* Sponsored by First Hydrogen Corp

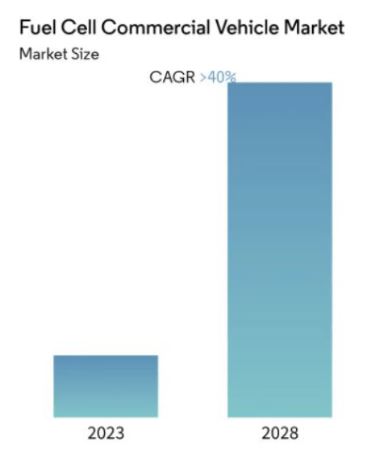

This Market is Growing at 40% Every Year…

Is This the Future of Highways and A.I.? Tap Into Hydrogen’s Unlimited Power Potential

First Hydrogen Corp.

FHYD: TSXV | FHYDF: OTC

5 Key Highlights of First Hydrogen (FHYD):

- Growing Market: Hydrogen is at the center of a new market expanding 40% annually and First Hydrogen has first mover advantage.

- Better than EVs: First Hydrogen’s vehicles have longer range than electric cars, carry more weight, and produce less emissions.

- Almost Launched: 16 of the largest fleet operators in the UK are trialing their vehicles over the next 18 months, with a full launch expected in 2026.

- 3 Income Streams: First Hydrogen doesn’t just produce Zero Emission Vehicles (ZEV), it also has two other businesses and one is a market set to reach $230 billion (more below…)

- Small Cap: First Hydrogen shares are worth just $189 million currently, roughly 4,014 times smaller than Tesla.

When AI melded with human intellect in 2023, the world was utterly unprepared for the astonishing evolution that followed.

From crafting groundbreaking medications to outpacing medical experts in disease detection, AI’s capabilities are staggering.

Consider this: An AI developed by a lone coder in merely 20 hours can beat a Chess Grandmaster.

And that’s not all – we even have AI composing symphonies across 10 instruments.

This revolution is poised to unleash a surge of human potential, with projections indicating a staggering $15.7 trillion boost in global wealth by decade’s end—equivalent to the combined outputs of China and India.

Yet, beneath all this brilliance lies a crucial component: hydrogen.

The critical element making future AI breakthroughs possible.

Hydrogen is a Powerhouse

Driving Future Technology

When hydrogen is burned in a fuel cell, it reacts with air to produce electricity, and the only emission it creates is water.

This offers significant advantages when paired with AI, because the need for data centers has rapidly increased ever since it went mainstream.

Global spending on AI is expected to grow 26.5% annually by 2026, and since AI applications burn more energy than conventional software, demand for data centers can’t keep up with supply.

- Equinix, which operates 245 data centers worldwide, cited power availability as one reason for a supply chain crunch.

Hydrogen can power more data centers in a much cleaner way, and without relying on foreign natural resources.

But data centers are just one part of the Hydrogen-AI boom…

Tech firms like Amazon, Google, and IBM are investing heavily to develop Quantum Computers.

Regular computers solve problems step by step, while Quantum Computers process more information simultaneously, and look at many steps at once.

Stephen Hawking said Quantum Computing “Quantum computers will change everything, even human biology.”

In order to unlock their full potential, semiconductor particles are required which rely on hydrogen to control the quantum state of electrons.

In other words, these electrons have to be in a particular form for Quantum Computers to work the way they’re supposed to. And hydrogen is a critical element which helps them get into form.

Since it can be compressed into tanks at high pressures, liquefied at extremely low temperatures, or chemically stored in solid materials…

- It will bring electricity and other technology to off-grid locations that otherwise never could have them.

- It will power homes and offices even in the most rural locations, while reducing the need for outside fuel.

Yet, there is one specific hydrogen application on the horizon, and it’s poised to unleash unparalleled shareholder value as it storms the mainstream.

The Market Growing an Astounding 40% Annually…

Is the Hydrogen Commercial Vehicle Industry.

Hydrogen-powered vehicles are about to take over a share of the roads…

Because compared to electric vehicles…

- They’re cleaner,

- Use power more efficiently,

- Charge faster and

- Have longer operating times.

While most people view electric vehicles as “green,” they still emit carbon dioxide if they’re charging at home, and there’s nothing “green” about that.

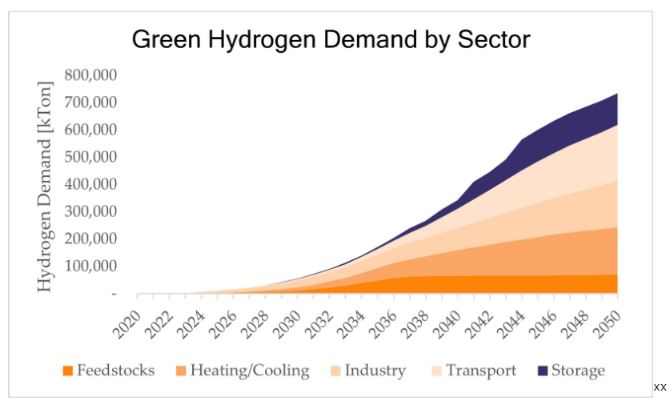

Hydrogen fuel cells are completely green. You’ll hear people refer to “green hydrogen,” meaning hydrogen that’s generated by renewable energy or from low-carbon power.

Green Hydrogen can cut annual global emissions by 20% on its own.

Electric battery production relies on precious and rare metals like lithium, cobalt, and nickel.

Putting an electric car in every driveway in America would require more lithium than the world produces, but hydrogen fuel cells don’t require any of these materials.

They are similar to gas cars because they refuel in just a few minutes, significantly faster than even the quickest electric vehicle charging times.

For commercial vehicles, where downtime means lost revenue, hydrogen is a game-changer.

Hydrogen fuel cells have a higher energy density, and for the same weight, hydrogen can deliver more energy than a battery.

Beginning in 2025, stricter emission standards in some countries will put further pressure on businesses to convert to greener energy.

Electric batteries can be heavy and don’t provide enough range for big trucks, especially when they’re carrying heavy loads.

That’s where hydrogen steps in.

It can power big vehicles without the issue of heavy batteries. And many argue it’s the future for commercial transport.

Hydrogen’s 2 Biggest Barriers

Have Been Lifted

Hydrogen currently accounts for less than 2% of total global energy consumption, mostly for refining and industrial purposes.

The International Energy Agency predicts hydrogen usage to grow sixfold by 2050 and will supply 10% of total energy consumption.

Hydrogen’s full potential is finally being tapped into in 2023 for two main reasons.

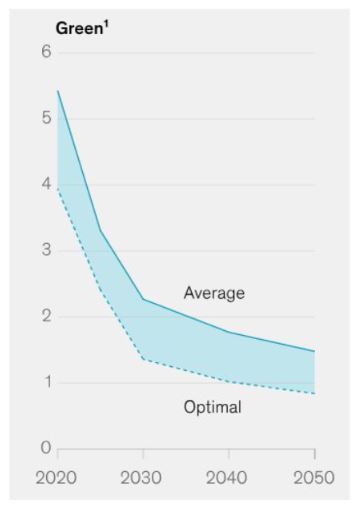

First, the expense of conducting electrolysis was prohibitively high for years. Electrolysis is a method which generates low-emission hydrogen from renewable or nuclear energy.

But this situation is now changing.

McKinsey & Company says: “The production costs of clean hydrogen are expected to rapidly decline over the next decade.”

The U.S. Department of Energy named hydrogen a “critical material,” and launched their “Hydrogen Shot” program to reduce the cost of green hydrogen by 80%.

The lower the cost, the faster hydrogen powered vehicles will spread throughout the world, and companies in this industry could grow substantially.

The second barrier to Hydrogen was the public’s awareness of its benefits compared to gas and electric cars.

However, this is also beginning to change.

In July, the U.S. Department of Energy said:

“Hydrogen demand is expected to grow in… long-distance heavy- and medium-duty trucks.”

As businesses wake up to the benefits of switching their vehicles from gas and electric to hydrogen, First Hydrogen (TSX: FHYD) is a first-mover ready to absorb this rise in demand.

First Hydrogen sells and leases next generation hydrogen commercial vehicles, the exact type the Department of Energy is predicting a boom for.

- In the UK, spending on zero-emission vans increased 50% in 2021.

First Hydrogen’s demonstration vehicle became road legal in October 2022 with a range of 500 kilometers or more, while the average electric car has just a 348 kilometer range.

Then on August 8, 2023 First Hydrogen announced their van cleared 630km of range in a trial with SSE Plc .

And Rivus has 120,000 vehicles in their fleet!

The company’s light and medium sized commercial vehicles can refuel in minutes, just like a gas-powered car.

A 18-month public trial started this year under real-world conditions to collect data while building up customer interest.

16 of the largest fleet operators in the UK have already signed up for the trial, from industries such as telecoms, utilities, infrastructure, delivery, grocery, and healthcare.

Once the 18-month trial concludes, First Hydrogen plans to commence public sales of its “First Gen” vehicle in early 2026.

The “Next Gen Large Series” is slated to launch in 2028 and this vehicle will provide a range 1,000 kilometers or more, nearly 3-times higher than the average EV.

Hydrogen Vehicles are Ramping Up

in the USA…

Sales of new hydrogen vehicles just hit a record high in California,

And most industry executives believe this technology will breakthrough the industrial transportation market.

Some of the most cutting-edge automakers are already transitioning to hydrogen…

- Toyota plans to sell more than 200,000 hydrogen vehicles by 2030.

- Ford is developing its first hydrogen semi-truck, which will be tested in 2025.

- BMW has rolled out a test fleet of 100 hydrogen-powered SUVs.

Yet, as major automakers jostle for dominance in this arena, First Hydrogen is aligning to capture the rapidly expanding light and medium commercial vehicle market.

Building Hydrogen Vehicles is Just One Income Stream for First Hydrogen…

First Hydrogen’s second business consists of providing powertrains for adjacent markets.

The company is in perfect position to provide these services because First Hydrogen has invested over $15 million into researching and developing hydrogen vehicles since 2021 alone.

It’s leveraging its expertise in hydrogen powertrains and all the work accomplished to date to help other businesses, while acquiring even more tech feedback for developing their own products.

By sharing its hydrogen technology with the markets below, First Hydrogen expects to boost short term revenue:

- Recreational boat market = +$16 Billion

- Agriculture = ~$2.5 Billion fuel cell market by 2030

- Back-up power, portable power, EV charging = ~$1.4 Billion fuel cell market by 2030

- Commercial trucks = ~6 million medium weight vehicles per year globally (units)

- Camper Vans = North American market valued at $56-billion (2022), anticipated to reach $108-billion by 2032

All of these markets are positioned to become early adopters of hydrogen vehicles and First Hydrogen has the technology and services to get them on the road.

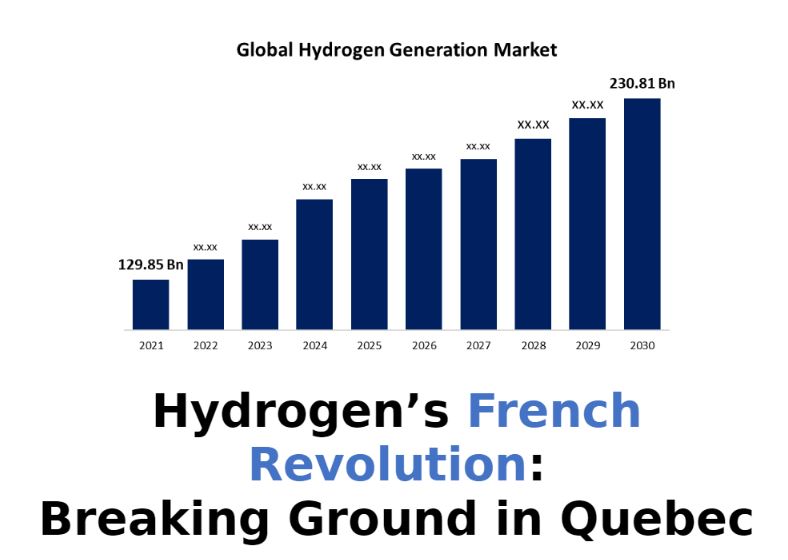

Hydrogen as a Service

First Hydrogen will control part of the global hydrogen fuel supply by building its own production operation.

The plan is to build refueling stations just like gas stations which are set to launch in 2026, however the company’s “Hydrogen as a Service” provides even more benefits.

Hydrogen as a Service is for customers who prefer their hydrogen fuel to be delivered to them directly.

This not only simplifies entry into the hydrogen vehicle market for new customers, but also ensures consistent fuel availability for current ones.

The long-term benefits are greater customer loyalty and retention for First Hydrogen, but also revenue diversification into a growing niche.

The global hydrogen generation market is expected to reach $230.81 billion by 2030.

First Hydrogen (FHYD:TSX) purchased two plots of land in the City of Shawinigan, Quebec, which will produce 35 megawatts of green hydrogen using advanced electrolysis technology.

- 35 Megawatts has the potential to power roughly 87,797 vehicles.

The company will distribute this hydrogen within the Montreal-Quebec City corridor, but this new Quebec location won’t just produce hydrogen…

It will also assemble 25,000 First Hydrogen vehicles every year, which will then be sold throughout North America.

First Hydrogen is partnering with regional educators to help foster the high demand skills needed for this booming industry.

Once hydrogen reaches full market penetration, it’s expected to create 675,000 new jobs in the United States alone.

Big Oil Pivots to Hydrogen

The most powerful global energy companies are now venturing into the rapidly expanding hydrogen market.

- Exxon Mobil is building a large-scale hydrogen plant in Texas, in addition to exploring green hydrogen production in Norway.

- Shell is building Europe’s largest renewable hydrogen plant and will spend up to $1 billion annually on hydrogen over the coming years.

- BP has a 150-person team dedicated to hydrogen, and has made several investments into large hydrogen projects, including in Australia, Europe and Britain.

- The Saudi Arabian Government is launching an $8.4 billion green hydrogen plant, and

- Saudi Aramco recently invested in a tech startup turning ammonia into hydrogen.

Big Oil’s investments are speeding up hydrogen’s path to the mainstream market.

First Hydrogen’s Unique Position

First Hydrogen has incredible potential and runway to capitalize on the hydrogen market.

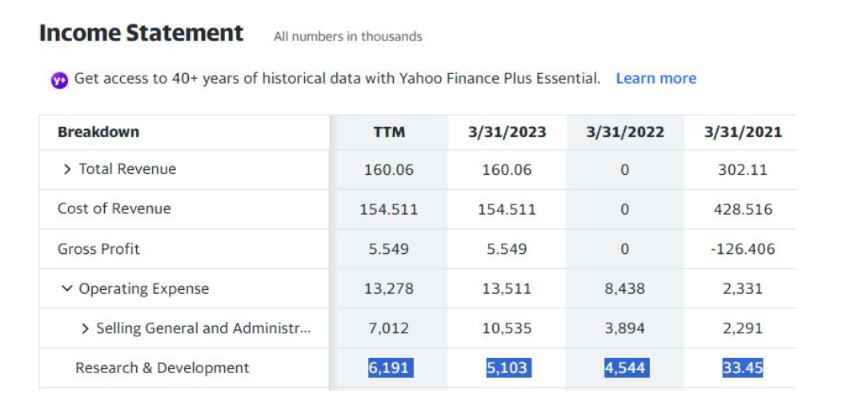

- A company’s Quick Ratio is a financial metric that measures its ability to cover its short-term liabilities with its most liquid assets, anything at “1” or over indicates a company can pay its debts, and First Hydrogen passes.

The company is in this position because it has nearly 13-times more cash than it does debt at the time of this writing.

- 7.67% of shares are owned by company insiders, which reinforces management’s dedication to enhancing shareholder value.

However, just 1% of shares have been bought by institutional investors so far, as many large funds simply cannot buy a stock this small due to their Charter Agreements. If First Hydrogen’s value rises, large investors will become eligible to buy it.

The Innovators Making It Happen

The company’s CEO is Balraj Mann, who has over 40 years of experience in corporate finance and acquisitions for public and private companies.

Rob Campell is the CEO of First Hydrogen’s Energy Business. He’s spent 40 years working in engineering, including as Chief Commercial Officer at Ballard Power Systems.

First Hydrogen’s CEO of Automotive is Steve Gill, who spent 20 years with Ford Motor Company, including as Director of Powertrain Engineering at Ford of Europe, and 11 years as Chief Engineer with Perkins Engines.

Francois Morin, VP of Corporate and Business Development – Quebec, brings 25+ years of business operations and development after leaving BMO Financial Group where he played a pivotal role in implementing a sustainable finance program for the Quebec business sector.

This team is on path to bring First Hydrogen’s products to North America, Europe, the UK, and more.

They have a track record of delivering success in automotive engineering, manufacturing, and finance, and their combined skillsets have positioned the company to be a first mover in this fast-growing industry.

“Hydrogen Highways” are Inevitable

The hydrogen vehicle industry is growing 40% every year, while the hydrogen generation market is expected to reach $230 billion by the end of the decade.

$10 billion worth of hydrogen projects are being announced every month.

First Hydrogen’s three main revenue streams, which include producing zero-emission vehicles, providing hydrogen to customers, and powertrain supply, all position the company to grow with this new demand.

Because hydrogen is the cleanest form of energy and offers benefits gas and electric vehicles do not, it’s poised to become the future of how businesses transport their goods.

First Hydrogen presents a unique opportunity to invest in a company with very little debt, yet huge potential to radically change transportation and provide shareholder value.

DISCLOSURES/Disclaimers

IMPORTANT DISCLAIMER

Carbon Credits, as a publisher, is not a broker, investment advisor, or financial advisor

in any jurisdiction. Please do not rely on the information presented by Carbon Credits as

personal investment advice. If you need personal investment advice, kindly reach out to

a qualified and registered broker, investment advisor, or financial advisor. The

communications from Carbon Credits should not form the basis of your investment

decisions. Examples we provide regarding share price increases related to specific

companies are based on randomly selected time periods and should not be taken as an

indicator or predictor of future stock prices for those companies.

First Hydrogen Corp. has reviewed and sponsored this article. The information in this

newsletter does not constitute an offer to sell or a solicitation of an offer to buy any

securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted

Securities, in the United States or to U.S. Persons. Securities may not be offered or sold

in the United States except in compliance with the registration requirements of the

Securities Act and applicable U.S. state securities laws or pursuant to an exemption

therefrom. Any public offering of securities in the United States may only be made by

means of a prospectus containing detailed information about the corporation or entity

and its management as well as financial statements. No securities regulatory authority

in the United States has either approved or disapproved of the contents of any

newsletter.

Carbon Credits nor any employee of Carbon Credits is not registered with the United

States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under

the Exchange Act, as an “investment adviser” under the Investment Advisers Act of

1940, or in any other capacity. He is also not registered with any state securities

commission or authority as a broker-dealer or investment advisor or in any other

capacity.

HIGHLY BIASED: In our role, we aim to highlight specific companies for your further

investigation; however, these are not stock recommendations, nor do they constitute an

offer or sale of the referenced securities. Carbon Credits has received cash

compensation from First Hydrogen Corp as reported in their July 28, 2023 news release

and is thus extremely biased. It is crucial that you conduct your own research prior to

investing. This includes reading the Audited annual financial statements and management discussion and analysis, as at March 31, 2023, available on SEDAR and SEC filings, press

releases, and risk disclosures. The information contained in our profiles is based on

data provided by the companies, extracted from SEDAR and SEC filings, company

websites, and other publicly available sources.

HIGH RISK: The securities issued by the companies we feature should be seen as high

risk; if you choose to invest, despite these warnings, you may lose your entire

investment. You must be aware of the risks and be willing to accept them in order to

invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You

understand this to be an expression of opinions and NOT professional advice. You are

solely responsible for the use of any content and hold Carbon Credits, and all partners,

members, and affiliates harmless in any event or claim. While Carbon Credits strives to

provide accurate and reliable information sourced from believed-to-be trustworthy

sources, we cannot guarantee the accuracy or reliability of the information. The

information provided reflects conditions as they are at the moment of writing and not at

any future date. Carbon Credits is not obligated to update, correct, or revise the

information post-publication.

FORWARD-LOOKING STATEMENTS: Certain information presented may contain or

be considered forward-looking statements. Such statements involve known and

unknown risks, uncertainties and other factors which may cause actual results or events

to differ materially from those anticipated in these statements. There can be no

assurance that any such statements will prove to be accurate, and readers should not

place undue reliance on such information. Carbon Credits does not undertake any

obligations to update information presented, or to ensure that such information remains

current and accurate.

First Hydrogen: 189.35M

ii https://www.clinicaltrialsarena.com/comment/first-drug-created-ai-enters-trials/#:~:text=Hong

%20Kong%2Dbased%20biotech%20InSilico,causing%20scarring%20within%20the%20lungs.

iii https://towardsdatascience.com/ai-diagnoses-disease-better-than-your-doctor-study-finds-

a5cc0ffbf32

iv https://medium.com/swlh/ai-beats-grandmasters-in-chess-cacb0a06bb5b

So, in the end, after around 20 hours of training, I faced off the AI against a 2600 rated bot. (2500

is the minimum rating to be considered a grandmaster). In 76 moves, the AI was able to create a

draw against an above-average GM. This project really gave insight into the situational ability of a

lot of types of AI. Hopefully, you learned something as well!

v https://openai.com/research/musenet

vi https://www.pwc.com/gx/en/issues/data-and-analytics/publications/artificial-intelligence-

study.html#:~:text=Total%20economic%20impact%20of%20AI%20in%20the%20period

%20to%202030&text=AI%20could%20contribute%20up%20to,come%20from

%20consumption%2Dside%20effects.

According to a report by PwC, AI could contribute up to $15.7 trillion to the global

economy by 2030.

viihttps://www.wsj.com/articles/rising-data-center-costs-linked-to-ai-demands-fc6adc0e

Global spending on AI is expected to exceed $301 billion by 2026, growing

at a compound annual rate of 26.5%, according to market research

company International Data Corp. viii https://www.wsj.com/articles/rising-data-center-costs-linked-to-ai-demands-fc6adc0e

The declines came even as overall inventories grew 19.5% year-over-year to a total of 2,132

megawatts, CBRE said.ix

https://www.wsj.com/articles/rising-data-center-costs-linked-to-ai-demands-fc6adc0e

Jon Lin, executive vice president and general manager of data center services at Equinix, which

operates more than 245 data centers worldwide, said building new data center capacity to keep up

with rising demand has become more challenging in recent years. He cites supply-chain

constraints, construction and permitting complexities and power availability, among other factors.

x https://www.techtarget.com/searchdatacenter/feature/Companies-building-quantum-computers

xi https://www.goodreads.com/author/quotes/1401.Stephen_Hawking?

page=9#:~:text=Computational%20power%20is%20growing%20and,change%20everything%2C

%20even%20human%20biology.

xii

https://chemistry-europe.onlinelibrary.wiley.com/doi/10.1002/cssc.202201925#:~:

text=Nowadays%2C%20quantum%20dots%20(QDs)%2D,excellent%20optical

%20and%20electrical%20properties.

%20global%20hydrogen%20fuel%20cell,its%20on%2Dboard%20electric%20motor.

xv https://www.mckinsey.com/~/media/mckinsey/email/rethink/2023/05/2023-05-10d.html

xvi https://www.scientificamerican.com/article/making-the-entire-u-s-car-fleet-electric-could-cause-

lithium-shortages/

xvii https://theicct.org/publication/eu-co2-standards-cars-vans-may23/#:~:text=More%20ambitious

%20emissions%20reductions%2C%20but,is%20open%20for%20e%2Dfuels.

xviii https://www.iea.org/reports/global-hydrogen-review-2022/executive-summary

xix https://www.iea.org/reports/global-hydrogen-review-2021/executive-summary

In the IEA’s Net Zero by 2050: A Roadmap for the Global Energy Sector, hydrogen use extends to

several parts of the energy sector and grows sixfold from today’s levels to meet 10% of total

final energy consumption by 2050. This is all supplied from low-carbon sources.

xx https://cleantechnica.com/2022/09/01/electrolyzer-supply-to-increase-green-hydrogen-

availability/

xxi https://pv-magazine-usa.com/2020/03/26/electrolyzer-overview-lowering-the-cost-of-hydrogen-

and-distributing-its-productionhydrogen-industry-overview-lowering-the-cost-and-distributing-

production/

xxii https://www.mckinsey.com/capabilities/sustainability/our-insights/five-charts-on-hydrogens-role-

in-a-net-zero-future

xxiii https://www.energy.gov/sites/default/files/2023-07/doe-critical-material-

assessment_07312023.pdf

xxiv https://www.energy.gov/eere/fuelcells/hydrogen-shot#:~:text=The%20first%20Energy

%20Earthshot%2C%20launched,%221%201%201%22).

xxv Page xii

https://www.energy.gov/sites/default/files/2023-07/doe-critical-material-

assessment_07312023.pdf

US Dept of Energy says: “Hydrogen demand is expected to grow in three

main areas: (1) decarbonization of long-distance heavy- and medium-

duty trucks, air, and marine transport; (2) applications requiring stationary

storage; and (3) applications requiring high-temperature heat generation and

chemical production, specifically to produce low-carbon ammonia, methanol, and

various other chemicals.”

xxvi https://firsthydrogen.com/investors/

xxvii https://blog.evbox.com/far-electric-car-range

xxviii https://firsthydrogen.com/encouraged-by-mini-budget-announcement/

xxix https://firsthydrogen.com/first-hydrogen-vans-receive-road-certification/

xxxi 1,000 / 348 = 2.87X

xxxii https://www.hydrogeninsight.com/transport/sales-of-hydrogen-fuel-cell-cars-reach-record-levels-

in-california-but-still-lag-far-behind-battery-electric/2-1-1494091

xxxiii https://firsthydrogen.com/investors/

xxxiv https://www.hydrogeninsight.com/transport/toyota-we-will-sell-more-than-200-000-hydrogen-

powered-vehicles-by-2030/2-1-1485373

xxxv https://www.hydrogeninsight.com/transport/ford-to-develop-its-first-hydrogen-semi-truck-

targeted-at-europe/2-1-1496008

xxxvi https://www.press.bmwgroup.com/global/article/detail/T0408839EN/bmw-group-brings-

hydrogen-cars-to-the-road:-bmw-ix5-hydrogen-pilot-fleet-launches?language=en

xxxvii https://www.gminsights.com/industry-analysis/light-commercial-vehicle-lcv-

market#:~:text=Light%20Commercial%20Vehicle%20Industry%20Analysis,CAGR%20from

%202023%20to%202032.

xxxviii https://finance.yahoo.com/quote/FHYDF/financials?p=FHYDF

xxxix All figures taken from investor deck:

https://firsthydrogen.com/wp-content/uploads/2023/05/May-2023-First-Hydrogen-Investor-Deck-

2.pdf

xl 1. Convert 35 MW to energy per day: 35 MW * 24 hours = 840 MWh/day

2. Convert this electrical energy equivalent to hydrogen: Given hydrogen’s energy content

and considering fuel cell efficiency, the equivalent hydrogen needed =

840MWh/day33.6kWh/kg∗0.633.6kWh/kg∗0.6840MWh/day ≈ 35,119 kg of hydrogen per day.

3. Calculate how many vehicles this amount of hydrogen could power based on average

consumption: Given our consumption rate of 0.8 kg/100 km, those 35,119 kg could power a car

for 35,119kg0.8kg/100km0.8kg/100km35,119kg = 4,389,875 kilometers.

day50km/vehicle-day4,389,875km ≈ 87,797 vehicles for one day.

xli https://www.energy.gov/energysaver/explore-hydrogen-and-fuel-cell-careers#:~:text=Analyses

%20show%20that%20widespread%20market,and%20fuel%20cell%20technologies%20increases.

xlii https://www.reuters.com/business/energy/exxon-mobil-sets-large-scale-hydrogen-plant-start-up-

2027-2023-01-30/

xliii https://www.nsenergybusiness.com/news/exxonmobil-partners-to-study-potential-of-green-

hydrogen-and-ammonia/

xliv https://www.renewableenergyworld.com/wind-power/shell-to-build-europes-largest-green-

hydrogen-plant/#gref

xlv https://www.hydrogeninsight.com/production/shell-will-spend-up-to-1bn-annually-on-hydrogen-

and-ccs-in-2024-and-2025/2-1-1467919

xlvi https://www.reuters.com/business/energy/bp-doubles-down-hydrogen-fuel-future-2022-12-05/

xlvii https://www.reuters.com/business/energy/saudi-neom-green-hydrogen-co-closes-deals-84-bln-

green-hydrogen-plant-2023-05-22/

xlviii https://www.cnbc.com/2023/02/01/saudi-aramco-backs-brooklyn-based-startup-turning-

ammonia-into-fuel.html

xlix

https://finance.yahoo.com/quote/FHYDF/key-statistics?p=FHYDF

l https://finance.yahoo.com/quote/FHYDF/key-statistics?p=FHYDF

li https://finance.yahoo.com/quote/FHYDF/key-statistics?p=FHYDF

lii https://www.mordorintelligence.com/industry-reports/fuel-cell-commercial-vehicle-market’

liii https://firsthydrogen.com/wp-content/uploads/2023/05/May-2023-First-Hydrogen-Investor-Deck-

2.pdf

DISCLAIMER

*PAID ADVERTISEMENT. Raging Bull has been paid fifteen thousand dollars by New Era Media who was compensated directly by First Hydrogen Corp for advertising efforts from a period beginning on August 21 through August 25, 2023. This advertisement and other marketing efforts, including alerts, may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of First Hydrogen Corp, increased trading volume, and possibly an increased share price of First Hydrogen Corp’s securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in First Hydrogen Corp, though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication.

FOR COMMERCIAL AND INFORMATIONAL PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for commercial and informational purposes only. A portion of our business is engaged in the promotion, marketing, and advertising of companies including public companies. A portion of Raging Bull’s business model is to receive financial compensation to promote public companies, conduct investor relations advertising and marketing, and publicly disseminate information regarding public companies through our websites email, SMS, and push notifications among other methods of communication. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. All material information contained in this advertisement is based on information generally available to the public, including information released to the public or filed by the Company with applicable regulators which public information is believed to be reliable and accurate. Nevertheless, Raging Bull cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments. Never invest in any stock featured in this advertisement, on our site or emails unless you can afford to lose your entire investment.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Our advertisements including this advertisement and related emails, reports and alerts may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information in this advertisement, related emails, reports or alerts or on our website or media webpage. This information is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https:// www .sec .gov/edgar/searchedgar/companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.