Sponsored by Interactive Offers*

TODAY’S TOP ALERT!

Nasdaq: ISPC

TODAY @12pm EST we’re hosting an OLD SCHOOL special guest and

LEGENDARY TRADER. He’ll be sharing his current Market Outlook and his best

strategies to navigate it (this guy is a TOTAL PRO — so come learn a thing…or TEN)!

LIVE in the Jason Bond Room Wed. at 12pm EST.

With stocks dipping slightly lower yesterday, investors seem to have shifted focus away from Republicans’ “trifecta” election victory and back toward the current state of the economy.

CME Group data suggests markets have been pricing in a 66% chance of another rate cut before year’s end, and/but this morning’s CPI data may increase those odds even further.

The critical inflation data came in right in line with what the market expected, and the initial reaction was very positive, at least out of the gate.

The markets are likely to have some wild swings on the news, and the producer-price index due out tomorrow could also jostle things in ways I won’t try to predict.

Really, the inflation news over the past month has weighed especially heavily on the markets.

Still, as you have probably noticed, I’ve found a lot of success identifying “tactical trade” ideas that have been making tremendous moves, regardless of the headlines.

Yesterday added to my win streak with a solid “base hit” idea that surged as high as 9% on the day. Not bad at all for a $5 stock, right?

Today, my “tactical trade” idea is iSpecimen Inc (ISPC).

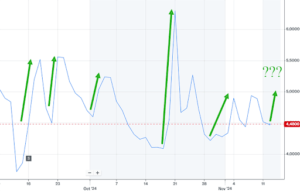

As you pull up ISPC on your favorite platform right now, you’ll notice the stock has established a lot of support around the $4 level over the past two months.

At the same time, over the past two months, it has jumped approximately 20% higher on five occasions, including a 54% rally, and even a whopping 128% surge a few weeks ago.

This is a great pattern to look for.

While you never know exactly when (or, if) the next mega spike will happen, ISPC has been a great one for trades to watch lately.

The upside breaks have been tremendous lately, as I just pointed out.

The $5 level has been a point of resistance for breakouts, so keep a close eye on that as you evaluate ISPC today.

At the same time, if the stock price breaks significantly lower below the recent support I just mentioned, I would use a lot of caution and consider waiting on the sidelines for a better opportunity.

The company itself is pretty fascinating.

These days, we’re used to being able to find any product we want on Amazon. Can you think of a product Amazon doesn’t have?

Well, there’s at least one, and ISPC is filling the gap.

I’m talking about human biospecimens.

Granted, not many of us are clamoring for samples of human urine, bone marrow, or cancerous tissue…

(Though there are some odd ducks out there, so who knows??)

But these types of specimens are absolutely critical for medical researchers.

The trouble is that — until ISPC — there was no centralized, online marketplace where healthcare organizations could offer their specimens and where researchers could find them.

As a result, the company reports that more than 3 billion clinical specimens are discarded annually worldwide.

At the same time, in 2022, “78% of researchers said they find it difficult-to-extremely difficult to find the type and quantity of specimens they need.”

ISPC is the first mover to establish an online marketplace to help solve these problems, and it has met with considerable success.

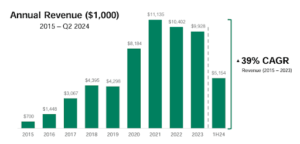

Its eight-year revenue CAGR is an impressive 39%, and that number would presumably be higher but for ISPC’s recent efforts to refine its supplier network.

The company says it works with 70% of the top-20 pharma and in vitro diagnostics (IVD) companies in the world and that it has “cumulatively delivered 175,000+ specimens across 2,400+ projects.”

It has agreements with more than 140 supplier organizations — including hospitals, blood centers, pathology labs, and others — and has more than 600 buyside customers.

Significantly, the number of registered users on the iSpecimen Marketplace has grown at 71% CAGR from 2015 through Q2 2024, and the number of Marketplace logins has grown at 36% CAGR from 2015 through 2023.

The company does a great job describing its value proposition.

Specimen providers can:

- “Monetize Banked Biospecimens: Instantly connect to a global network of researchers in search for biospecimens”

- “Advance Scientific Discovery: Support research mission and advance diagnostic, therapeutic and vaccine research”

- “Ensure Compliance: Protect the privacy and security of patient information”

And researchers can:

- “Save Time and Money: Instantly connect to global network of specimen providers”

- “Accelerate Research: Procure specimens, even hard-to-find samples, through our streamlined biospecimen matchmaking process”

- “Reduce Risk: Manage contracting and regulatory compliance”

The firm AceInsight Analytic estimates the biospecimen contract research services market to be $4.4 billion as of 2023, and predicts it to reach $13.5 billion by 2032 for a 13.3% CAGR.

Just last week, ISPC announced “a significant enhancement to its searchable inventory that … includes highly sought-after cancer samples across a variety of tumor types, stages, and patient demographics, enabling researchers to access the specific samples they need efficiently and by cancer type.”

The company also “rolled out new strategies and tactics for lead generation leveraging email marketing, organic search, and search engine marketing to increase inbound order volume.”

As a result, the company estimates “there are $10,000,000 worth of orders that can be converted annually.”

To state the obvious, the human biospecimen industry isn’t exactly sexy, but I think ISPC’s website does a great job explaining the business model, and its August 2024 investor presentation is surprisingly clear and helpful. I recommend starting at those places when you do your own research on the company.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: ISPC is sitting at a pretty firm support as of this writing. It has tested levels roughly 20-120% higher on five occasions in the past two months, and based on that history, I won’t be surprised to see it test those levels again soon — maybe even today?

Pay close attention to ISPC as the day unfolds, and let’s see if I can extend my “tactical trade” win streak!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty two thousand five hundred dollars (cash) from Interactive Offers for advertising iSpecimen Inc for a one day marketing program on Novemeber 13, 2024. This was paid by someone else not connected to iSpecimen Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into iSpecimen Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.