*Sponsored by Interactive Offers

This Tiny Powerhouse Just Made a 200% Move and is Gearing Up Again

It looks like we have another big day for the markets out of the gate today, and small cap traders are piling into stocks that are on the move.

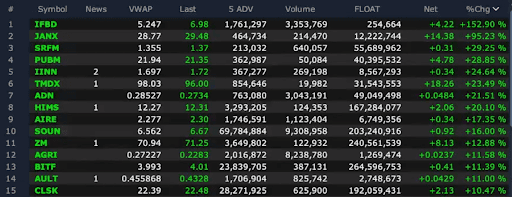

Just look at how many double-digit movers we have in pre-market trading today already…

Did you know that you can trade small stocks in pre-market?

You’ll need to check with your broker and make sure it is enabled for your account, but virtually all platforms allow you to trade now… some places even as early as 4am!

I have a new stock that I want to bring to your attention, that I think has agreat chance of making this list soon today. ☝️

The stock is simply called – 1847 Holdings (EFSH)

I suggest you pull it up on your platform right away and start looking into it.

I think EFSH could be one of the hottest movers, and I want you to watch it as early as you can.

Let me tell you some of the reasons I like it right now.

As you know, I follow a lot of small stocks that are not on the radar of most traders. I do this because that is where I have found the biggest opportunities lie.

It is extremely rare that I will find a 10%+ move on a large tech stock like MSFT, AMZN, of even TSLA.

But, like you see in the chart above, these types of moves happen a lot with smaller stocks (both up and down).

While I like the business model EFSH has (more on that in a minute), I think the price chart is what you should pay the most attention to right now.

You see, this sleepy little stock drifted as low as $1.25 just a few weeks ago as traders overlooked the story.

But then, recently, you’ll see around the second week of February, traders woke up, read the news, and started to pile into EFSH.

They drove up the price to over $4 in about a week’s time, which was over a 200% gain from the week before.

See why I love looking for these types of plays!

Now, I was simply watching the first move. If happened too fast for me, and I obviously didn’t know how high the stock was going to go.

After that epic rally, there was a natural pullback, and then last week, we saw another 35% move higher over a 4-day period of trading.

Now, EFSH has cooled off again… and I don’t want to miss it this time!

It can be very tough to pinpoint absolute bottoms or tops on trading moves. But right now, I think it is an ideal time to give this stock a very close look.

EFSH has shown that when it starts to move, it can really deliver some incredible gains in a short period of time.

I don’t know for certain if that day is today, of course, but I sure like this trading setup and I will be all over this one soon.

While I am drawn to the stock for technical reasons today, EFSH also has a fascinating, and unique business model.

As you look into it, you’ll read that 1847 Holdings LLC (EFSH) is a holding company that uses a private-equity strategy but as a public company.

Its model exposes investors to the attractive parts of owning private, lower-middle market businesses while giving them the transparency of a publicly traded company and not locking them into their investments.

This is a business I think Warren Buffett would love!

He only invests in simple, high-growth companies that have easy to understand business models, like Coke, Geico, railroads, etc. I think EFSH’s businesses would fit right in with what he loves.

It was founded in 2013 by private-equity veteran Ellery Roberts, who currently serves as chairman and CEO. Roberts has directly overseen more than $3 billion in private equity investments in his career.

The core strategy of EFSH is to acquire “diamond in the rough” companies that have a lot of value but have difficulty finding a buyer due to their smaller size.

EFSH scoops up these stable, mature companies at a good price relative to their cash flow, grows the businesses using its management expertise, and either sells the companies or keeps them as long-term revenue generators.

To date, EFSH has acquired eight businesses and sold two.

One of the businesses it sold was 1847 Goedeker’s, which now goes by Polish.com Inc. EFSH acquired the e-commerce furniture and appliance retailer for $6.5 million in April 2019 and took it public two years later at a roughly $60 million valuation.

“Our investors were able to sell the shares in what was a fairly robust market,” said Ellery Roberts.

A few of the EFSH’s current subsidiaries are:

- Wolo Manufacturing Corp., “a leader in horn technology (electric, air, truck, marine, electronic specialty, air & back-up alarms) and vehicle emergency warning lights offering the highest quality and the largest selection for cars, trucks and industrial equipment,” that’s been in business more than 45 years.

- ICU Eyewear Holdings Inc., “a recognized leader in reading eyewear and sunglasses, as well as select health and personal care items” that’s been around nearly 70 years.

- Kyle’s Custom Wood Shop, Inc., “a leading custom cabinetry maker servicing contractors and homeowners since 1976 in Boise, Idaho and the surrounding area.”

In the third quarter of 2023, the EFSH reported that its revenue increased 29.8% year-over-year and gross profits increased 64.9%.

According to Roberts, EFSH has “reached the scale that we need so the incremental dollars or profits added from each new operating entity that we acquire, a disproportionate amount of their profits flow through to the bottom line.”

Bottom line: I think EFSH has real potential today. Look into it right away and see if you think the same.

As always, it is critical that you come to the market with a solid trading plan and know your own risk tolerance. Make sure you spend time to research and put together a trade plan that makes sense for you.

This is a stock I am sure will love when you look into it, and I think you’re going to enjoy watching it today!

To Your Success,

Jeff Bishop

*Sponsored content/paid advertisement. This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results.

👊 Make sure you are getting my mobile text alerts – text “RAGE” to 1-(888) 404-5747 to get all of my latest HOT STOCK ideas de

*PAID ADVERTISEMENT. RagingBull has currently been paid seventeen thousand five hundred dollars by ach bank transfer by Interactive Offers, LLC for advertising 1847 Holdings LLC for a one-day advertising program. As a result of this advertisement and other marketing efforts, RagingBull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, the owners of Raging Bull do not hold a position in 1847 Holdings LLC. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of 1847 Holdings LLC, increased trading volume, and possibly an increased share price of the 1847 Holdings LLC securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in 1847 Holdings LLC., though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. A portion of our business is engaged in the marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. A portion of RagingBull’s business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, SMS, push notifications. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently, companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the corporate awareness program ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https: // www. Sec. gov/ edgar/searchedgar /companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.

livered right to your phone (make sure you put the “1” at the front!). Don’t miss out!