Wednesday Mar 19, 2025

DEVVSTREAM (Nasdaq: devs)

Good morning, folks,

Yesterday was another rough one for the markets, and there’s no telling whether Jerome Powell’s presser this afternoon will help or hurt things.

Now is the perfect time to look for small-stock ideas that can weather the storm.

My eye is on one stock in particular that I think is at a very attractive price level for a serious “bottom bounce.”

I brought this one to your attention a few months ago on Black Friday…

It had just climbed 60% in a matter of days and clearly had huge momentum at its back.

But what happened next surprised even me.

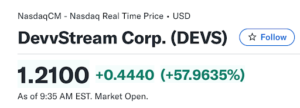

I sent the alert before the bell, and it went on to rocket 🚀 over 57% shortly after…

That’s right, today’s “tactical trade” idea once again is DevvStream Corp. (DEVS).

👉 DEVS is TODAY’S #1 ALERT 👈

I alerted the stock again in early February, and it made a respectable 14% move that day.

I love stocks that have that kind of explosive potential, and right now, I think this one is in a great position for another bottom bounce.

Its current level has been pretty reliable support, and as you can see, it has been flirting higher all month.

Pay close attention to DEVS today to see if we get another liftoff!

DEVS describes itself as “a leading authority in the use of technology in carbon project development.”

The company’s mission is “to create alignment between sustainability and profitability, helping organizations achieve their climate initiatives while directly improving their financial health.”

DEVS has its hands in a number of green initiatives with the ultimate goal of reducing the impact of climate change.

Regardless of your views on the politics or science of climate change, we can all agree there is a ton of money flowing to these initiatives…

Deadal Research estimates that the global carbon market has already reached $1 trillion and will more than double by 2028:

As an investor and a trader, that’s what most interests me…

DevvStream went public in November via a de-SPAC merger, making it the “first and only carbon credit company to list on any major U.S. exchange.”

The Vancouver-based company — founded in 2021 — says it “works with governments and corporations worldwide to achieve their sustainability goals through the implementation of curated green technology projects that generate renewable energy, improve energy efficiencies, eliminate or reduce emissions, and sequester carbon directly from the air.”

It adds that it “also helps these organizations meet their net zero goals by providing them access to high-quality carbon credits.”

DEVS does this by partnering with companies that have technologies that are eligible for generating carbon credits, producing the credits on their behalf.

DevvStream then gets 25% of the credits that are generated for the life of the project. This is highly profitable since the company isn’t investing in the project itself.

The company has more than 140 of these projects in its pipeline, with more than a dozen signed contracts representing an opportunity to generate 30 million+ credits per year.

Over the past year, the company has announced several signed contracts with EV charging networks to help them generate carbon credits. These include:

- Texas-based Go-Station

- New York City-based Green Energy Technology

- India-based E-Fill Electric

- Florida-based OK2Charge

The de-SPAC merger precipitated two major business developments for DEVS…

The first was to enter into agreements to stockpile carbon credits, including 1.2 million credits for conservation of 200,000 hectares of Amazon territory and 2.5 million credits “selected from a field of over 120 million potential carbon credits from dozens of other projects.”

The company says that its carbon portfolio provides “a strategic complement to its own carbon credit generation programs and carbon sequestration offerings,” believing it took advantage of “an important buying opportunity.”

The second major development was the establishment of a 50% equity stake in Monroe Sequestration Partners (MSP) and its carbon sequestration operations.

As DEVS explains, “MSP is working within the geographic area and geologic formations capable of carbon storage for a legacy oil and gas field — covering 425 square-miles across 3 parishes in northern Louisiana — to develop one of the largest carbon sequestration reservoirs in the United States, with an estimated total storage capacity of 260 MMT of CO2, and capable of capturing a significant portion of the 30 million metric tons of CO2 emitted from local sources annually, generating up to 30 million carbon credits per year.”

DEVS expects the reservoir to be fully functional by 2027, and for revenues from the project “to be generated within a two-year timeframe via carbon credits and sequestration federal tax credits.” The tax credits alone are worth $85 per ton of CO2 sequestered, with a capacity of 260 million tons.

Late last year, DEVS announced that it will be diversifying its revenue streams to include renewable energy certificates (I-RECs).

An I-REC is generated when a power plant generates 1MWh of renewable energy. It can then be sold to companies that need them to maintain their commitments to renewable energy.

These days, some of the largest companies in the world — heavyweights such as Apple, Google, Microsoft, and Samsung — have commitments to use 100% renewable energy, which often requires buying I-RECs.

DevvStream has secured exclusive agreements in Asia’s renewable energy market:

- Medellin Solar Power Facility (Philippines): A 730 MWp project capable of generating over 1.2 million I-RECs per year.

- PT.Siteba Hydroelectric Facility (Indonesia): An already operational hydro facility expected to generate I-RECs in 2025

You can read more about those projects here and here.

DEVS launched another very interesting project in December called “D-PIVOT.”

D-PIVOT “is a carbon offset tool designed specifically to enable eco-conscious consumers to counterbalance the emissions-related impacts associated with shipping their online purchases.”

It integrates directly with any Shopify storefront and allows customers to add carbon offsets from DEVS’ portfolio to any purchase. Here is its page in the Shopify app store.

I love the idea of allowing people who want to offset their carbon footprint to do so right at checkout.

In case you aren’t familiar, Shopify powers 28% of all e-commerce stores in the US, and DEVS notes that D-PIVOT will give the company “a strong sales channel for its inventory of several million high-quality carbon credits.”

Just yesterday, the company announced that it will be partnering with Zing and Minimus Fulfillment, two “key players in the online retail ecosystem” to provide access to D-PIVOT to their clients. This should really help the company get the word out.

DEVS seems well connected in the “green” space, with CEO Sunny Trinh even speaking at a “high-level session” of the United Nations Science-Policy-Business Forum on the Environment in Nairobi, Kenya, last year.

Last month, DEVS was admitted to the Singapore Carbon Market Alliance (SCMA).

Through its membership, DEVS “plans to generate carbon credits from emission reduction projects located in nations with whom Singapore has signed implementation agreements, then sell those credits directly to the government of Singapore.”

It adds that “As one of only a handful of project developers in the SCMA, DevvStream expects to be well positioned to achieve high sales volumes within the alliance.”

As you do your own research on this breakthrough company, be sure to check out its November 18 investor presentation. You may want to watch this webinar to have the CEO walk you through the presentation and add more color.

I thought the company’s website was also very clear and helpful.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: DEVS is the first and only pure-play carbon-credit company to list on a major U.S. exchange.

Previous alerts I’ve sent on it went on to surge 58% and 14% the day I sent them.

Tune in to see if we get another double-digit gain on DEVS today!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Legends Media for advertising DevvStream Corp for a one day marketing program on March 19, 2025. Prior to this, we received twenty five thousand dollars (cash) from Legends Media for advertising DevvStream Corp for a one day marketing program on February 3, 2025, and we also received twenty thousand dollars (cash) from Legends Media for advertising DevvStream Corp for a one day marketing program on November 29, 2024. This was paid by someone else not connected to DevvStream Corp. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into DevvStream Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.