*Sponsored by Gold Royalty Corp

With an election only months away, I am certain that the Fed will cut interest rates in the coming months.

The market is anticipating that as well, of course, and it is the main driver of the lofty stock prices (mainly for tech stocks) that we see today.

Unfortunately, that is going to further erode the fiat currencies, like our precious dollars!

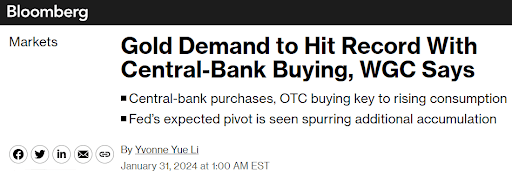

That’s why central banks are buying gold hand over fist. They understand gold is a real store of value, and they know better than anyone how fiat currencies are being undermined.

If you have followed me for any length of time you know that I’m a big fan of gold.

I don’t own any crypto, but I’ve held physical gold for about 20 years now.

Over the years, I have learned to “buy the dips,” and we are seeing one of those opportunities right now…

But as you know, I’m always in search of outsized gains, and even though physical gold has done well — its spot price is up about 8 percent from a year ago, and still flirting with the all-time high it set in December — I’m especially interested in gold stocks right now…

When people think of gold stocks, it’s the mining stocks that usually come to mind.

And if you check the major indexes — like the benchmark VanEck Gold Miners ETF (GDX) — it’s actually down over the past year, despite gold’s rise.

That’s because even though the gold these companies mine has gone up in value, the cost of extracting it has gone way up. In other words, these companies’ bottom-line profits are being held down by inflation itself.

But what if there was a business model that depended only on the top-line revenue of these miners? A model that profited from rising gold prices while dodging inflationary extraction costs?

It turns out there is such a model: gold royalties.

Within that space, three major companies together represent 80 percent of the value of all gold royalties.

Frankly, I don’t think their bloated stocks — which are trading at huge multiples — have much upside left.

That’s why my eye is on one company that stands out as a prime opportunity. Here’s the one stock I think you should focus on today:

Gold Royalty Corp (NYSE: GROY)

This is a company that’s small enough to still grow meaningfully, but established enough that we can see what they’ve got going.

Let’s dive in…

Exposure and protection

As its name suggests, gold royalties are the core of GROY’s business…

Since the company’s IPO in March 2021, it has gone from 18 royalties to over 245 today — an over 13.5x increase in less than three years.

In case you aren’t familiar, here’s how a gold royalty works…

A company such as GROY provides up-front capital to a mining company in exchange for a fixed percentage of that company’s top-line revenue.

That up-front capital is not a loan; it’s a one-time investment in exchange for a perpetual royalty.

The royalty is calculated by taking the ounces of gold the mine produces, multiplying it by the gold price, and multiplying the product by an agreed percentage — typically between 1% and 3%.

As you can see, this means a royalty company such as GROY gets exposure to current gold prices but protection from rising capital- or operating-costs due to inflation or anything else.

In an environment of entrenched inflation and rising gold prices, this is an incredibly appealing prospect.

On top of that, royalty companies benefit from the upside of mining exploration and expansions without direct financial exposure to the associated risks.

This means GROY has royalties not only on known reserves in the ground, but of future ones to be discovered.

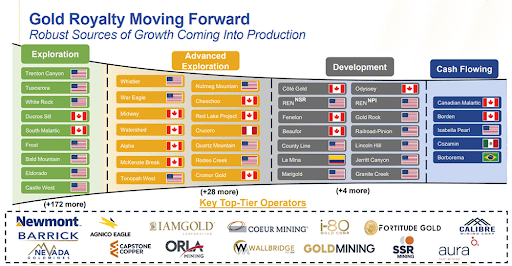

GROY also benefits from diversification. As mentioned, its portfolio has more than 245 royalties, and those span more than 80 operators. These are all in mining-friendly jurisdictions in the Americas.

You can find the full list of royalties and operators on the company’s website here.

As you can see, GROY has royalties in projects at all stages of production — ranging from exploration to fully cash flowing:

Source: Corporate presentation.

I love this approach because this mix gives investors exposure to cash-flowing assets with future upside potential as well as up-and-coming projects with the potential to be cash flowing in the future.

In other words, it’s a good blend of low and high risk ventures.

Of course, the key to this business model is knowing which ventures to choose, and that’s where GROY’s leadership team comes in…

Board and management

At the helm of Gold Royalty Corp is 34-year industry veteran David Garofalo.

Before becoming CEO of GROY, David was president and CEO of Goldcorp Inc., one of the top three gold producers in the world before it merged in 2019 with the second-largest producer, Newmont Mining Corporation, thus creating the world’s largest gold miner.

(You can read about Goldcorp’s impressive track record here.)

As David explains in this interview with Robert Kiyosaki of Rich Dad Poor Dad fame, he pivoted from 34 years of building and operating mines to running a royalty company specifically because he saw the stars aligning in the royalty space.

He also points out that his team at GROY has over 400 combined years of industry experience…

That gives them the know-how to identify worthwhile projects, as well as the contacts to get their feet in the door.

As David says, “I know everyone in this space. It’s a small industry especially once you’re in it for 30 years.”

Going forward

From everything I have read, GROY’s prospects for the future look stellar.

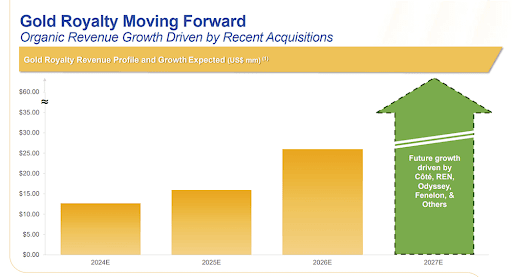

As David points out in this video, their operation could grow to 10x its current size with the same team. He says this means every dollar of revenue growth goes straight to the bottom line and increases the potential to extend value to shareholders.

These high margins no doubt contribute to an announcement he just made in a presentation at the 2024 Vancouver Resource Investment Conference that GROY is “pivoting for the first time into free cash flow positive this year.”

Source: Corporate presentation.

It’s no surprise that analysts are upbeat about the company, with an average one-year price target nearly 150% higher than its current valuation…

I think it will take quite some time before the gold spot price makes a move like that.

Nothing is guaranteed in the markets, of course, and every investment carries risk.

Do yourself a favor and see whether GROY meets your risk profile.

I recommend starting with David Garofalo’s recent presentation I mentioned above, as well as this information-packed video that features him.

I also found the company’s corporate presentation very informative…

And of course, be sure to study the GROY chart.

I’ll be eager to hear what you think!

To Your Success,

Jeff Bishop

*This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results.

*ISSUE-PAID ADVERTISEMENT. RagingBull has currently been paid fifty thousand dollars by ach bank transfer by Gold Royalty Corp from a period beginning on February 6, 2023 through March 7 of the same year. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Gold Royalty Corp, increased trading volume, and possibly an increased share price of the Gold Royalty Corp securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in Gold Royalty Corp., though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull can guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. A portion of our business is engaged in the marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. A portion of RagingBull’s business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, SMS, push notifications. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently, companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the corporate awareness program ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at

https://www.sec.gov/edgar/searchedgar/companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.