Sponsored by Stock AI News*

TODAY’S TOP ALERT!

Nasdaq: CHSN

Top of the morning, Folks, Jeff Bishop here.

As a trader, there are just some days you know you are “on”…

I woke up this morning feeling like that is going to be this entire week.

Stock futures are down ever so slightly but I don’t think that will last even through the closing bell.

We are still clearly in a bull market, and I believe the dips will continue to get bought up – probably for the rest of the year.

With the Dow up 7.5% last month, the S&P 500 up 5.7%, and the Nasdaq rising 6.2%, I think a handful of traders are asking: Was that too much?

I think they’ll soon get their answer as the rest of us answer with a resounding “NO!”

Don’t forget: As this article notes, “December is the S&P 500’s most consistent month of gains.”

And gains are even better with strong year-to-date performance: “Of the past 10 times the S&P entered December up more than 20%, the month of December recorded an average gain of 2.4%.”

But if I know you, dear reader, I doubt you would be satisfied with a 2.4% gain on the month. Positive market momentum is great, but we’re hungry for outsized gains.

Last week’s “tactical trade” ideas delivered those in spades…

Like Monday’s idea, which had 200% potential in the 24 hours after I sent it…

Or Tuesday’s two ideas, which both went on to make 52-week highs…

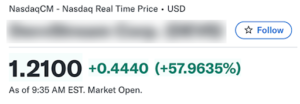

Or Friday’s cherry-topper, which ripped as high as 60% over Wednesday’s closing price:

As I mentioned to you last night, the key component to my biggest, recent “tactical” winners has been momentum…

They were stocks that had overcorrected but then turned a corner and began trending up.

That’s exactly what I see with today’s “tactical trade” idea.

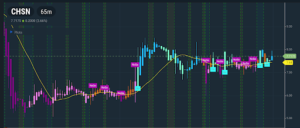

Have a look at the chart for Chanson International Holding (CHSN).

As you can see, it took a rocket ride 🚀 in October, with a 400% jump from October 2 to October 28…

It pulled back from there through the first week in November but it has enjoyed positive momentum ever since.

In the past two weeks, it has rallied 35%, including a nice 6% jump on Friday.

It began trending above the 20-day moving average into the close on Friday, signifying momentum that I think is likely to continue into today.

And if you focus on just the last two weeks, you’ll see the chart formed a wedge from which it clearly broke out to the upside on Friday.

That’s one of my favorite signs that we could be looking at a huge breakout today (though it is very tough to time exactly when, or “if” a move will happen)

Just remember that nothing is guaranteed, and definitely watch to be sure it doesn’t dip down below the 20-day moving average around the $7.30 mark.

I will be keeping a very close eye on on the $8.00 level which has been stiff resistance lately.

If CHSN finally breaks above there again, then it could be off to the races.

Make sure CHSN is the top stock on your watchlist today.

I would lose some confidence there and might head for the sidelines to wait for a smarter entry.

And while the technicals here are very promising, it’s important also to do research into the company itself.

Here are some notes to get you started…

Founded in 2009, CHSN is “a provider of bakery, seasonal, and beverage products through its chain stores in China and the United States.”

The company is headquartered in China, and currently operates 49 stores in Xinjiang as well as three stores in New York City.

It also sells on digital platforms and third-party online food ordering platforms.

CHSN’s main brands are:

- George Chanson — This brand “produces and sells various bakery commodities, cakes, desserts, quick meals, a wide variety of drinks, and specialty cocktails.” This brand also operates a number of storefronts with in-store dining that include “delicately furnished lounge areas.”

- Patisserie Chanson — This is “a modern European cafe and French bakery highlighting the art of dessert making in New York City’s Flatiron District.” The company says that its “quaint interior embraces the French pastry shop spirit, serving Michelin standard viennoiserie and an extensive drink menu.”

- Thyme Bar — Established in 2020, this is ”an underground hideaway just steps away from Madison Square Park . . . [that] pays homage to the location’s history as a Prohibition Era speakeasy, offering its patrons light fare and crafted libations in an alluring ambiance.”

The company’s “Chanson” brands offer more than 250 products ranging from cakes, breads, and pies to coffees and craft cocktails.

A great thing about CHSN is that it is profitable — which is more than you can say for a lot of dining establishments!

For the first half of fiscal 2024, the company had a gross margin of 41.5%, raking in a gross profit of $3.1 million on $7.5 million in revenue.

The company seems confident in its business model, announcing on November 21 that it was busy furnishing eight new stores in China that would open before December 31.

CHSN noted that the expansion “brings Chanson’s total store count to 60 across China and the United States, marking a significant growth from the 37 stores Chanson operated when its initial public offering was completed in April 2023.”

And just last week, CHSN revealed that it would be expanding a franchise model of its Soul Song café.

The company opened its first store under this model in July 2024 at the Nalati National Tourist Resort in Xinjiang, and its success inspired them to plan to open five additional Soul Song cafés under the franchise model by 2025.

For more info on CHSN, be sure to check out the company website and this investor relations site.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: CHSN is a profitable business that by 2025 will have expanded its storefronts 62% since its April 2023 IPO.

Its stock price surged 35% over the past two weeks, and just Friday, it escaped a wedge pattern to the upside.

Pay close attention to CHSN today to see if this is the breakout I think it is!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received thirty thousand dollars (cash) from Stock AI News for advertising Chanson International Holding for a one day marketing program on December 2, 2024. This was paid by someone else not connected to Chanson International Holding. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Chanson International Holding might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.