I think this is a really fun company, and writing about them is a labor of love.

Just moments ago, AREB announced that they are entering “full production” in order to meet demand for their American Rebel Light beer (which I’ll discuss more about below).

This is a very significant development because it should dramatically move the needle on a very important line of sales.

AREB was founded in 2014 as “America’s Patriotic Brand” by country singer/songwriter and now-CEO Andy Ross.

Ross was the star of a TV show called “Maximum Archery World Tour” that aired on the Outdoor Channel for 10 years.

He recorded several country songs for the show that caught the attention of some Nashville bigwigs, and he has since released three CDs and nine singles of patriotic country and rock-n-roll.

One of his viral songs “American Rebel” is the company’s namesake.

The company started out producing concealed-carry backpacks and apparel that debuted at places like the NRA Annual Meeting and SHOT Show.

In 2019, AREB entered the gun safe industry, and in 2022, the company acquired its safe manufacturer, Utah-based Champion Safe Company, outright… including its manufacturing facilities, so AREB now makes its own safes.

Within only 5 months of the acquisition, AREB’s revenues jumped 756%.

It’s no secret that I’m a big 2nd Amendment guy…

I own several guns, and a fun fact is that I was one of the youngest people to get a concealed carry permit in Texas. They started classes on my 21st birthday in 1996 and I was first in line to get a permit!

The fact is, gun safety is a huge issue, and every time there’s a big news story about a weapon that wasn’t stored properly being misused, it’s another step closer to losing our precious rights.

The more secure gun storage, the better as far as I’m concerned.

The company’s safes got a “big boom in business” during a news cycle in September about how Liberty Safe — perhaps AREB’s main competitor — gave a customer’s code to the FBI.

CEO Andy Ross appeared on Fox & Friends to discuss the story, noting that his company fights for his customers’ privacy just like some tech companies do, and that his customers can completely opt out of having the company store their access codes.

Andy Ross was also interviewed on Nashville’s WKRN News last year to discuss his career and company.

AREB officially listed on the NASDAQ in February 2022, and right now, the company has roughly 300 stores around the country that carry its products. Its revenue reached $16.2 million in 2023.

Over the past decade, “American Rebel” has become a trusted brand in the Second Amendment and liberty-minded community, and that’s what makes its next move so impactful.

Earlier this year AREB launched American Rebel Light Lager (“Rebel Light”), which bills itself as “America’s patriotic, God-fearing, constitution-loving, National Anthem singing, stand-your-ground beer.”

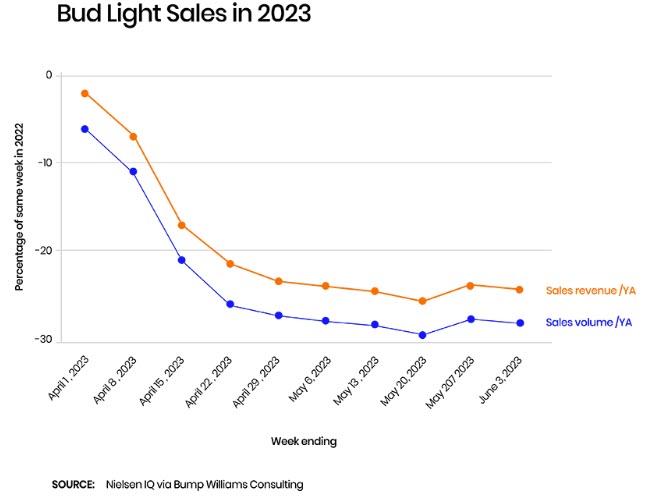

The company cited Bud Light’s PR disaster and subsequent decline in sales as a motivator:

AREB thinks it can scoop up a share of Bud Light’s lost revenue — and other revenue besides — in the $110 billion beer market.

To produce and market the beer, the company has teamed up with industry powerhouses:

- BevSource, the “largest integrated supplier in the beverage industry.” Dan Macri, BevSource’s EVP of Business Development, says “American Rebel has all the attributes to be one of BevSource’s highly successful sustainable brands.”

- City Brewing, which has a capacity of over 130 million cases annually.

- CMC, an outsourced sales and marketing team that “saves us twenty years of work to build out our own distribution network.”

It has reached distributor agreements with:

- Standard Beverage Corporation, the “largest single alcohol distributor” in Kansas, has placed Rebel Light in more than 125 retail locations, including local liquor stores, grocery stores, and 7-Elevens.

- Best Brands is launching the beer in Tennessee this month and has already secured commitments from some of the largest bars in the Nashville Entertainment district, which is “reported to sell more alcohol per square mile than anywhere else in the world.”

- Dichello Distributors is supplying four counties in Connecticut in September

- Bonbright Distributors “has already launched American Rebel Light Lager at Tony Stewart’s Eldora Speedway and the surrounding area and will expand throughout their entire 9-county territory in west central Ohio in September.”

The company says the beer is slated for nationwide distribution, and it has impressive marketing behind it, including sponsoring Matt Hagan’s Dodge SRT Hellcat Funny Car as it made it to the finals this past weekend of the Lucas Oil NHRA Nationals.

Of course, this is all only scratching the surface. I encourage you to do your own research, starting with this July 2024 investor deck as well as the main American Rebel website and the Rebel Light website. And definitely be sure to listen to Andy Ross perform the Rebel Light jingle here.

Always approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

AREB is already up 20% in the last two weeks. Be sure to get it on your radar before it really gets off to the races.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from West Coast Media for advertising American Rebel Holdings, Inc for a one day marketing program on August 23, 2024. This was paid by someone else not connected to American Rebel Holdings, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case..

Now, diving right into American Rebel Holdings, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.