*Sponsored by Sica Media. Please see disclosures below

I’ve been on a tear lately hunting down lesser-known companies with big upside potential.

Over the last couple of weeks, I brought an e-sports stock to your attention a few times that gained over 45% since I first introduced it to you.

Then, on Monday, I alerted you to a gold mining stock that jumped over 15% in a couple of days after I shared my thoughts on it.

This is a red-hot market lately for small-cap ideas, and I am always on the lookout for new ones!

While nothing is certain in the markets, today there’s a kind of urgent situation I think you should look at right now.

It is a stock that I showed you a few months ago, and right now all of the technicals are flashing again, so I think it merits your attention. That company is:

BioSig Technologies (Nasdaq: BSGM)

If you have been following me for a while, you might recall this idea back from April when I first showed it to you.

Within a few weeks of that initial alert, BSGM went on a 50%+ run to make a high for the year (so far) over $1.60.

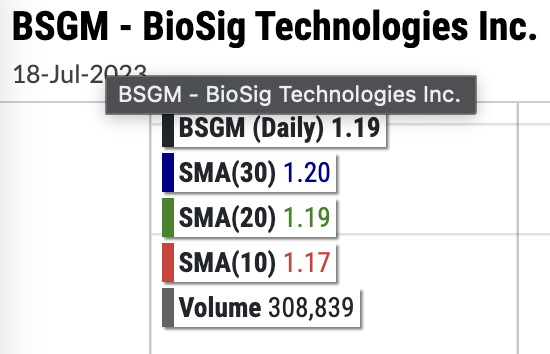

As you can see, the stock has since pulled back a little but has held support above $1.10 on multiple occasions over the last month.

I don’t know if that is the short-term bottom, but it is shaping up for another trend reverse signal.

I highlighted the other signals in the chart above from over the last year and what happened following those signals when the stock began to trade above the daily moving averages.

I mean, when I say we are close, we are literally on the edge right now. It might be hard to see in the chart above, but look at where the moving averages are all sitting…

Right now, BSGM seems right on the cusp of all of these, which converge around the $1.20 level.

If we see BSGM break above that, then buckle up – it would be a very strong signal in my book.

I think you really need to pay attention to BSGM right now. It has a history of making very big moves (both ways sometimes!).

Of course, the past isn’t going to always predict the future, but it is good to see how powerful those signals have been over the past year.

What initially got me excited about BSGM was the technology they are creating and how they are leaning into developing an AI medical device platform.

This pioneering biotech company is already up a whopping 183% this year. Compare that with the S&P500, which has gained only 19% over the same time – that’s a nearly 10x difference!

And there are plenty of good reasons besides just the technicals to consider BSGM again…

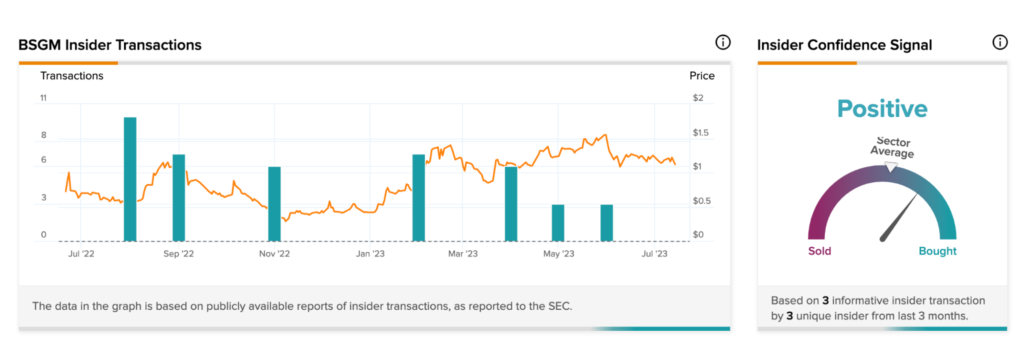

For instance, last month BSGM founder and CEO Kenneth Londoner recently increased his stake in the company on three occasions.

Here is a great visual from TipRanks as of July 18, showing the recent insider buying going on (I don’t see any significant selling at all).

Mr. Londoner has a background in finance — at one point managing $3.5 billion in assets — so he knows a good investment when he sees one.

BioSig CEO Kenneth Londoner

Perhaps he saw what was on the horizon…

And as we’re all aware, AI is the next Big Thing.

It’s credited with helping rocket the NASDAQ composite 38% higher this year, with standouts like NVIDIA jumping 232% and C3.ai up 269%.

With that in mind, consider that BSGM announced a strategic collaboration with AI firm Reified Labs late last month, just weeks after Mr. Londoner increased his company share.

Cambridge, Massachusetts-based Reified Labs is headed by Harvard- and MIT-trained Dr. Alexander D. Wissner-Gross, an award-winning computer scientist who is renowned in the field of AI and its healthcare applications.

This isn’t the first time BioSig has teamed up with Reified. The companies began a collaboration in 2019 that yielded several patent applications and a research publication.

In many ways, the companies were ahead of their time, and the meteoric advances in AI technology promise to take this new collaboration to even more rarefied heights.

At stake is BioSig’s breakthrough PURE EP™ Platform, an FDA 510(k) cleared device that provides superior, real-time visualizations of critical cardiac signals.

As traders, this technology is largely Greek to us, but I’m sure you’ve come across cluttered financial charts with candles, multiple overlays and trendlines, and wondered, “What the heck am I looking at?”

It’s much the same for electrophysiologists who try to separate signal from noise in cardiac scans. The PURE EP™ Platform isolates what matters, delivering clear, actionable insights.

The result is an unprecedented ability to evaluate all types of arrhythmias, with the company claiming a 75% improvement in signal quality and an 83% increase in confidence interpreting multi-component signals.

Already, BioSig has established partnerships with leading centers such as the Mayo Clinic, the University of Pennsylvania and the Texas Cardiac Arrhythmia Institute, and its PURE EP™ Platform has been used in thousands of patient cases across the United States.

With its collaboration with Reified, BioSig hopes to leverage AI to enhance its PURE EP™ technology for potential commercial application.

👉So where is the BSGM headed from here?

Again, nothing is certain in the markets, but analysts cited by CNN Business must believe it’s destined for the stratosphere because the median forecast would represent a whopping 362% gain from its current $1.19 share price.

From what I’ve seen, I believe these analysts are on to something. Small stocks like this have incredible potential right now if the catalyst is right.

At the very least, BSGM is worthy of your own research, as well as a clear-eyed analysis of the risks and potential rewards. The company’s website is a great place to start.

So spend time today getting to know more about BSGM and see if it makes sense for you!

To Your Success

By the way… 👉 Make sure you text “RAGE” to (888) 404-5747 to get all of my latest HOT STOCK ideas delivered right to your phone!

*This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results

*PAID ADVERTISEMENT. RagingBull has been paid twenty five thousand dollars by ach bank transfer by Sica Media for advertising BioSig Technologies from a period beginning on July 19, 2023 through July 21 of the same year. RagingBull has previously been paid fourteen thousand dollars by ach bank transfer by Lifewater Media for advertising BioSig Technologies from a period beginning on April 17 , 2023 through April 18 of the same year. To date, RagingBull has been paid a total of thiry nine thousand dollars for coverage of BioSig Technologies. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, the owners of Raging Bull, do not hold a position in BioSig Technologies. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of BioSig Technologies, increased trading volume, and possibly an increased share price of the BioSig Technologies securities, which may or may not be temporary and decrease once the marketing arrangement has ended.