SL: 💡 Will lightning strike twice with this week’s Bright Idea? ⚡

Preview: I am so excited to see this stock setting up again. It was an incredible performer the last time I alerted it, and I have high expectations this week as well.

*Sponsored by Lifewater Media. Please see disclosures below.

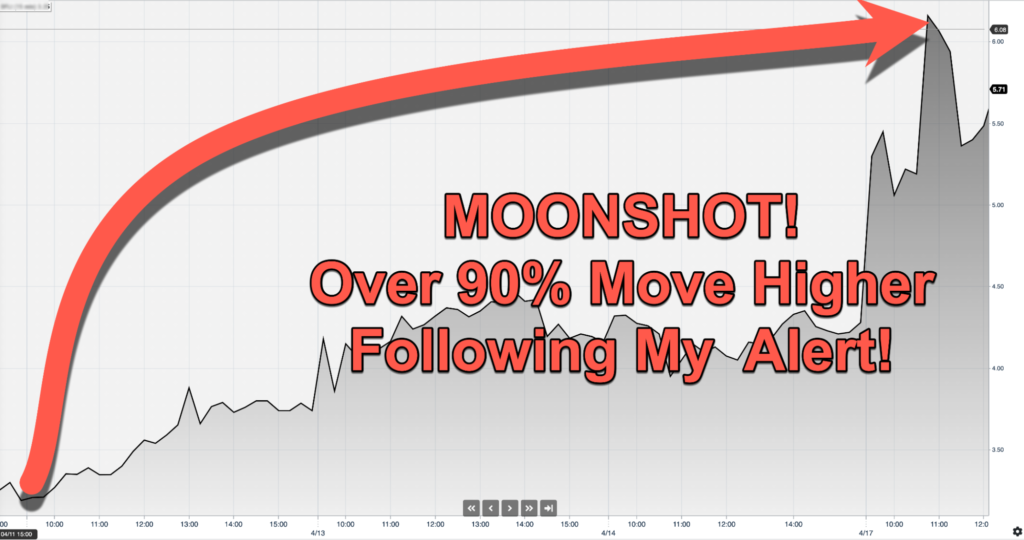

Last time I brought Dragonfly Energy (Nasdaq: DFLI) to your attention, I was noticing a peculiar formation on the stock chart that I felt could be the signal of a strong reversal after a long downtrend.

At that point, DFLI had somehow fallen 50% on the year, but the indicators I look at were all pointing higher, telling me this selloff was likely done, and the stock was worth looking at again.

My timing couldn’t have been any better on that call.

Within days of alerting everyone to it, we saw DFLI make a stunning move over 90% higher from where I brought it to the attention of everyone.

(if you have been following me for a few months, you remember seeing this!)☝️

(if you have been following me for a few months, you remember seeing this!)☝️

Normally, I am pretty happy to see a stock make a 10-20% gain. When I saw the violent move higher for DFLI last time I told you about it – even I was amazed! Of course, we never know what’s going to happen in the future, and I won’t suggest we are going to see a move quite that strong again, but…

Today, I am seeing what I would call an even better setup for DFLI than what I did last time.

Look at this chart below. I have highlighted the last 3 times that I spotted the “gamma trigger” breakout pattern.

Twice, it led to some incredible gains of 218% and 90%, as you can see above.

Once, it failed, but by keeping a tight stop loss below the trigger, there was little harm.

I have been patiently waiting for an ideal opportunity to show this to you again, and right now, I am seeing the same formation – but at a much lower price.

These are exactly the kind of opportunities I love in the market – massive upside potential, while keeping a tight reign on losses if I’m wrong.

Something new in the mix is the addition of stock options for DFLI.

Last time I brought this stock to your attention, I don’t think options existed. Today, it can open up a whole opportunity.

Just be sure you are comfortable with the risks and rewards of trading options, over stock.

You can find the option chain from your broker, or you can watch them from this link on Yahoo.

DFLI has set out to develop cleaner and less wasteful processes to create lithium-ion batteries. 🔋

Their cutting-edge technology is enabling the widespread conversion to green, renewable energy.

DFLI produces batteries that solve today’s lead-acid problem and are creating next-generation non-flammable solid-state batteries to address tomorrow’s energy storage needs.

To understand how important cutting-edge batteries are right now, just consider this…

Recently, Elon Musk bluntly said that battery shortage is the one thing holding back Tesla.

It is a MAJOR problem that every manufacturer is facing right now.

However, DFLI is meeting this challenge head-on.

They have carved out a very unique niche that specializes in the development of batteries that serve the RV industry.

In a groundbreaking announcement last year, tiny DFLI detailed the terms of a $15 million investment from $4 billion THOR Industries (NYSE: THO), which is one of the largest players in the RV industry.

This company is at the forefront of developing cleaner and more efficient lithium-ion batteries and has its focus on next-generation non-flammable solid-state batteries.

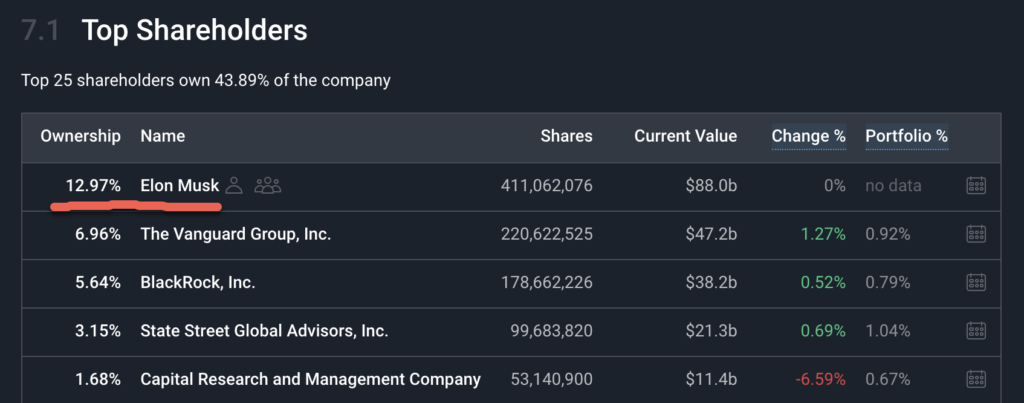

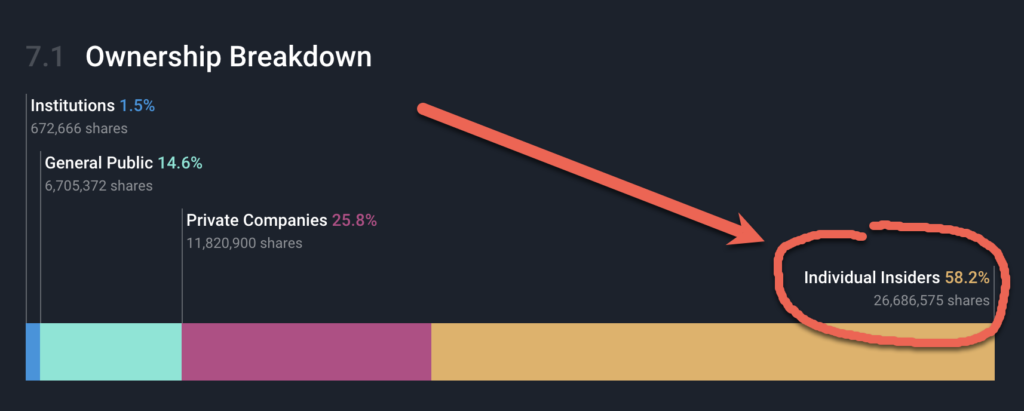

One of the overlooked fundamentals that I think traders overlook is the ownership structure.

I think strong insider ownership is important because it signals how confident the people who know the company the best feel about the stock.

The way I look at it, if insiders don’t care enough to own their own stock… why should I?

Consider that one of the biggest corporate cheerleaders is Tesla’s Elon Musk. While I applaud his enthusiasm for TSLA, he has sold $10’s of billions of stock and now “only” owns around 13% of the shares.

On the other hand, we have DFLI insiders who own a whopping 58% of the shares.

Is it possible that the people closest to the company see something we don’t about its future? 🤔

DFLI was an early mover in the transition from lead acid to lithium-ion batteries in the RV industry. Their new batteries are non-toxic, lighter-weight, longer-lasting, and safer than their lead-acid counterparts. As a result, they not only improved customer experiences but also enhanced and powered their lifestyles.

Since 2018, DFLI has sold over 175,000 of the most popular deep-cycle lithium-ion batteries on the market, leading to rapid growth of both the Dragonfly Energy and Battle Born Batteries brands. The company’s products have been well received, not only for their superior quality but also for the exceptional customer service and support provided by the company.

I learned a lot about the company simply by watching some of the short videos they put out recently. They are very well-produced and tell a great story about what they do and the opportunity at hand.

I encourage you to take a few minutes and watch some of these videos for yourself…

(pretty incredible once you see it)

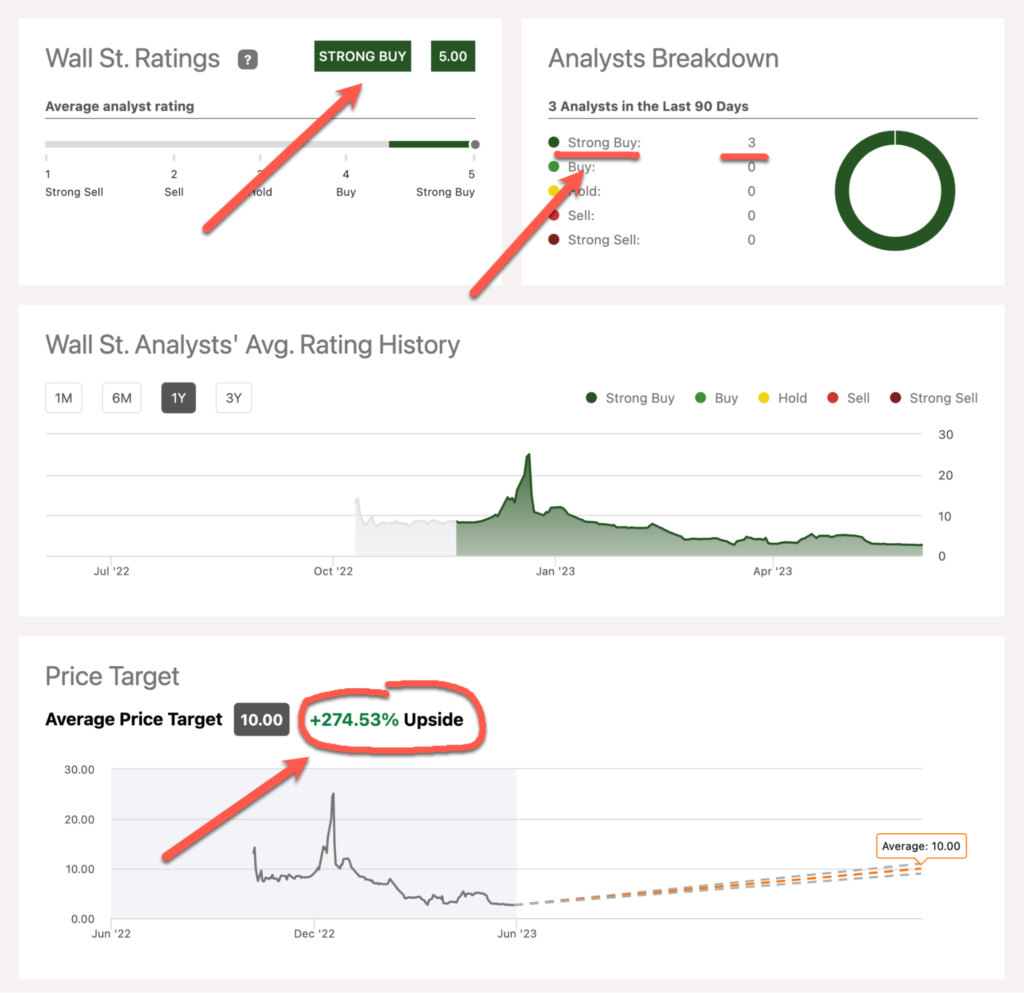

And, it’s not just insiders who love the stock.

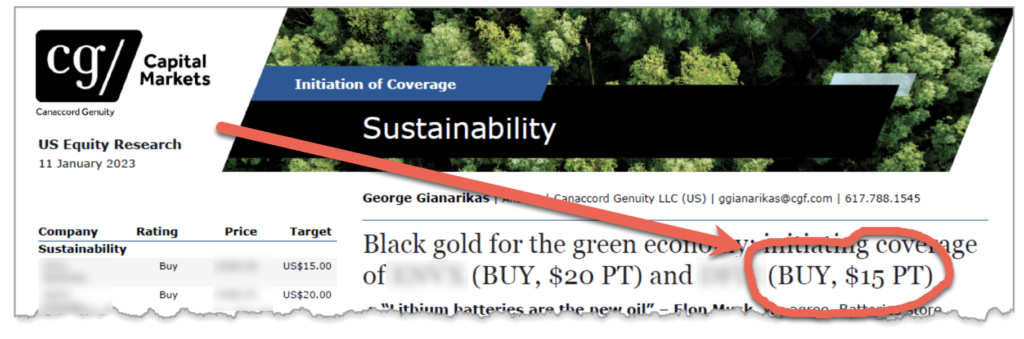

Wall Street analysts are warming up to the story as well.

SeekingAlpha reports that analysts have an average price target that is over 274% higher than current levels, as you can see on this graphic from SeekingAlpha.

And the word is getting out. From their website, just look at some of the places that have picked up on Dragonfly Energy Holdings (Nasdaq: DFLI) already…

And they have secured MAJOR partnerships (and investments) with some top RV and outdoor brands like:

DFLI lithium-ion batteries address the limitations of lead-acid batteries, which suffer from poor shelf life and toxicity.

For example, in material handling and forklift industries, lead-acid batteries have traditionally been installed after the manufacturing process due to these deficiencies. However, lithium-ion batteries enable original equipment manufacturers (OEMs) to install the batteries directly during manufacturing, eliminating post-production hassles.

One of the biggest opportunities I think they have ahead of them is coming with cutting-edge “solid-state” battery technology. 🔋

DFLI was recently awarded a patent on the concept, and there is enormous potential if they are successful here.

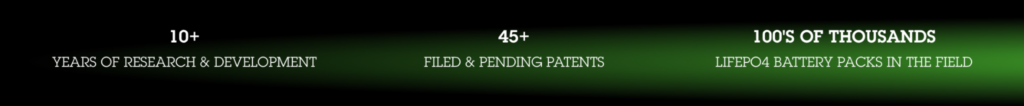

In fact, from their website, you’ll see that they have 45 active patents and an incredible footprint already established.

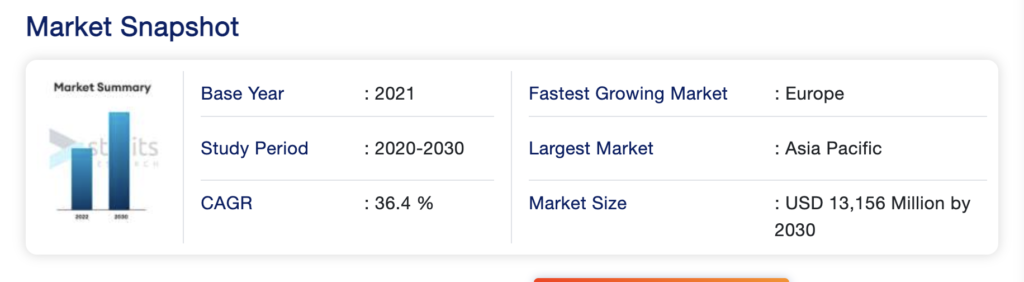

If you don’t know about solid-state batteries, see for yourself how big this market is going to be.

I think it is going to completely replace lithium-ion batteries in the next few years.

This report from Straits Research shows that they expect the market for solid-state batteries to grow over 36% year over year and become more than a $13 BILLION market by 2030.

DFLI is not your run-of-the-mill “battery maker.” This is a high-tech company that is delivering cutting-edge technology in a sector that is undeniably going to be hot for many, many years to come.

Considering how low the stock price is right now versus just a few months ago, I think it is a no-brainer to dig deeper into this story and see for yourself if DFLI deserves a spot in your portfolio.

With any investment, I think it is a great idea to get familiar with the risks and opportunities associated with it. A great place to start with DFLI would be to visit its website and learn all you can about it.

Good luck, and happy trading!

By the way… 👉 Text “RAGE” to (888) 404-5747 to get all of my latest HOT STOCK ideas delivered right to your phone! 🔥📲

To Your Success,