Here we go again.

Another start to the month, another day with a sharp downturn…

Is this déjà vu from August?

The NASDAQ dropped nearly 3.5%, the S&P 500 slipped about 2.3%, and NVIDIA led the charge downward with a 9.5% plunge. 📉

Weak manufacturing data seems to have renewed fears of slow growth in the broader economy, which was a big factor in last month’s selloff.

Personally, I think we are very close to a short-term bottom. I am not making big bets here, but it is a great time to start building a “shopping list” of stocks you want to buy at a discount.

Traders are more sensitive to data releases now than at any point I can remember, and that makes navigating these markets difficult for anyone without a crystal ball.

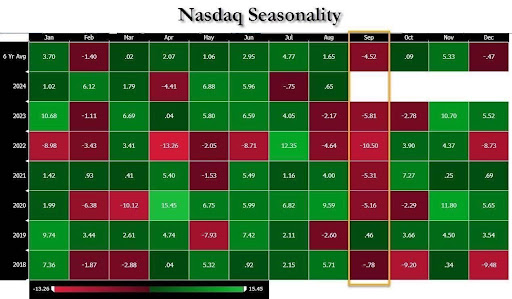

On top of that, traders are having to contend with the famous “September Effect.”

According to MarketWatch, “History suggests September is the worst month of the year in terms of stock-market performance.”

Investopedia notes that “September is the only calendar month to average a negative return over the past 98 years.”

The exceptions are presidential election years, which have yielded positive returns in nearly two-thirds of the 24 elections since 1925.

And, of course, complicating all of this will be the FOMC meeting in two weeks.

Will we get a big bounce back after today’s downturn?

You’ll recall that after that bloody Monday last month, the markets climbed all the way back by that Friday.

Lately, the rule has been that “what goes down must come up,” so I certainly won’t be surprised.

For now, I’m examining small companies that I think have a chance of beating the odds.

I’ve come across one such company that I think deserves your attention…

Go ahead and pull up Femto Technologies Inc. (BCAN).

The company went through a reverse split effective last Monday, and right now its float is very low, at around 640,000 shares.

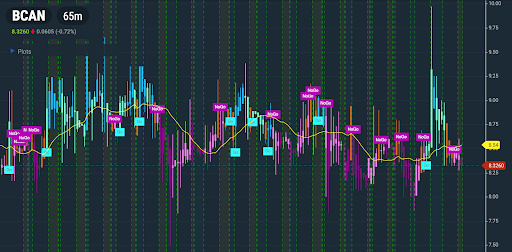

Right now, the stock is very quiet and trading in a narrow range, as shown in the chart below…

Just yesterday, the stock managed to reach nearly $10 in pre-market activity showing that it can make some very fast moves.

I would keep a close eye on the $8 level, which has recently been a source of support. That is an area I do not want to see it close below.

On the upside, anything above $9 has been a resistance level, and if BCAN can make a move above that, we might be ready to see some fireworks.

These reverse-split stocks have been doing well lately, so let’s take a closer look at this one…

The company is based in Israel but has a foothold in Vancouver.

It has two parts to its business. The first part seems to be an older focus for the company as the owner and marketer of customer relationship management (CRM) software called “Benefit.”

Benefit is aimed at small- and medium-sized businesses, helping them “optimize their day-to-day business activities such as sales management, personnel management, marketing, call center activities, and asset management.”

Right now BCAN seems focused on the other side of its business, developing and manufacturing AI-enhanced women’s wellness devices.

The company’s website focuses on four main “FemTech” products, all of which rely on BCAN’s proprietary “Smart Release System,” which “utilizes advanced sensors to precisely detect, infuse, and personalize wellness substances.”

One is a sleeve for muscle relaxation that combines therapeutic gel with warmth and vibration.

Another is a brush that releases essential nutrients and growth-promoting compounds through the bristles, and that also uses LED light therapy and gentle vibration — all to stimulate hair growth.

A third product is a smart cosmetic face device that delivers serums for different facial treatments and skin conditions. This device also uses LED light and vibration to stimulate the skin.

A fourth featured product is its flagship “EZ-G” device which the company describes as a “therapeutic device uses proprietary software to regulate the flow of low concentrations of CBD oil, hemp seed oil, and other natural oils into the soft tissues of the female reproductive system to potentially treat a wide variety of women’s health issues.”

All four products seem to be in various stages of development, but the EZ-G device is the closest to release, with BCAN signing agreements in January with two large Chinese manufacturers to begin production.

In July, the company said it had entered into “the last stretch before the expected start of sales of the EZ-G device” and that, following a user survey, it would approve initial production of approximately 10,000 units of the EZ-G device.

BCAN is scheduled to showcase the device at “the most powerful consumer tech event in the world,” the CES trade show in Las Vegas to be held from January 6-9, 2025.

In August, BCAN reported some financial highlights including a 62% increase in revenue for the three-month period ending June 30, 2024 compared to the same period in 2023.

It also noted a net profit of $77k for the three-month period ending June 30, 2024 compared with a net loss of $1.15M for the same period in 2023.

As always, these are just some notes to get you started. Be sure to do your own research on this company if you find it interesting.

Always be sure to approach any trading responsibly. As you know, trading is risky, and nothing is guaranteed, so never trade with more than you can afford to lose.

Please also read the disclaimer at the bottom of this email which contains additional risks and considerations. Be sure you have a thoughtful game plan that accounts for your personal risk tolerance.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Lifewater Media for advertising Femto Technologies Inc, which is formally known as BYND Cannasoft Enterprises, Inc for a one day marketing program on September 4, 2024. Previously, we received fourteen thousand dollars by ach bank transfer by Lifewater Media for advertising BYND Cannasoft Enterprises from a period beginning on April 24, 2023 through April 25 of the same year This was paid by someone else not connected to Femto Technologies Inc, which is formally known as BYND Cannasoft Enterprises, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Femto Technologies Inc, which is formally known as BYND Cannasoft Enterprises, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.