*Sponsored by Shore Thing Media

IVDA is a cloud-based, AI-powered video surveillance technology company that needs to be #1 on your watchlist today

I once heard someone define humans as “storytelling animals.” The idea is that stories are central to how we view ourselves and the world around us.

I would add that stories are also central to how we view the markets.

Think back to the Covid era, with all the stories about finding a vaccine and working from home. Money poured into stocks like Pfizer, Moderna, Wayfair, etc.

The big story now, I’m sure you know, is Artificial Intelligence.

Since January 2023, that story has propelled MSFT over 60% higher… META over 210%… and NVDA over 270%…

And while none of those companies seems to have lost steam, I think their short-term upside is probably limited.

As I keep saying, it is evident that money is pouring into smaller stocks, as you can see with the IWM small-cap index catching fire lately.

Right now, I have a much smaller AI company on my radar that — if one analyst is to be believed — has three-bagger potential in the next 12 months.

Do yourself a favor and pull this stock up immediately:

Iveda Solutions, Inc. (NASDAQ: IVDA)

Over the last two weeks, it has gone nearly vertical — popping over 60%.

While most stocks are rolling over right now, and have hit their short-term peaks, IVDA has quietly been one of the strongest stocks in the entire market over the last week.

I have no idea why anyone would want to get in the way of a bullish trend like this.

You know me. I always say that I want to ride a trend higher, not fight against it.

This is one of the undeniable trends in the market right now. The only question is how long it lasts and how high it goes?

If you’ve been paying attention, you know that I said much the same about three other companies in the last few weeks…

Since my alerts, traders who watched those stocks from the moments after my initial alert saw those stocks surge 32%… 35%… and a whopping 40% (so far!).

So do I have your attention on IVDA?

Great, let’s dive in…

Broad-based AI solutions

Mesa, Arizona-based Iveda has been providing cloud-based video surveillance technology for over two decades.

In the past several years, it has branched into AI video search, Internet of Things (IoT), and smart-city technologies.

This wide-ranging suite of technologies means IVDA can profit from a variety of sources: homeowners, nursing homes, schools, and even entire city governments (more on that later).

The company’s technologies and products are all fascinating. Here are a few that jumped out at me:

- vumastAR — This is a portable, AI vision system that can operate on a tablet/smartphone, smart glasses, or an internet-protocol camera. This “augmented reality” solution allows users to turn their everyday devices into AI assistants with use cases spanning many industries. Check out a video on it here.

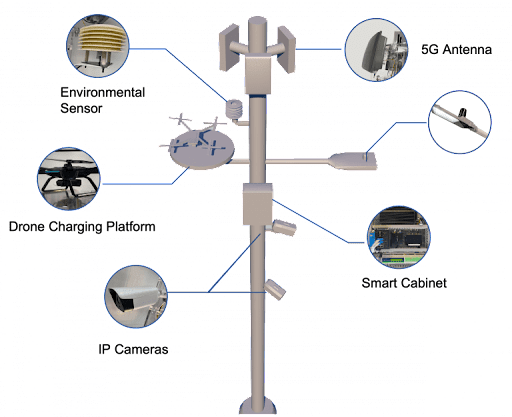

- Utilus — This is IVDA’s “smart pole” technology that turns light poles into high-tech marvels. Utilus combines several of the company’s technologies which you can see in this diagram:

IVDA says the poles can do things as varied as reducing emergency response times, sound detection, and monitoring and improving air quality.

- SmartDrone — IVDA’s latest rollout, these cloud-based drones are equipped with the company’s video surveillance system and intelligent video search technology. These things remind me of something out of Terminator — but in a good way. You can watch a cool video and read all about them here.

That’s just a sample of IVDA’s offerings. For a full breakdown, check out the company’s website.

Suffice it to say that if something can be considered “Smart,” Iveda probably has a version of it, or software to make it even better.

At the core of this now-global organization is founder, chairman, and CEO David Ly.

He was recently quoted as an AI expert in Forbes and he has also been published there:

I also found a cool article in FOX Business that quoted Mr. Ly extensively as well.

These media appearances are a great way for small companies like IVDA to get traction in the markets, and indeed the last two articles I mentioned were associated with double-digit runups in the stock’s share price…

But what most interests me now is what’s responsible for IVDA’s massive 60% runup over the past two weeks…

Building Momentum

From what I can tell, momentum started building with a Forbes article by David Ly on February 2…

From there, the IVDA piled on the good news with a February 13 announcement that the company’s branch in the Philippines “is set to achieve $5M in executed contracts over the next 12 months” as it works to “collaborate with 100 Government Units across the country as the region works to radically modernize its key infrastructure, including the country’s airports, streets, and sidewalks.”

$5M in contracts is a big deal for a company this size!

Two days later, the company announced its expanded footprint in Africa as it opened an office in Cairo, Egypt…

This was the result of the company’s partnership with the Arab Organization for Industrialization and no doubt related to the company appointing Major General Ashraf Hassan to the company’s advisory board.

In its announcement of the latter, IVDA said General Ashraf was “poised to make a profound impact, leveraging his multifaceted background in business development and engineering expertise to shape the future of Egypt’s technological landscape powered by Iveda.”

It appears that appointment is paying dividends!

Wrapping Up

Momentum has clearly been building for IVDA. Its 156% year-over-year revenue growth earned it a sector-relative grade of A+ from Seeking Alpha.

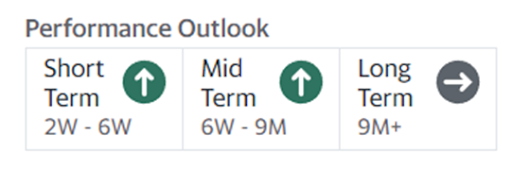

According to the indicators at Yahoo! Finance, that momentum is not showing signs of abating:

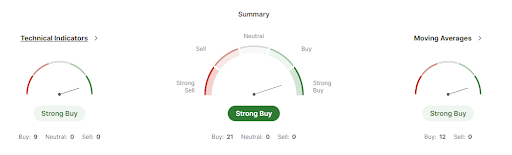

The technical outlook at Investing.com looks awfully similar:

And the icing on the cake for me right now is a report from analyst Allan Klee (Maxim Group), which recently reiterated a “buy” rating on IVDA and raised the 12-month price target from $2.00 to $3.00 — a target 267% higher than Friday’s closing price.

Along with my standby go/no-go algorithm, all signs are pointing to a quick, continued surge in the share price.

Nothing is guaranteed in the markets, of course, and as with the three stock alerts I mentioned earlier, the window to get in on this one at a good price is likely to be narrow, so be sure to do your research now.

Personally, I am closely watching the $.80 support level to see if that holds and then see if IVDA can test (hopefully break above) the crucial $1 mark soon.

See if you’re as impressed as I am with the IVDA’s cutting-edge technology showcased on its website and, of course, scour the stock chart. I found this Yahoo! Finance interview with David Ly especially informative.

I think this company fits in perfectly with the broader market “story” about AI, and with the NVDA earnings announcement coming tomorrow, that story will be at the top of everyone’s minds.

I nailed 🔨 three huge winners in a row. Will this be a fourth? Stay tuned to find out…

To Your Success,

Jeff Bishop

*Sponsored content/paid advertisement. This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results.

*PAID ADVERTISEMENT. RagingBull has currently been paid seventeen thousand dollars by ach bank transfer by Shore Thing Media for advertising Iveda Solutions, Inc for a one-day advertising program. As a result of this advertisement and other marketing efforts, RagingBull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, the owners of Raging Bull do not hold a position in Iveda Solutions, Inc. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Iveda Solutions, Inc, increased trading volume, and possibly an increased share price of the Iveda Solutions, Inc securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in Iveda Solutions, Inc., though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. A portion of our business is engaged in the marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. A portion of RagingBull’s business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, SMS, push notifications. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently, companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the corporate awareness program ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https: //www. sec.gov/edgar/searchedgar/companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.