*Sponsored by IA Media

When expert investors talk about undervalued stocks, they aren’t typically talking about TSLA, AAPL or AMZN…

They’re talking about low-priced stocks, trading at an even further significant discount, with potentially unlimited upside potential.

And I really love low priced stocks with huge breakout potential. 📈

If I am really being honest, I could care less about what a company does. All I really care about is if it goes up, right?

While no one ever knows for sure what is going to happen, I like to take shots where I think it makes sense and follow a game plan to protect myself along the way.

That brings me to today’s “Bright Idea 💡,” which I’m focusing on today:

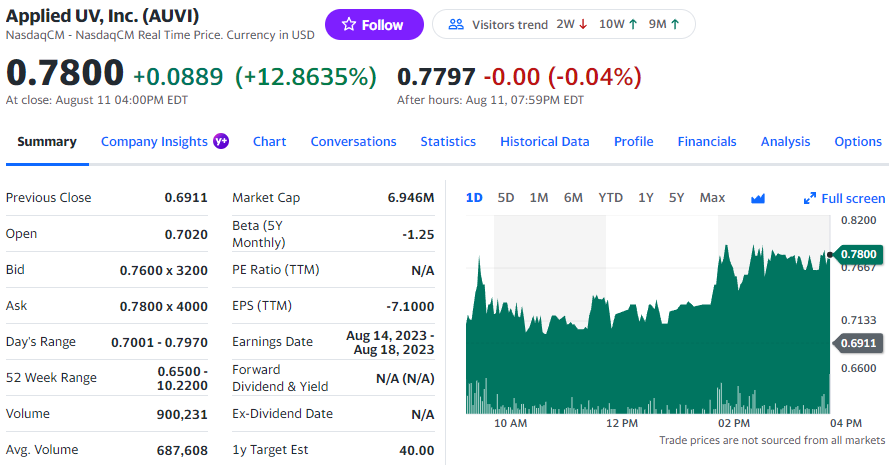

Applied UV, Inc (Nasdaq: AUVI)

The top reason you need to get this stock on your radar immediately is simple – earnings.

Just moments ago, AUVI dropped a bombshell 💣 as they announced huge sales growth:

- Total revenues for the second quarter of 2023 of approximately $10.8 million, representing an 83.6% increase over the comparable period in 2022

- Gross profit grew to approximately $2.4 million, up 84.8% from $1.3 million in the comparable period in 2022.

Today has all of the catalysts I would look for in a breakout for a stock trading under $1.

If you are a small-cap, momentum trading junkie like I am… then this is the type of day you live for!

AUVI is a perfect example of why I Iove low-priced stocks. Remember all the way back to Friday last week (I know, it was a long weekend!), the market got hammered.

But, little AUVI investors were up more than 12% on the day, even though the stock only traded up around a dime:

Source: Yahoo Finance

It’s just the tip of the iceberg for why I think AUVI could be poised for an unprecedented breakout.

Let’s start with short-term technicals. Right now, AUVI is trading at a 7-day support level, with a nearly oversold Relative Strength Index (RSI) reading of 31.

Even better, AUVI’s first major resistance level (the 50 day moving average) is nearly double the price of AUVI’s current price per share, of only $0.78.

AUVI Daily Chart Source: stockcharts.com

If you are a momentum trader, you need to be closely eyeing AUVI right now, and the reason is simple.

AUVI’s trading at support while quietly creeping out of oversold territory.

And look at the volume recently! There has been a flurry of trading activity that may be a leading indicator of the next move.

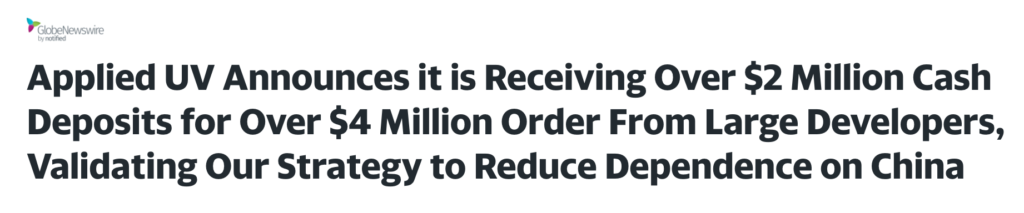

It certainly helps that AUVI just announced a major piece of news late last week when they announced a significant cash-infusion from a new deal…

What I think the market really missed here is the reported $22 million backlog of projects as well.

That is a massive pipeline for a tiny company like this!

Also consider that AUVI is described as a “top Smart Buildings Technologies provider”… for reasons like providing proprietary insurance and air pathogen elimination, drastically improving indoor air quality.

Indoor air quality might seem like small potatoes, but awareness of indoor air quality is skyrocketing – particularly since Covid.

And per a recent company letter to shareholders, governments are globally mandating health agencies to address air quality, primarily to protect facilities against future pathogens and to “ease visitation.”

In response, the Company’s products are timely, being specifically “targeted for use in facilities that have high customer touch and turnover which include hospitals, hotels, commercial facilities, sports arenas, dental offices, schools, food processing, post-harvest, cannabis grow facilities, long-term care, and other public spaces.”

With the company’s barrage of bullish catalysts, it should come as no surprise that AUVI, a $0.69 stock, has a $12.50 price target.

That’s no typo.

It’s north of 1,600% upside potential.

Add AUVI’s +217% revenue increase in Q1 of 2023 from Q1 of 2022 sourced by their income statement, and it should be even more obvious why AUVI has outrageous investing sentiment.

Investors have become interested in AUVI to the point where the Company’s executives need to issue press releases more frequently.

In June, for example, AUVI announced:

“Applied UV’s Subsidiary, LED Supply Co., and Its FORTUNE® 500 Technology Partner Awarded Approximately $0.8 million Contract for Comprehensive Lighting & Building Controls Solution for Global Auto Manufacturer’s U.S. Facility.”

As a business that’s always keeping its investors in mind, AUVI further explained:

“The project represents a significant milestone for Applied UV and highlights the Company’s commitment to providing advanced lighting and building controls solutions in the transportation industry. The collaboration between LED Supply Co. and its FORTUNE® 500 technology partner brings together expertise and innovation to enhance energy efficiency and sustainability in industrial settings. The scope of work includes comprehensive lighting and building control design tailored to the facility’s specific requirements, followed by custom fabrication of state-of-the-art systems.”

Additionally, the company most recently announced:

“We are pleased to provide an update on the recent progress and achievements of Applied UV, Inc. We are proud to report a record company backlog of over $22 million as of June 30, 2023, and we are on track to hit our revenue targets of $45-50 million for 2023. Our partnership with Canon continues to expand, providing valuable support in product development, contract manufacturing, sales and marketing, and customer financing options.”

They proceeded to add even more value for investors.

“Our Healthy Building Technologies Division has seen significant growth, thanks to the successful acquisition of PURO and LED Supply Co. This division now boasts a substantial backlog of roughly $7.4 million as of June 30, 2023, the largest in its history, validating our acquisition strategy and the division’s growth potential. Puro’s partnership with industry leader MFPHD has increased our hospital deal flow, particularly in the Surgical Suite. The division, comprising PURO, LED Supply Co, and Sterilumen, continues to gain recognition in the marketplace, helping to reinforce our position in Food Preservation Tech, Air Disinfection, Surface Disinfection, and commercial lighting and building control solutions.”

And they continued stacking value!

“Our Hospitality Division is experiencing unprecedented growth, with current orders and orders in process totaling approximately $14-$15 million. This includes an order underway and valued at over $4 million with a leading hotel brand, marking the largest backlog in the company’s history. This represents over 300% year-over-year growth, underscoring the success of our strategic expansion and our ability to meet the evolving needs of the hospitality and leisure industry.”

(Note: Above details sourced by AUVI’s presentations).

I’ve seen many companies grow from the ground up in my time, and AUVI’s executives appear to genuinely know their business and how to please their shareholders.

Case in point. If a +217% revenue increase isn’t enough to excite new or experienced investors, I don’t know what is?!

Remember, we’re talking about a $0.78 stock with a $12.50 price target!

And upon further review of AUVI’s current chart, the stock is seeing increasing money flow from traders and investors alike.

AUVI Daily Chart

Source: Yahoo Finance

Part of me feels terrible for AUVI’s short sellers, but most of me feels excited for AUVI’s new investors!

The future of this company is almost too exciting to put into words, and I’m honored to be sharing its developments with the RagingBull community.

Not to mention letting you in on its 1,600%+ potential upside price target!

I encourage you to review the “investors” tab on Applied UV, Inc. (AUVI)’s website and jump on their email list, especially if you’re looking for an innovative opportunity right now.

As always, doing your due diligence is crucial.

That said, so is further familiarizing yourself with the risks and rewards associated with Applied UV, Inc. (AUVI) as a company – and if you wish – getting on the inside of what I believe to be a company on the verge of accelerated growth.

To YOUR Success!

P.S. Make sure you text “RAGE” to (888) 404-5747 to get all of my latest HOT STOCK ideas!

*This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results.