Wednesday Feb 26, 2025

Nasdaq: bnzi

*together with IR Agency

Want Priority Alerts?

Download the stocks.News APP!

*Disclosure: We are a proud affiliate for IR Agency and you can assume we will be compensated in some way if you download the STOCKS.NEWS app. By signing up, you agree to their terms of use & privacy policy which are provided on their page.

👉 BNZI is TODAY’S #1 ALERT 👈

Hey folks, Jeff Bishop here.

Two weeks ago, I went out on a limb.

I wrote that, “Overall … the back-and-forth action we’ve been seeing in the major indexes makes me feel like we’re making a top in the market.”

The Nasdaq is down about 5% since then. 🩸

I noted that I was going to continue seeking out “tactical trade” ideas that had good chances of performing regardless.

All told, 15 of my last 18 “tactical” ideas have gone on to make double-digit gains the day I alerted them. One even made a 115% gain!

On the same day I made the prediction about the top in the market, I alerted Banzai International, Inc. (BNZI).

The small marketing-tech stock had just come off a 6% pullback the day before, which I thought “sets it up nicely for a potential surge today.”

And indeed, the stock went on to surge double-digits the day I alerted it.

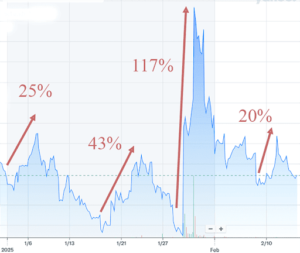

The stock has a great, recent history of nice bottom bounces:

I’m bringing it to your attention again now because there is a similar setup in place.

The company notched down along with the rest of the market yesterday, despite the release of excellent news.

With things rebounding today, I’m looking for BNZI to make a solid, outsized gain.

👉 BNZI is TODAY’S #1 ALERT 👈

Yesterday’s news was the announcement of CreateStudio 4.0.

CreateStudio is “a top-rated video creation app that enables users to produce eye-catching 3D character animations for social media and websites.”

It was already “Recognized as a Top 3 Best Rated product in the video maker category by Capterra and a High Performer by G2.”

This latest version includes three new, AI-powered features:

- Video Sales Letter (VSL) Builder: “Answer seven simple questions about your product or service, and CreateStudio’s A.I. generates a compelling video sales script to help you sell effectively.”

- Explainer Video Builder: “Quickly create an animated explainer video by providing a brief description, and selecting a 3D character, narrator, and music genre. The CreateStudio’s A.I. will then build an engaging animated 3D explainer video project for you.”

- A.I. Shorts Builder: “Effortlessly generate social media-ready content. The A.I. creates scripts, voiceovers, images, and music, delivering a fully edited short video optimized for engagement.”

When you look further into the company, it’s easy to see why investors are getting excited.

Banzai is on a mission to become a one-stop shop for data-powered marketing tools.

As CEO Joe Davy explained in this interview, “Marketing today is very fragmented… the average marketer today uses about 120 different tools to get the job done.”

As someone whose business relies on marketing tools, let me say that may be a conservative estimate.

BNZI aims to roll up some of these data-driven tools and integrate them seamlessly.

The company has developed a number of platforms that are being leveraged by some big-name companies.

To name a few…

Demio is the company’s webinar product, which Forbes in February 2024 named the “best webinar tool for marketers.”

That’s being employed by the likes of Hewlett Packard, ActiveCampaign, and Thermo Fisher Scientific, as well as more than 1,400 other customers the company signed on in 2024.

Last April, the company launched Reach 2.0, a marketing platform that drives attendance to real-world events and to webinars.

BNZI says Cisco, The Economist, and CrowdStrike all use the platform. Ever heard of them?

In October, BNZI launched Curate, “an AI-powered newsletter platform designed to streamline content creation and audience engagement for organizations of all sizes.”

The goal of Curate is to “pull down the cost and effort for our customers to create high-quality newsletters by 90%.”

“Banzai announces launch of Curate — the AI-newsletter that writes and grows itself”

But apart from its self-built marketing tech, the company has been aggressively scaling over the past few months through acquisitions.

In December, it signed a definitive agreement to acquire OpenReel, an AI-powered platform that “enables companies to rapidly create high-quality, branded video content.”

OpenReel’s enterprise-customer base include Bristol Myers Squibb, Ingram Micro, and, DXC, and BNZI says the acquisition grew its trailing 12 months revenue 152% to $10.9 million.

The next week, the company signed a definitive agreement to acquire Vidello, a platform that provides video hosting and marketing suite solutions.

According to the press release, “Vidello has over 90,000 customers. Their flagship CreateStudio product has been named a Top 3 Best Rated product in the video maker category by Capterra, and a High Performer by G2.”

The acquisition was expected to “increase Banzai’s revenue by $6.5 million and increase EBITDA by $2 million for the twelve-month period ended December 31, 2024, on a pro-forma basis.”

(And as we noted above, just yesterday BNZI announced the launch of CreateStudio 4.0.)

Last month, BNZI signed a deal to acquire Act-On Software, “an easy-to-use and intelligent marketing automation platform” with clients such as Hitachi, BestBuy, and Progressive Insurance.

The bottom line: “The acquisition is projected to increase revenue by $27 million for the twelve-month period ending December 31, 2025, on a pro forma basis.” [emphasis added].

For perspective on these acquisitions, BNZI’s total revenue for Q3 2024 was $1.1 million, or $4.4 million annualized.

If the company’s estimates and projects are right, these acquisitions could multiply revenue more than tenfold.

As you do your own research on BNZI, I recommend checking out this interview with the CEO. I found his view that “AI is going to eat marketing” especially interesting.

This November 2024 investor presentation is also worth browsing, though it gets pretty technical. And of course check out the company website.

Lastly, BNZI’s CEO was featured in the New York Times last month for pursuing a Bitcoin strategy with the company treasury. That’s a fun read.

Be sure to approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: BNZI has been on the warpath, with acquisitions that they hope could multiply its revenues tenfold.

Its stock has responded with powerful moves recently, including a triple-digit gain in just two days and a double-digit gain the day I last alerted it.

BNZI is my #1 alert today, so be sure to keep a close eye on it!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from West Coast Media for advertising Banzai International, Inc for a one day marketing program on February 26, 2025. Prior to this, we received thirty five thousand dollars (cash) from Sideways Frequency for advertising Banzai International, Inc for a one day marketing program on February 13, 2025, and we also received seventeen thousand five hundred dollars (cash) from West Coast Media for advertising Banzai International, Inc for a one day marketing program on January 17, 2025. This was paid by someone else not connected to Banzai International, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our advertising program ends, though that is not always the case.

Now, diving right into Banzai International, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.