Sponsored by Sica Media*

TODAY’S TOP ALERT!

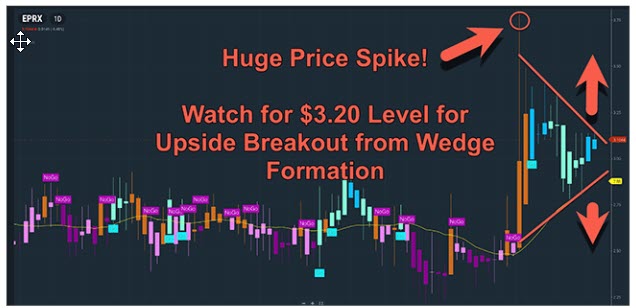

Nasdaq: EPRX

Happy Hump Day!

It’s hard to believe we’re almost one week out from Thanksgiving.

While I’m not a big believer in Santa Claus (sorry!), I am a big believer in the “Santa Rally.”

What most people don’t realize is that the rally really begins the week before Thanksgiving.

As this article notes, “For the entire week [before Thanksgiving], the S&P 500 has been positive two-thirds of the time, allowing investors to harvest a median gain of 0.75%.”

Of course, that means the time to place your bets is… now.

I’m especially interested in small-cap stocks with promising setups that I think have a great chance of outperforming the big indexes.

And when it comes to promising setups, I’ve found one that’s about as good as it gets…

Do yourself a favor and pull up the Eupraxia Pharmaceuticals Inc. (EPRX) chart.

Right away, you’ll notice that the stock kicked off in November with an incredible 39% jump over the course of three days.

It began trading on the Nasdaq only in April, and that rally led to its all-time high on the exchange.

The stock pulled back a bit over the following week, but last Wednesday, it began a nice, steady 17% ramp-up to where it is now.

The question is: How far will this momentum take it?

As you can see, a clear wedge has formed, and that’s why I think it’s a critical time to watch this stock.

If the stock breaks above the $3.20 level, I think it could be in store for its next major gap up.

On the other hand, if it ticks much below $2.90, we could be looking at a leg down.

Ultimately, as I’ll explain below, I think investors are hot on EPRX this month for good reason, and I think a breakout to the upside is the most likely scenario.

Even in yesterday’s trading, momentum pushed the stock 4% higher.

This is an urgent situation — so pay close attention to EPRX today.

In the meantime, here are some notes from my research on the company…

Eupraxia Pharmaceuticals is a clinical-stage biotechnology company focused on developing locally delivered, extended-release alternatives to currently approved drugs.

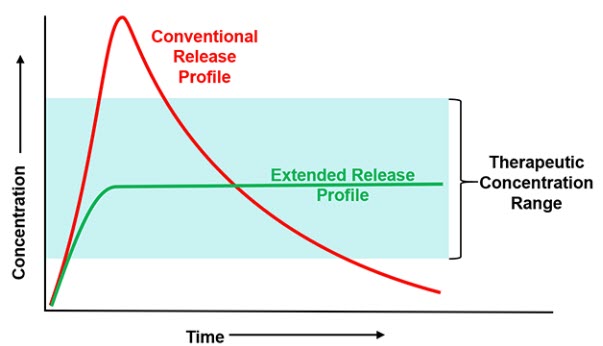

Its main innovation is its patented DiffuSphere™ delivery technology, which coats a drug with a micro-thin polymer membrane designed to release the drug at a pre-defined rate.

If ultimately successful, the technology could have a variety of applications — including in oncology — but for now, the company is focused on using it to deliver a highly potent, widely used corticosteroid called fluticasone propionate.

If you’ve ever gotten a corticosteroid injection for an injury, you know that the pain relief is incredible — but short-lived.

EPRX is aiming to change that with its lead candidates, EP104-IAR and EP-104GI, which use the DiffuSphere™ to encapsulate and slowly release fluticasone propionate over the course of months.

EP104-IAR is intended to treat osteoarthritis (OA) in the knee, a disease which Clearview Partners estimates affects ~18 million patients in the US, a majority of whom have moderate or severe cases.

The company notes that “Current therapies are challenged by poor safety, inadequate efficacy and/or limited duration of activity.”

EP-104IAR is injected into the knee and is “intended to slowly release drug at therapeutic concentrations for up to six months. This has the potential dual advantage of providing long-duration pain relief with fewer side effects.”

A Phase 2b trial for the drug called “SPRINGBOARD” was completed, and last month, the results were published in the prestigious, peer-reviewed journal Lancet Rheumatology.

The publication concluded:

These phase 2 results suggest that EP-104IAR has the potential to offer clinically meaningful pain relief in knee osteoarthritis for an extended period of up to 14 weeks, longer than published data for currently marketed corticosteroids. There were minimal effects on glucose and cortisol, and stable fluticasone propionate concentrations in plasma. The safety and efficacy of EP-104IAR will be further evaluated in phase 3 trials, including the possibility of bilateral and repeat dosing with EP-104IAR.

EPRX has initiated its Phase 3 development program for EP-104IAR following its End-of-Phase 2 meeting with the FDA.

The company’s other lead candidate, EP-104GI, is intended to treat eosinophilic esophagitis (EoE), “an inflammatory-mediated disease in which white blood cells migrate into and become trapped in the esophagus, creating pain and difficulty with swallowing food.”

Clearview Partners estimates there were 451,000 EoE patients in the US in 2023.

As the company notes, “corticosteroids have been used off-label to successfully address symptoms of EoE and are recommended as a first-line treatment by the American College of Allergy, Asthma and Immunology. They are currently inhaled or swallowed, which limits effective contact time in the esophagus and creates opportunity for unwanted exposure elsewhere in the body.”

By contrast, EP-104GI is injected directly into the esophagus via endoscopy and is “designed to slowly release [the] drug to affected areas, maximizing therapeutic action at the site and minimizing undesirable effects.”

EP-104GI is currently undergoing a Phase 1b/2a trial called “RESOLVE.”

A press release from last Tuesday quotes EPRX CEO Dr. James Helliwell:

As the RESOLVE trial advances, we are observing increasingly positive data on efficacy and safety outcomes, including no adverse events such as candidiasis, adrenal suppression or glucose derangement.

The big news that seems to have sent the stock higher this month was a C$44.5 million private placement that — along with existing cash and anticipated proceeds from in-the-money warrants — the company expects “will be sufficient to fund the Company to the third quarter of 2026.”

That’s a fantastic cash runway for a clinical-stage pharma company.

Right now, TipRanks is flashing that EPRX is a “strong buy”:

And analysts at Raymond James and Rodman & Renshaw have set 12-month price targets of $11.77 and $9.00, respectively.

Those estimates indicate upsides of 261% and 176% from its closing price yesterday.

Those wouldn’t be bad returns for 12 months!

As you do your own research on EPRX, be sure to check out the company website and this investor presentation from September.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: EPRX has broken out big time this month after fresh funding helped extend its anticipated cash runway through Q3 2026.

The stock soared to start the month, and over the past week, it has climbed 17%.

Keep a close eye on EPRX today to see if the momentum continues and it breaks out of its “wedge” to the upside.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Sica Media for advertising Eupraxia Pharmaceuticals Inc for a one day marketing program on November 20, 2024. This was paid by someone else not connected to Eupraxia Pharmaceuticals Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Eupraxia Pharmaceuticals Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.