Sponsored by Sideways Frequency*

TODAY’S TOP ALERT!

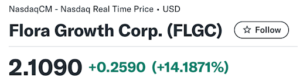

Nasdaq: FLGC

Pull up Flora Growth (FLGC) on your screen immediately.

This is an urgent situation our algo scanner has identified.

Last time I alerted you to this stock, it gained over 14% the very same day, if you recall…

As you can see in the chart below, FLGC is in a clear breakout over the last few days.

Once $1.20 resistance was taken out, FLGC has been in a “GO” hourly uptrend

Watch to see if the next resistance level at $2.00 will break next.

Also, watch $1.50 support on the downside, if the trend breaks.

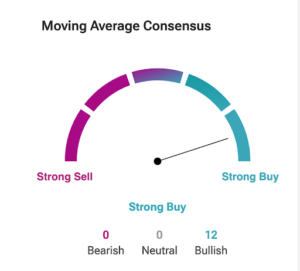

Tipranks’ computer model also shows a perfect “STRONG BUY” right now on the 5-hour chart.

While FLGC is trading under $2 right now, analysts have a $4.00 price target on the stock, which would be a 130%+ move from current levels.

Today’s tactical stock of the day 🔥 is Flora Growth Corp. (FLGC), and it has been on an incredible tear.

I expect “MJ” stocks to be a strong focus as we head into the new Presidential cycle.

Currently, the DEA classifies cannabis as a substance that has “no currently accepted medical use and a high potential for abuse,” whereas this new status would classify it as a substance with “a moderate to low potential for physical and psychological dependence.”

Vice President Harris has gone further, affirming in September her support of full decriminalization.

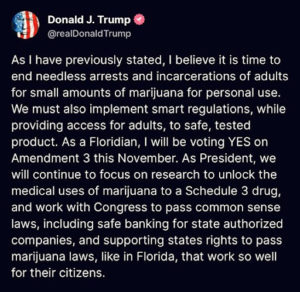

Also in September, we got this from President Trump:

Florida’s Amendment 3 would allow “adults 21 years or older to possess, purchase, or use marijuana products and marijuana accessories for non-medical personal consumption.”

According to Gallup, 70% of Americans now support legalizing marijuana, including 55% of Republicans, and 47 states have instituted some form of cannabis legalization; only Kansas, Nebraska, and Idaho are holding out.

Full legalization is almost inevitable, and both presidential candidates have promised to usher it along.

Grand View Research expects the U.S. cannabis industry to reach $40 billion this year and $76.4 billion by 2030.

The question is: Which companies are most likely to benefit?

FLGC is an especially promising contender, with a mission “to create the leading NASDAQ small-cap international cannabis company.”

The Toronto- and Miami-headquartered company IPO’d in 2021 and has made a number of impressive acquisitions since then.

It’s now active in 28 countries and has more than 20,000 distribution points.

In 2023, its revenues reached $76.1 million in 2023 (128% growth year-over-year) and in Q2 this year, it reduced its cash used in operations by 91% from the prior quarter.

The company has four main brands:

- Just CBD – Acquired in 2022, it is “an established CPG wellness brand with over 300 products and a seamless omni-channel approach that includes a direct-to-consumer business with over 300,000 customers and a network of over 14,000 distribution points across the United States and internationally.” You can check out the products on the Just CBD website and its 95k-follower Instagram page.

- Vessel – A cannabis accessory brand featuring sleek vapes, pipes, lighters, etc. The company says that “From the moment you pick up any Vessel product, you’ll obsess over its signature design and character.” Here is the Vessel website and here is its 38k-follower Instagram page.

- HAZE – “A dynamic brand offering a diverse range of recreational hemp-derived products, including gummies and flower.”

- PEAK – A cannabis-infused beverage brand that includes Melo Seltzer, which has a slick website and 12k followers on its Instagram page.

FLGC notes that “JustCBD and Vessel achieved gross margins of 34% and 53%, respectively in Q2 2024.”

Melo Seltzer just officially launched last week with the completion of a specialized beverage facility, arguably precipitating this latest runup in the stock price…

The company notes that its “entry into the beverage market is not just a business decision; it is a strategic move to align our brand with the growing consumer trends towards meaningful alternatives to alcohol.”

There’s a lot more I could say about this impressive company, but the last thing I’ll point out is it has a very strong reach internationally, including in the UK, South America, and Germany.

The latter is especially important since in April Germany legalized recreational cannabis, becoming the “largest federally legal recreational and medicinal cannabis market in the world.”

FLGC says its “wholly-owned subsidiaries have been active in Germany since 2017, obtained the first medical cannabis license in Germany and are responsible for selling the first gram of medical cannabis in the country.”

The firm Roth MKM has given FLGC a $6.00 12-month price target, more than 220% over its current price.

FLGC redesigned its website in September, and I highly recommend checking it out for your own research. You should also look through this excellent investor presentation and fact sheet.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

I think this could be only the early innings of another major breakout as investors hunt for companies primed to benefit if/when cannabis regulations relax even further.

I recommend keeping FLGC clearly in your sights today as we watch the action unfold.

To Your Success,

Jeff Bishop

*Issuer Paid Content. Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we were paid ten thousand dollars (cash) from Sideways Frequency for advertising Flora Growth Corp for a one day marketing program on December 3, 2024 Previously, we were paid thirty thousand dollars directly from Flora Growth Corp for a five day marketing program on October 28, 2024. And before that, we received twelve thousand five hundred dollars (cash) from Sideways Frequency for advertising Flora Growth Corp for a one day marketing program on October 7, 2024. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Flora Growth Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.