👉 REMINDER, I’ll be hosting a special guest in the Market Master’s Trading Room today at 11am EST during my normal Bullseye session.

This is a FREE trading room open to all – LIVE action starts at 9AM EST daily.

And… Jason’s NEW $2000 Small Account Journey is starting on Tuesday — lowest price I can ever recall for this top-rated service. Good for any level of options trader!

I was amazed to find that U.S. stock futures are actually slightly lower this morning.

Fresh turmoil in the Middle East and scenes of the vast destruction caused by Hurricane Helene must be weighing on people, plus, let’s admit it… this recent rally is due for some profit taking.

This has been one of the most incredible markets of my lifetime…

Barring something unexpected today, the NASDAQ will close September up nearly 6%. That’s better performance in a single month than the index has had in 15 entire years since it was established in 1971.

And September is usually a terrible month for stocks!

Now, Bloomberg is trumpeting “Traders Blow Off U.S. Election Risks as Stocks Race Into October,” noting that the S&P 500 has been heading for the best nine months of a year since 1997.

Optimism is in the air, and the release of the September jobs report on Friday is the only thing that could clear it out, but even that is expected to hold the unemployment rate steady.

I’ve been having a lot of success identifying “tactical trade” ideas on small stocks lately, with some in the past two weeks seeing gains of 35%… 70%… even 200% without options.

I’ve now found another idea that I think deserves your immediate attention…

Have a look at ImmunoPrecise Antibodies (IPA) to start off your trading week.

As you can see, the stock had a wild 70% runup last month, going nearly vertical over the course of three days.

It slowly tracked back down over the following weeks before enjoying a 36% rally from its lows two weeks ago.

Right now, it’s trading about 10% down from its high-water mark on September 20, and I think it could be poised to retest that level today if things go well.

I love what I see with this opportunity right now.

If things don’t go well, I think a closing price under $.60 would signal that this trend is not ready to reverse course yet. That would be a small loss from the current price.

On the other hand, if momentum really starts to pick up, then I think we could see IPA test the recent resistance in the $.90 range from a few weeks ago.

Keep a close eye on $.72 as well, which was the upper resistance from the previous week. If that gets taken out, then I think we could see a much bigger move.

This could be a very big day for IPA, so make sure you start to look into it immediately.

And as we’ll see, if analysts are right (more on that below), it could be set to explore much rarer heights in the coming year…

IPA is a fascinating company that’s at the cutting edge of biotherapeutic research.

As I mentioned to you yesterday, it seems every company wants to get in on the AI action, but few are actually producing revenue based on it.

IPA is different. The company offers “AI-enhanced antibody drug discovery” and is already bringing in tens of millions in revenue.

The company is headquartered in Victoria, British Columbia, and has offices in North Dakota, The Netherlands, and Belgium.

Its services include “highly specialized, full-continuum therapeutic biologics discovery, development, and out-licensing to support its business partners in their quest to discover and develop novel biologics against the most challenging targets.”

At the core of the company is its proprietary AI-driven platform, LENSAI, from BioStrand (a subsidiary of IPA).

In a Youtube video interview released three days ago, IPA CEO Jennifer Bath, Ph.D., explained that LENSAI is a robust platform that can analyze a wide variety of data, including genome data, biopsy data, electronic health records, and medical publications.

A handful of its more than 90 applications include:

- Discovering new drugs

- Modifying existing drugs to make them safer so the immune system won’t see them as foreign

- Reducing the cost and increasing the speed of drug manufacturing

- Better understanding diseases and how to target them

- Selecting patients most likely to respond best for enrollment in clinical trials

The company therefore has a variety of potential clients, and right now it boasts 19 of the top 20 global pharmaceutical companies among more than 600 clients in the pharmaceutical and biotech industries.

The company says it is an “end-to-end solution for building better, safer drugs” for all different types of diseases. It wholly owns some of the drugs, but mostly it discovers novel drugs such as antibodies for other companies who then take them to the clinic.

IPA has three main sources of revenue:

- Drug Discovery & Development Fee-for-Service

- LENSai Data Analytics SaaS/API

- Assets, Collaborations and Partnerships

And those revenues have been growing rapidly, from $20.6M CAD in FY2023 to 24.5M in FY 2024 — a 19% increase year-over-year.

In June, the company debuted the LENSAI API, which it said would enable “new commercial capabilities” such as:

- “Partnerships with Large Companies: Major pharmaceutical, technology, and healthcare companies will be able to rapidly leverage BioStrand’s new software capabilities through partnerships that may include upfront payments, clinical milestones and commercial royalties.”

- “Subscription Model: BioStrand is offering a subscription service that enables a wide range of technology, healthcare, and pharmaceutical companies to access BioStrand’s unique capabilities using integration of the software into their existing platforms, with a strong probability of enhancing their drug discovery and development programs.”

In the interview mentioned above, Dr. Bath said the company is increasingly demanding its “piece of the pie when it comes to milestones and royalties and owning some of the equity on those assets” that clients develop with the help of LENSAI.

In 2022, the company was ranked the #1 contract research organization (CRO) by Roots Analysis, and just this June, it received the prestigious 2024 Impact Award, sponsored by InterSystems, in recognition of its “groundbreaking work in biotherapeutic research.”

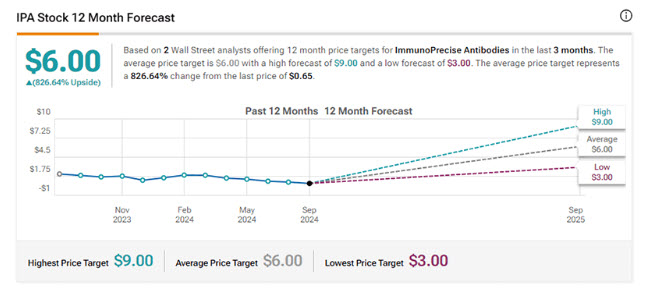

Analysts are also recognizing the company’s promise, with firms Benchmark Co. and H.C. Wainwright both reiterating their BUY ratings within the last two months, and delivering an average 12-month price forecast of $6.00 — more than 800% higher than Friday’s closing price.

Those are some things that jumped out to me about this interesting company. For more information, check out this recent investor presentation and of course do your own research.

Always approach your trading in a responsible manner and remember that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom Line: IPA is a revenue-generating company at the bleeding edge of drug discovery and development, counting 19 of the top 20 global pharma firms as its clients.

The stock has tested significantly higher levels very recently, and I think today could be the day it pushes those boundaries again.

Keep IPA at the very top of your watchlist and let’s see if I kick off another week with a winning “tactical trade” idea.

To Your Success,

Jeff Bishop

👊 Make sure you are getting my mobile text alerts – text “RAGE” to 1-(888) 404-5747 to get all of my latest HOT STOCK ideas delivered right to your phone (make sure you put the “1” at the front!). Don’t miss out!

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Legends Media for advertising ImmunoPrecise Antibodies Ltd for a one day marketing program on September 30, 2024. This was paid by someone else not connected to ImmunoPrecise Antibodies Ltd. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into ImmunoPrecise Antibodies Ltd might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.