Monday April 14, 2025

gauzy ltd.(Nasdaq: gauz)

Hey Folks, Jeff Bishop here.

I’m back on my horse and ready for an action-packed trading week.

The big news over the weekend was the revelation that there will be exemptions for whole classes of goods from President Trump’s “reciprocal tariffs.”

According to CNBC, “smartphones, computers, and other tech devices and components” made the list.

First, we heard there would be no 90-day pause… then there was one. We also heard there would be no exemptions, and now here we are.

There’s some question whether or not these exemptions will be permanent, but tech companies are surging in the pre-market regardless.

Right now, I have my eye on a smaller tech company that I think could well benefit from the news.

My “tactical trade” idea of the day is Gauzy Ltd. (GAUZ).

I actually alerted this stock last month, and it went on to rip more than 30% that day.

The stock has had some other great bounces lately, if you look at the chart, but overall it has taken a hit since tariff talk began.

While the company does make some of its products in the U.S., it also has manufacturing sites in France, Germany, and Israel.

The company also relies on a global supply chain, so these tariff exemptions could be fantastic news for the company.

The stock was already up 10% on Friday, and it was up again in the pre-market.

It’s had some strong support around $7.75, so if it dips below there, I’d likely wait for a better trend.

But it’s sitting right at its recent resistance for April, so if it climbs much higher today, I think we could be off for the races.

Stay dialed in the GAUZ today to see if it rips once again!

The company itself is fascinating and has a lot going on…

It has drawn the attention of big-name analyst firms such as Barclays, B.Riley Financial, TD Cowen, and Stifel Nicolaus, who are giving it a “Buy” rating and an average 12-month price target that’s 67% higher than its closing price last week:

Here are some of my notes covering what all the excitement might be about…

GAUZ describes itself as “a global leader in vision and light control solutions.” Headquartered in Tel Aviv, Israel, the company has four main business segments:

- Architecture: Providing smart glass technologies for buildings, including switchable glass for privacy and shading, as well as next-generation digital displays.

- Automotive: Developing smart glass solutions for vehicles, including panoramic sunroofs, side windows, and windshields that replace traditional visors and shades.

- Aerospace: Supplying smart glass, shading systems, and cockpit shading for private and commercial aircraft, helicopters, and other aerospace applications.

- Safety Tech: Offering AI-powered Advanced Driver Assistance Systems (ADAS) for buses, semi-trucks, tractors, and construction vehicles, incorporating AI-powered camera monitoring, motion sensor systems, and safety doors.

I’m particularly fascinated by the company’s electricity-powered smart glass technology, which it calls LCG® (Light Control Glass). It comes in two main types: Polymer Dispersed Liquid Crystal (PDLC) and Suspended Particle Device (SPD).

According to GAUZ, this technology “creates dynamic, light-controlled spaces by applying technology to new and existing glass. PDLC Smart Glass can change glass from opaque to clear giving you privacy and temperature control with the click of a switch.

“SPD smart glass blocks 99% of light, allowing windows to dim and tint without blocking views, making it the optimal shading choice for exterior windows across industries.”

There are details about the technology as well as helpful demos on this page.

And this excellent video has “everything you need to know about smart glass technology in 2 minutes.”

The company’s Safety Tech segment produces Advanced Driver Assistance Systems (ADAS), including camera monitor systems (CMS) and driver protection doors.

You can read more about those technologies here, and here is a two-minute video overviewing them.

GAUZ has an impressive roster of partners and customers, including Ford Trucks, Ferrari, Hilton, Crowne Plaza, and Hyundai, to name a few.

The company has too many impressive deals to cover all of them here, but these are some recent highlights:

It signed a deal with “a major European OEM” to deliver LCG® Smart Glass into an average of 50,000 cars per year for nine years.

It also announced a deal with Ferrari in October to supply the smart glass for its first-ever four-seater for eight years.

And a ”major international airline” has contracted with GAUZ to supply cabin shading with LCG® Smart Glass on its Boeing 737 MAX fleet.

Yutong, the world’s largest bus OEM, increased sales of GAUZ’s Smart-Vision ADAS in Q3 2024 by 250% year-over-year, and handed GAUZ the “Outstanding Supplier Award” in December.

In October, GAUZ announced that “its advanced driver assistance system (ADAS) has fully replaced traditional side mirrors on the Capital District Transportation Authority (CDTA) of New York’s public buses.” These solutions are now deployed in more than 80 cities worldwide, with continued expansion underway.

Impressively, the largest cruise ship manufacturer, MSC, chose GAUZ for “11,000 sq ft of LCG® Smart Glass Transparent Display Façade [for its] new cruise ship terminal in Miami, Florida.”

Again, this is just a small sample of the company’s deals…

In August, GAUZ announced that its “commanding market-leading position in cockpit shading for all commercial aircraft and business jets, which now stands at a dominant 95%, will yield an aggregate revenue of $240 million over the next 10 years.” [emphasis added]

The company said it is “uniquely positioned to capitalize on the sizable opportunity for new aircraft and aftermarket products due to its commercial relationships with leading OEMs for both commercial and business jets, such as Boeing and Airbus, which span more than 20 years.”

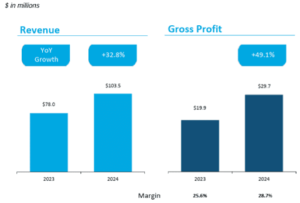

Here is a helpful breakdown of the company’s impressive revenue growth:

As you can see, its revenues more than doubled in two years — breaking into $100 million+ territory. On top of that, its gross profit jumped 49.1% year-over-year:

For a full breakdown of the company’s Q4 2024 earnings, see this detailed press release and this webcast of its earnings call.

As of March, the company had 708 employees, 146 granted patents (18 of them in the U.S.), 4 manufacturing sites (Tel Aviv, Israel; Stuttgart, Germany; Lyon, France; and Melbourne, Florida), and more than 1,300 customers in more than 30 countries.

That’s just a brief overview of this very impressive company. As you do your own research, be sure to check out this promo video to get a sense of the company’s slick marketing as well as this earnings/investor presentation and the company’s excellent website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: GAUZ is a company on the move. Its revenues in 2024 were up over 32% year-over-year, and its gross profits jumped 49.1%.

The stock was already up 10% on Friday, and tariff exemption news could push it to the next level.

Today could be a very explosive day for GAUZ so be sure it’s topping your watchlist!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Sica Media for advertising Gauzy Ltd for a one day marketing program on April 14, 2025. Before this, we received fifteen thousand dollars (cash) from Legends Media for advertising Gauzy Ltd for a one day marketing program on March 11, 2025 and we also received ten thousand dollars (cash) from Legends Media for advertising Gauzy Ltd for a one day marketing program on December 20, 2024. Previously, we received twenty five thousand dollars (cash) from Legends Media for advertising Gauzy Ltd for a one day marketing program on December 6, 2024. This was paid by someone else not connected to Gauzy Ltd. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Gauzy Ltd might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.