Friday, Dec 20, 2024

Gauzy Ltd. (Nasdaq: GAUZ)

We have been on an absolute heater lately! 🔥

This week alone, we’ve had alerts that jumped 10%, 20%, and even 40%+ after I showed them to you.

This is really incredible when you consider that this has been one of the worst declines the market has seen in a long time.

Even in the midst of that, I have been able to land on some very solid momentum ideas that have been exciting to watch.

Today, I am ending the week with an idea I introduced to you a couple of weeks ago before it made a big run.

Right now, I see a very similar technical setup that demands your attention.

If you look at the algo-generated chart below, you’ll see a series of “GO” signals prior to the last surge.

Now, look at those same “GO” signals firing right now above the 20-hour moving average. This is one of my favorite setups to monitor.

Right now, I am anxiously watching the $8.50 level to see if GAUZ will breakout and possibly retest the upper end of the recent trading range.

That could be a massive move from here.

On the downside, I am looking at $7.50, which is the recent support level. If that breaks, then we might be entering a new downward trend, so be on alert.

This is a fantastic time to look at GAUZ again if you have not been watching it lately.

👉 GAUZ is TODAY’S #1 ALERT 👈

I also want you to look at TipRanks (which is one of the world’s largest stock research sites). Their proprietary algo shows a “STRONG BUY” on multiple levels.

This is an urgent situation right now. Take time to do your research on GAUZ right now.

The company itself is fascinating and has a lot going on…

It has drawn the attention of big-name analyst firms such as Barclays, B.Riley Financial, TD Cowen, and Stifel Nicolaus, who are giving it a “Strong Buy” rating and an average 12-month price target that’s 97% higher than the current price:

Here are some of my notes covering what all the excitement might be about…

GAUZ describes itself as “a global leader in vision and light control solutions for the automotive, aeronautics, architecture, and safety technology industries.”

Headquartered in Tel Aviv, Israel, the company has three main segments:

- Architecture and Automotive: Providing smart glass technologies for buildings and vehicles, including next-gen digital displays, glass rooftops, side windows, and windshields, to replace conventional sun visors and shades.

- Safety Tech: Offering Advanced Driver Assistance Systems (ADAS) for buses, semi-trucks, tractors, and construction vehicles, such as AI powered camera monitor and motion sensor systems, and safety doors.

- Aeronautics: Supplying smart glass, traditional shading, and cabin management systems for private and commercial aircraft, as well as helicopters.

I’m particularly fascinated by the company’s electricity-powered smart glass technology, which it calls LCG® (Light Control Glass). It comes in two main types: Polymer Dispersed Liquid Crystal (PDLC) and Suspended Particle Device (SPD).

According to GAUZ, this technology “creates dynamic, light-controlled spaces by applying technology to new and existing glass. PDLC Smart Glass can change glass from opaque to clear giving you privacy and temperature control with the click of a switch.

“SPD smart glass blocks 99% of light, allowing windows to dim and tint without blocking views, making it the optimal shading choice for exterior windows across industries.”

There are details about the technology as well as helpful demos on this page.

And this excellent video has “everything you need to know about smart glass technology in 2 minutes.”

The company also has a business unit called Safety Tech that produces camera monitor systems (CMS), advanced driver assistance systems (ADAS), and driver protection doors.

You can read more about those technologies here, and here is a two-minute video overviewing them.

GAUZ has an impressive roster of partners and customers, including Hilton, Crowne Plaza, Hyundai, Ford trucks, and Ferrari.

The company has too many impressive deals to cover all of them here, but these are some recent highlights:

It signed a deal with “a major European OEM” to deliver LCG® Smart Glass into an average of 50,000 cars per year for nine years.

It also announced it signed a deal with Ferrari in October to supply the smart glass for its first-ever SUV for eight years.

And a ”major international airline” has contracted with GAUZ to supply cabin shading with LCG® Smart Glass on its Boeing 737 MAX fleet.

Yutong, the world’s largest bus OEM, increased third-quarter orders for GAUZ’s Smart-Vision ADAS by 250% year-over-year.

In October, GAUZ announced that “its advanced driver assistance system (ADAS) has fully replaced traditional side mirrors on the Capital District Transportation Authority (CDTA) of New York’s public buses.” These solutions are now deployed in more than 80 cities worldwide, with continued expansion underway.

Impressively, the “largest cruise ship manufacturer” chose GAUZ for “11,000 sqft of LCG® Smart Glass Transparent Display Façade [for its] new cruise ship terminal in Miami, Florida.”

Again, this is just a small sample of the company’s deals…

In August, GAUZ announced that its “commanding market-leading position in cockpit shading for all commercial aircraft and business jets, which now stands at a dominant 95%, will yield an aggregate revenue of $240 million over the next 10 years.” [emphasis added]

The company said it is “uniquely positioned to capitalize on the sizable opportunity for new aircraft and aftermarket products due to its commercial relationships with leading OEMs for both commercial and business jets, such as Boeing and Airbus, which span more than 20 years.”

Here is a helpful breakdown of the company’s impressive revenue growth (LTM stands for “last twelve months”):

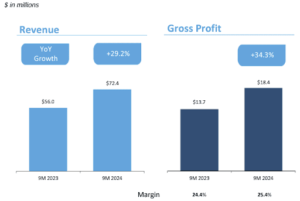

As you can see, its revenues have nearly doubled in two years. On top of that, its gross profits have jumped 34% year-over-year:

By the numbers, the company has 662 employees, 145 granted patents (18 of them in the U.S.), 4 manufacturing sites (Tel Aviv, Israel; Stuttgart, Germany; Lyon, France; and Melbourne, Florida), and more than 1,000 customers in more than 30 countries.

In September, company insiders — including its CEO, CTO and CFO — as well as a long-term investor purchased nearly 50,000 shares of GAUZ stock.

CEO Eyal Peso commented, “Our strong orderbook, pipeline of exciting new technologies and expanding market presence position us well for continued success. We are excited about our future and the opportunity to increase our ownership stake in Gauzy at attractive levels.”

That’s just a brief overview of this very impressive company. As you do your own research, be sure to check out this promo video to get a sense of the company’s slick marketing as well as this investor presentation and the company’s excellent website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: GAUZ is a company on the move. Its revenues for the first three quarters are up 30% year-over-year, and its gross profits are up 34%.

Today could be a very explosive day for GAUZ so be sure it’s topping your watchlist!

To Your Success,

Jeff Bishop

👊 Make sure you are getting my mobile text alerts – text “RAGE” to 1-(888) 404-5747 to get all of my latest HOT STOCK ideas delivered right to your phone (make sure you put the “1” at the front!). Don’t miss out!

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received ten thousanddollars (cash) from Legends Media for advertising Gauzy Ltd for a one day marketing program on December 20, 2024. Previously, we received twenty five thousand dollars (cash) from Legends Media for advertising Gauzy Ltd for a one day marketing program on December 6, 2024. This was paid by someone else not connected to Gauzy Ltd. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Gauzy Ltd might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.