Today is like the Super Bowl of earnings.

NVIDIA releases its numbers after market close today, and like the Big Game, it’s something everyone has to watch.

I’ll be watching, too, but that’s all I’ll do.

I understand the temptation to want to get in on the action. Believe me, I do.

But after more than two decades of trading, one of my ironclad rules is not to trade a stock on its earnings day.

And as you know, NVDA is no regular stock. An entire market narrative hinges on how well the company performs, and investors could react violently in either direction.

The entire market is holding its breath.

Projections are that the company’s second-quarter revenue more than doubled, but even that may not be enough to satisfy investors accustomed to its gravity-defying results.

No, I’m going to enjoy this spectacle from the sidelines.

But that’s not all I’ll be watching today…

On days like this, I like to look for companies that I think will be largely insulated from the big news.

Biopharma companies are great candidates, and I have my eye on a very promising one.

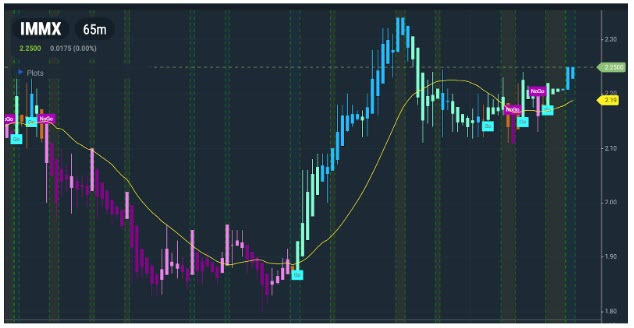

Do yourself a favor and check out the chart for Immix BioPharma (IMMX).

You’ll see right away that the company has been on a tear since its earnings announcement on August 12…

In the two weeks since then, it has jumped as high as 26%, and right now, it’s up about 18% from the announcement.

The chart pattern right now is a thing of beauty as well.

Look at how IMMX has found support around the 20-hour line, and is now breaking higher…

I would closely monitor the $2.10 level if this trend breaks down.

On the upside, I would love to see a move above $2.40 (near the high after earnings) and possibly even $2.60, which has been a resistance level.

I think this is one of the best-looking charts in the market right now.

Make sure you are paying close attention to IMMX today!

It’s a great sign when a clinical-stage biopharmaceutical company like this experiences that big of a jump after earnings.

Clearly, investors are feeling confident, and as we’ll see, company insiders and analysts are as well…

But first, let’s see what the company is up to.

Los Angeles-based IMMX is pioneering cell therapies for immune-mediated diseases, most notably a rare disease called AL amyloidosis (ALA).

ALA is an often life-threatening disease caused by an abnormal protein called amyloid that’s produced by plasma cells in the bone marrow, and that accumulates in various organs, such as the heart, kidneys, liver, spleen, nerves, and digestive tract.

Symptoms vary according to where the deposits occur, but the most common ones are fatigue, swelling (especially in the legs), weight loss, shortness of breath, numbness or tingling in the hands and feet, and changes in bowel habits.

Although ALA isn’t a cancer, it is closely related to a type of blood cancer called multiple myeloma. ALA treatments include chemotherapy and in some cases stem cell transplantation.

The prevalence of ALA is expected to hit 33,000 patients in the U.S. this year, and right now there is no FDA-approved treatment for relapsed/refractory cases.

That’s where IMMX sees a “blue ocean opportunity” for its NXC-201 CAR-T therapy, which the company describes as a “type of immunotherapy that uses the patient’s own immune cells, modified with ImmixBio proprietary technology, to create NXC-201, which is then introduced into the patient’s body.”

Those cells are then able to “recognize and eliminate diseased cells, with up to a 92% rate of disease reduction (overall response rate) in the case of relapsed/refractory AL Amyloidosis.”

Preclinical testing showed the treatment “completely eliminating AL Amyloidosis aberrant plasma cells from patient bone marrow.”

The main problems with traditional CAR-T therapies are cytokine release syndrome (CRS) and neurotoxicity.

Importantly, IMMX thinks its NXC-201 may have solved those problems, with a median CRS duration of just 1 day (4–8x shorter than other CAR-Ts) and zero neurotoxicity detected so far in AL amyloid patients.

The company says that “NXC-201’s uniquely favorable tolerability profile (no neurotoxicity + “Single-day CRS”) combined with proven preclinical and clinical efficacy make NXC-201 uniquely suited to treat AL Amyloidosis.”

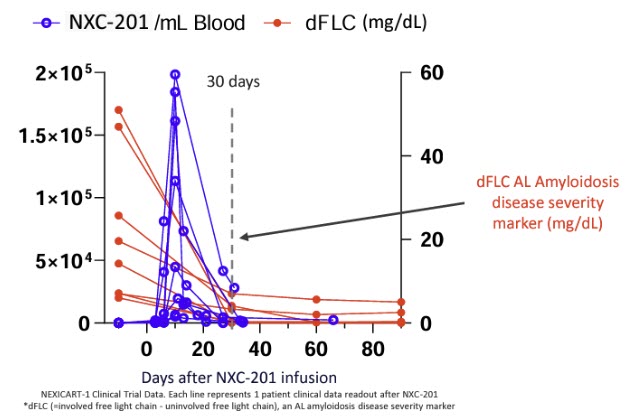

And indeed, data from the NEXICART-1 clinical trial revealed that “NXC-201 rapidly eliminates diseased AL amyloidosis plasma cells and exits within ~30 days”:

NEXICART-1 is an ongoing Phase 1b/2a clinical trial in Israel, and a separate Phase 1b/2a clinical trial in the U.S. — NEXICART-2 — just dosed its first patient in July.

NEXICART-2 is a more refined study that’s limited to patients with adequate cardiac function and who have not been exposed to similar therapies.

The lead clinical site is the prestigious Memorial Sloan Kettering Cancer Center under principal investigator Dr. Heather Landau, the Amyloidosis Program Director at the center, who has authored more than 100 peer-reviewed publications.

IMMX expects its initial clinical data release in NEXICART-2 in Q4 this year.

In July, the company received a sizable $8 million grant from the California Institute for Regenerative Medicine to support the development of NXC-201.

The Institute’s vice president of therapeutics development commented: “This one-time therapy would be an innovative treatment for patients with AL Amyloidosis, and the preliminary data are encouraging.”

Beyond its impressive therapeutic candidate, IMMX has assembled an incredible team…

Its executives hail from the likes of Goldman Sachs, AstraZeneca, and Pfizer…

And its scientific advisory board boasts doctors with positions at Columbia University, Harvard Medical School, and Stanford Medicine.

Even before that $8 million infusion, IMMX had established a very long cash runway, with Simply Wall St. noting that “In March 2024, Immix Biopharma had US$29m in cash, and was debt-free. Importantly, its cash burn was US$13m over the trailing twelve months. So it had a cash runway of about 2.2 years from March 2024.”

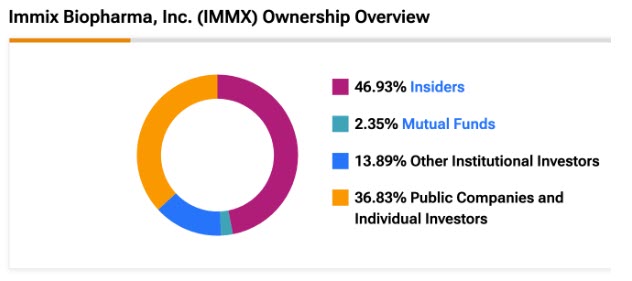

Company insiders seem confident.

Since the company’s Q2 earnings release on August 12, directors Carey Ng and

Jason Hsu both made solid five-figure stock purchases.

Overall, TipRanks reports that company insiders own a whopping 46% of the $59M market cap (estimated) company:

Source: TipRanks

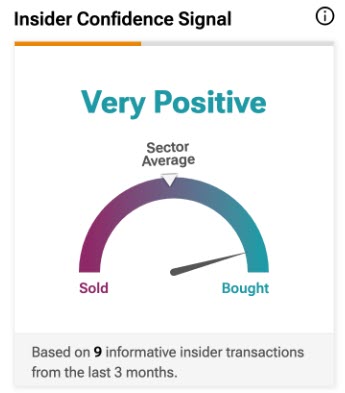

And this strong insider confidence hasn’t let up in the last three months:

Source: TipRanks

Lastly, I should note that while only one firm is covering IMMX right now, it reiterated its BUY rating on August 19 with a 12-month price target of $7.00 — that’s more than 220% over yesterday’s close.

Those are just some notes to get your own research started. If you want to look more into the company, check out the company website and especially the videos on this page. The company’s investor deck is informative but seems geared toward a technical crowd.

Always approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

I’m sure you’ll be watching NVIDIA today like everyone, but definitely keep this company on your radar. I think it could be in for a big swing.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Shore Thing Media for advertising Immix Biopharma, Inc for a one day marketing program on August 28, 2024. Previously we received ten thousand dollars by ach bank transfer by Lifewater Media for advertising Immix Biopharma, Inc. from a period beginning on May 10, 2023 through May 10 of the same year. This was paid by someone else not connected to Immix Biopharma, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Immix Biopharma, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.