*Sponsored by Sica Media

On July 11, the stock of a little-known healthcare IT company opened at $3.00 per share. Within an hour of the opening bell the next morning, it rocketed as high as $10.89 — a 263% gain in 24 hours.

If you are an active momentum stock trader like I am, you might remember this one lighting up your trading screen.

I have been watching it like a hawk since then, and today, I’ll explain why I think everyone needs to be solely focused on just this one stock:

Healthcare Triangle, Inc. Nasdaq: HCTI)

As you start your research on this one, go back and look at the explosive gain on July 12th. That will give you a feel for exactly the sort of move small stocks are capable of…

All it takes is one press release… one earnings report… one news story…

But my primary interest with HCTI isn’t what the big jump in valuation meant for investors.

Honestly, I don’t even really care about the news that caused the stock to soar — I care about what this means for short sellers.

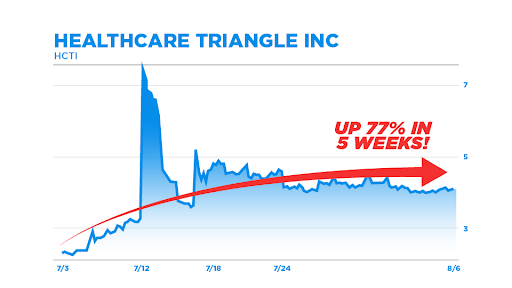

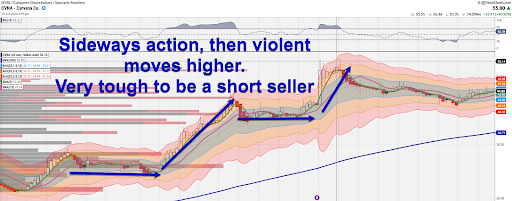

Take a look at this chart:

You can see the big jump on July 12, followed by a dip down and a consolidation around $4.20 that’s held steady over the last three weeks.

Three weeks.

HCTI makes an epic move of over 200%, and then the stock trades sideways in an extremely narrow range for nearly a month.

This is the kind of price action that should make you very, very afraid… that is, if you are short the stock!

If you aren’t familiar with what “shorting” a stock is, it basically means that traders are “selling” the stock without owning it. They want to buy it back at a future date, and hopefully a lower price. If that happens, they will pocket the difference as their profit.

But what happens if the stock doesn’t go down? What happens if there are more “shorts” out there trying to buy the stock than there are real sellers?

Well, this imbalance is what we call a “short squeeze.”

It is when shorts are scrambling to buy back shares, and create an upward spiral that forces other shorts to also buy back their shares at a loss.

Charles Schwab has a great description of this phenomenon. Take a moment and read it if you want to brush up on how a short squeeze can work.

If you have been trading for a few years, you have probably seen AMC, GME, TSLA, BBBY, CVNA, etc. make some INSANE moves higher that left you scratching your head. 🤯

There was a ton of organic interest in those stocks, to be sure, but the mega jumps were often due precisely to the “short squeeze” phenomenon.

But back to HCTI…

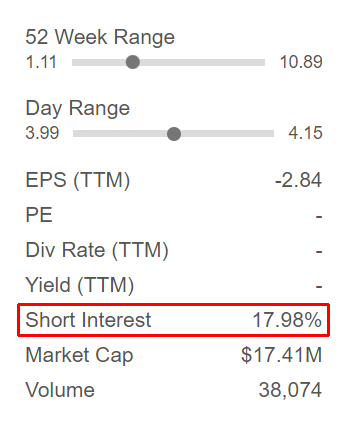

According to SeekingAlpha, short interest in HCTI is currently at about a staggering 18%.

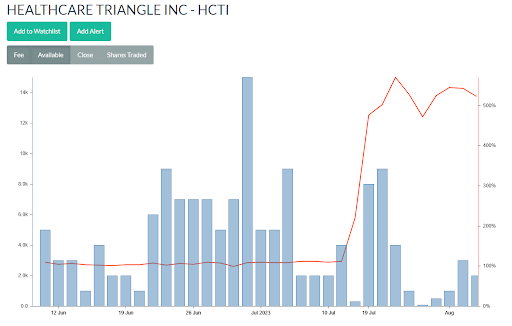

On top of that, the number of shares available to borrow (the blue bars on the chart below) have plummeted since July 20, and the borrow fees (the red trendline) have soared to an astronomically high 523%

This means there is an acute shortage of fresh shares to borrow, and the fees that shorts have to pay to hold the existing shares is painfully high.

(Imagine sitting on a position you had to pay over 500% interest on!)

These are some of the highest borrow rates I’ve come across, especially for a stock with such a small market cap ($17.4 million, per Yahoo! Finance).

Even during the height of the “meme stock” craze, when massive institutions were heavily shorting the stocks, GameStop’s borrow rates didn’t top 130%.

Folks, this is bad news for HCTI short sellers.

As you may have picked up during the whole meme stock saga, short sellers rely on borrowed shares to bet against stocks.

When a stock price jumps like HCTI did last month, you typically see tons of people shorting it. High short demand means low supply of shares to borrow and high fees to do so.

You can check out this article in its entirety for more on the importance of high borrow fees, but for our purposes, this is the money quote from S3 Partners analyst Ihor Dusaniwsky:

“An increase in stock borrow rates may force (squeeze) some short sellers into closing their positions — getting out to realize their remaining mark-to-market profits and exiting before other buy-to-covers drive the stock price up.”

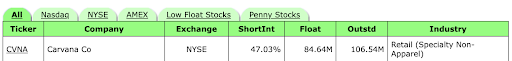

Let’s look at a recent example with Carvana (CVNA) from just last month.

Keep in mind that the stock is up a mind-blowing 858% so far this year, as you can see in the graphic below.

Is this because it is a fantastic company that is blowing away earnings estimates?

No. It’s not even a great company at all, if you ask me.

I think the reason is that CVNA is one of the highest “short interest” stocks in the market right now (as reported here and shown in the chart below)

Now, let’s talk about the ideal setup I look for in a “short squeeze.”

#1: We have to have a high level of short interest (I think we already determined that for HCTI).

#2: We have to see a chart pattern that has a violent move higher, followed by a “pause,” where the stock trades sideways for a period of time. The next move after that is typically higher… sometimes much higher.

I outlined what that looked like for CVNA just last month when on two occasions it jumped over 100% higher.

Sideways… then breakouts higher. Textbook moves right here.

Does it work 100% of the time? Of course not, nothing in the market does. But go back and look at lots of stocks with high short interest and see how often you see similar moves.

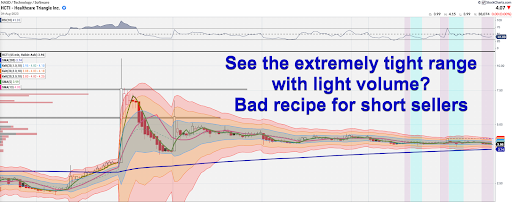

Now look at where we are with HCTI.

If we compare the current price to the typical price over the last six months, we can see that the consolidated price is at a higher plateau compared to the preceding months:

This means the stock hasn’t dropped nearly to where short sellers would prefer. This could mean big trouble for them… and big profits for regular investors.

You won’t find an opportunity like this very often, and barring some ugly piece of news, I think this is a “cupcake setup.” 🧁

The stock made the violent move higher, and now it is in the “waiting phase” as it looks for the next direction.

As traders, we have to look for “clues” as to what that direction could be. 🔍

The key level I’d look for would be a move into the $4.20–$4.30 area, since that would be above the recent price over the last week or so.

If that breaks, then I can only imagine how many shorts might decide to throw in the towel and exit their positions.

Now let’s look at some other indicators for HCTI right now.

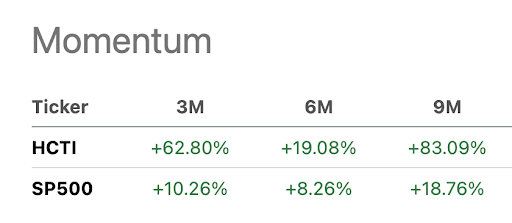

The first is pure momentum.

One of the first things I ask myself when looking at a potential trade is, “How is the stock trading versus the overall market in general?”

Well, you can clearly see HCTI has outperformed compared to the SPY on just about any timeframe this year.

(source: SeekingAlpha)

Then, look at key technical indicators and market oscillators. Here is a great overview from Barchart showing a whopping 88% buy rating on their indicators.

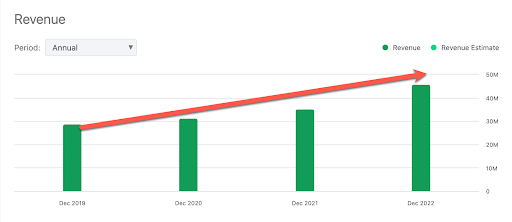

Why is the market so optimistic about HCTI this year?

Well, on top of all of the great news they have been issuing (like the July 12 news that shot the stock up over 200% in a single day), HCTI has been executing very well if you consider growing sales to be a success.

And Wall Street is starting to pay attention.

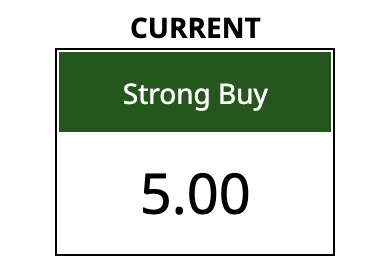

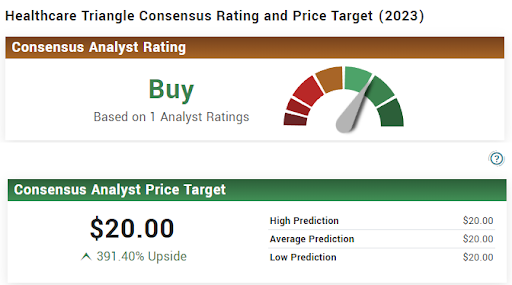

Barchart reports a perfect “Strong buy” rating from the analyst coverage it reports.

That “strong buy” rating comes from an analysis by investment bank EF Hutton. They released their report with a split-adjusted (HCTI did a 1-for-10 reverse stock split in May of this year) price target of $20 back in September 2022.

That’s nearly 400% higher than its current $4.07.

(source: MarketBeat)

All of this suggests that short sellers are out on a limb, and an upward price move could be imminent.

And like I said, a small tick up could set off a cascade of shorts covering their positions. But without the available volume for them to do so, they could panic and start to buy shares at any price.

If that happens, as the meme stock “apes” were fond of saying, the stock price could go to the moon. 🚀

Just because I like a stock doesn’t mean it is going to work out like I think it could – it might do better, or worse. If you decide to trade it, make sure you understand all the risks involved and have your own game plan in place. A good place to start is by visiting the company’s website and getting to know more about the story.

I am simply showing you something that I think is an outstanding opportunity to look at right now, but you have to make your own choice and take ownership of your own trading.

*PAID ADVERTISEMENT. RagingBull has currently been paid twenty four thousand dollars by ach bank transfer by Sica Media for advertising Healthcare Triangle, Inc from a period beginning on August 7, 2023 through August 9, 2023 of the same year. As a result of this advertisement and other marketing efforts, RagingBull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, the owners of Raging Bull do not hold a position in Healthcare Triangle, Inc. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Healthcare Triangle, Inc, increased trading volume, and possibly an increased share price of the Healthcare Triangle, Inc securities, which may or may not be temporary and decrease once the marketing arrangement has ended.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull can guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. A portion of our business is engaged in the marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. A portion of RagingBull’s business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, SMS, push notifications. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. In cases where a third party is involved, please note we have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently, companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the corporate awareness program ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https:// www. sec. gov/edgar/ searchedgar/companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.