*Promoted by Shore Thing Media

My Sights Are Set on a Tiny Stock With HUGE Opportunity Today

The mighty markets are fighting hard this week! 💪

After another choppy session yesterday, the small-stock index is picking itself up and climbing higher again.

This is one hard market to keep down! You better stay on the right side of the trend when it comes to your trading.

With small caps continuing to have great action, I want to keep taking shots on stocks that I think have great short-term potential.

Today, I have another brand new one that I think could deliver a knock-out punch! 🥊

Pull up Adamas One Corp. (Nasdaq: JEWL) on your platform right away

Don’t forget… A lot of stocks have been making their biggest moves in pre-market trading.

You will want to get your eyes on this before the market even opens today.

JEWL is trading for around just $.50 right now.

You know what kind of percentage return (up or down) could happen if a small stock like this could move just a dime or more right?

There is one simple reason I like this stock a lot today – JEWL can really move!

And right at this moment, I think we might be at a key inflection point on the price chart.

JEWL has tested $.45 at least 4 times in the last 4 months.

Each time, the stock then made a move 30- 50% higher in the days that followed.

Over the last few days, JEWL has been on the move to a higher uptrend once again, and I think it could easily deliver a fast opportunity.

There has been previous resistance in the $.65 – $.70 range, so keep an eye on that level.

If JEWL can break through that, I don’t see why a retest of $1 isn’t possible?

I’m not saying that is going to happen, but the gain on that move would be incredible.

Anyway, I think with the markets in full-bull mode again today, it could provide a nice tailwind for a lot of small stocks.

If JEWL can catch a ride on that market trend today, it could really be exciting to watch!

Remember, at just 50 cents, it doesn’t take a lot of movement to result in a lightning-fast percentage move.

Make sure you keep JEWL 💎 front and center on your stock watchlist today.

Once you know more about the company itself, I think this opportunity will look even more appealing…

You see, Adamas One Corp. (JEWL) is a manufacturer of high-quality lab-grown diamonds right here in the USA — Greenville, South Carolina, to be exact.

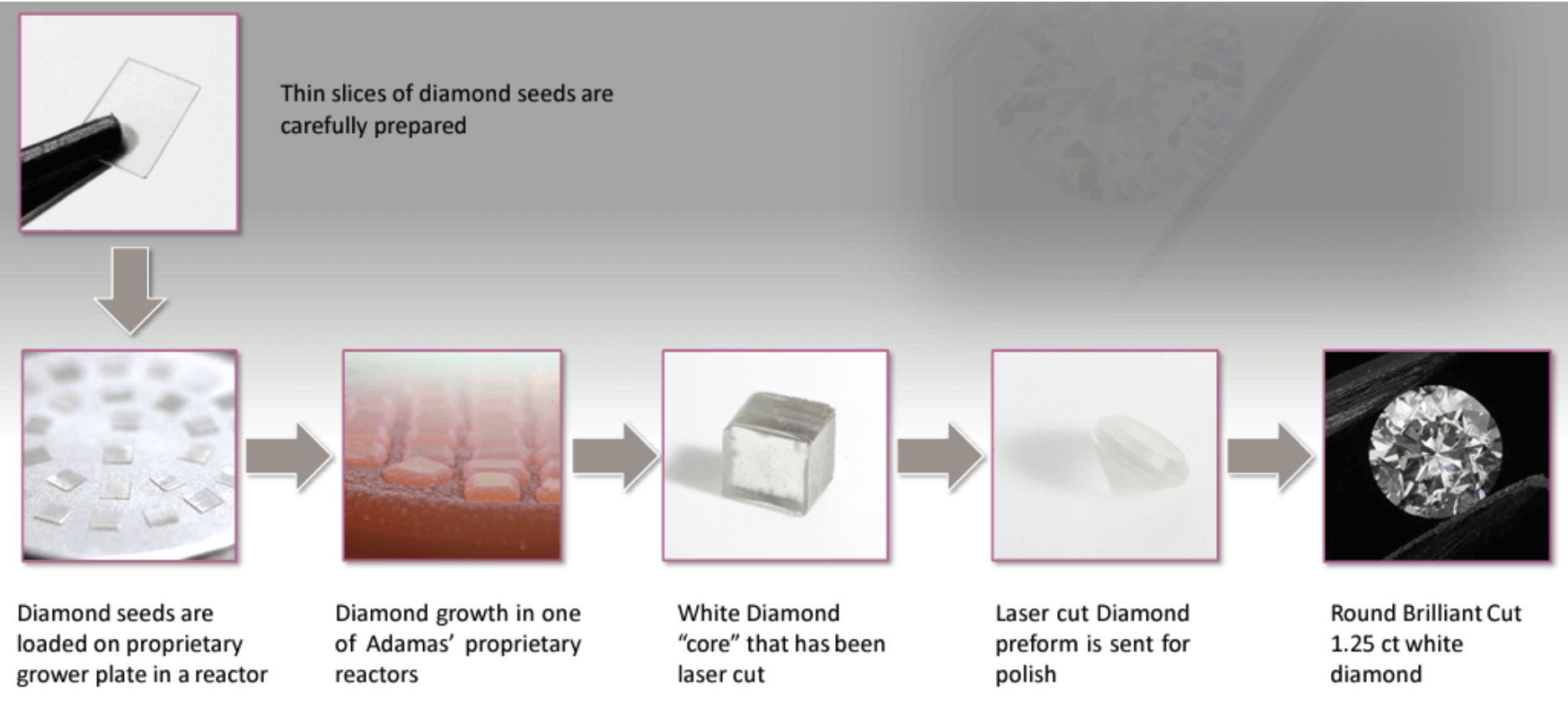

The company is at the literal “cutting edge” of its field, with 28 U.S. patents and 8 foreign patents, including its pioneering CVD (chemical vapor deposition) manufacturing process.

I didn’t realize this, but did you know that more than half of the diamonds sold for engagement rings are now lab grown?

Pandora — the world’s largest jewelry company, and the one you can always count on in major malls — has moved exclusively to lab-grown diamonds.

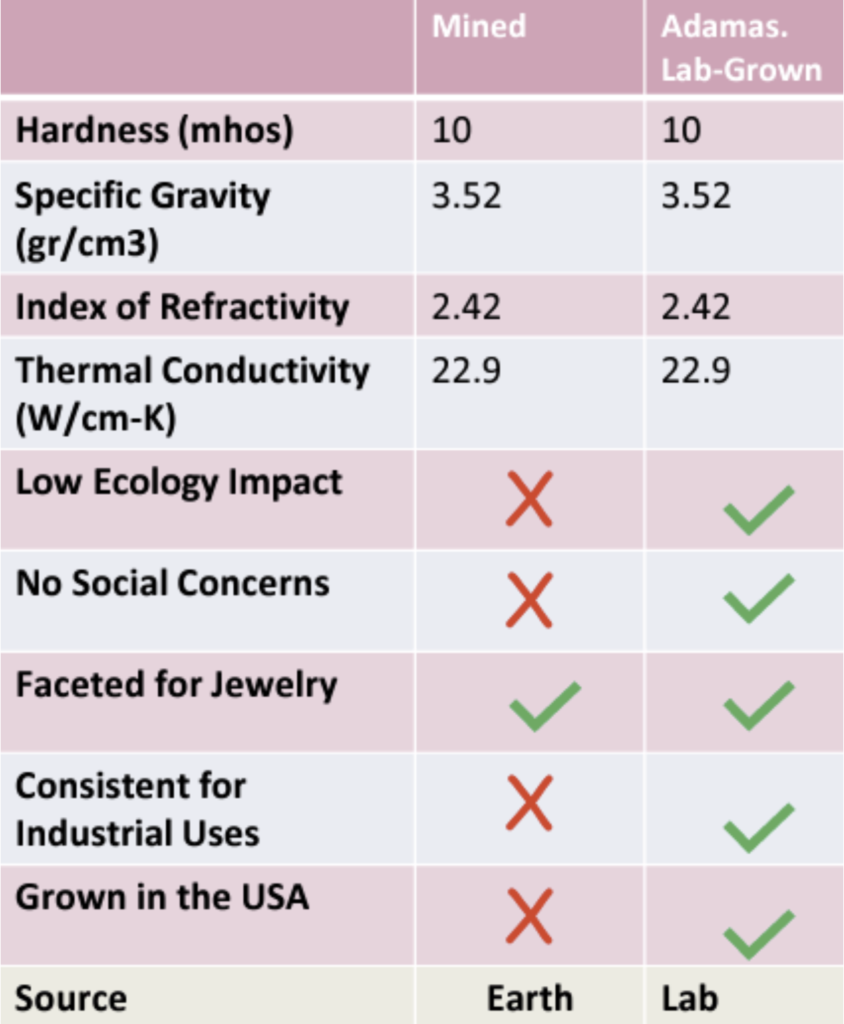

And these aren’t “fake” diamonds. They’re nothing like the cubic zirconia used in costume jewelry.

We’re talking about stones that are optically, chemically, thermally, and physically identical even to the best-mined diamonds…

The only difference is that these diamonds are sustainably produced, less expensive, and aren’t ethically questionable (we’ve all seen Blood Diamond, right??).

Source: Investor presentation.

In JEWL’s words, “Our customers enjoy beautiful diamonds that are cost effective, eco-friendly and socially conscious.”

Here’s a slide from the company’s Investor Presentation that show the basic manufacturing process:

Last spring, JEWL completed designs for nearly 200 pieces of jewelry for its in-house Elle Jolie™ luxury jewelry line, which it expects to launch in the second quarter of this year.

At the forefront of that effort is a high-end digital agency partnering with them on branding, marketing, e-commerce and fulfillment.

The goal is to “compete with high-end retailers by bringing sustainable luxury to the lab grown diamond sector in a way that delivers increased revenue and high gross margin.”

And if you studied that chart above, you saw that only lab-grown diamonds are “consistent for industrial uses.”

That’s critical because diamonds are increasingly showing promise in the semiconductor space as well as in EVs, quantum computing lasers, and telecommunications.

It’s with that in mind that in November, JEWL announced the formation of a wholly-owned subsidiary, Adamas One Technologies, to break into those areas.

As Adamas One CEO Jay Grdina said, “Lab-grown diamonds offer the repeatability, consistency, and reliability that both industry and technology applications demand at a cost that will support market acceptance.”

The company has also been working with Oak Ridge National Laboratories on things that are over my head: “thermal conductivity, neutron bombardment, and transport mechanisms.”

Remember that trading is always risky, and you never want to put more at risk than you can comfortably afford to lose. You need to have a solid trading plan in place that makes sense of your unique risk tolerance before you trade anything.

Bottom line: JEWL presents a fascinating opportunity right now. With multiple retests of the bottom over the last few months, the ability of this tiny stock to make some very fast moves is all but certain. If you can time those moves, this could be a very rewarding stock to follow.

To Your Success,

Jeff Bishop

👊 Make sure you are getting my mobile text alerts – text “RAGE” to 1-(888) 404-5747 to get all of my latest HOT STOCK ideas delivered right to your phone (make sure you put the “1” at the front!). Don’t miss out!

*Sponsored content/paid advertisement. This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results.

*PAID ADVERTISEMENT. RagingBull has currently been paid seventeen thousand five hundred dollars by ach bank transfer by Shore Thing Media for advertising Adamas One Corp for a one-day marketing program. RagingBull has previously been paid twenty five thousand dollars by ach bank transfer by CGTP Enterprises for advertising Adamas One Corp from a period beginning on August 3, 2023 through August 4, 2023 of the same year. The third party, Company, or their affiliates may own and likely wish to liquidate shares of the Company at or near the time you receive this advertisement, which has the potential to hurt share prices. This advertisement and other marketing efforts, including alerts, may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Adamas One Corp, increased trading volume, and possibly an increased share price of Adamas One Corp’s securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in Adamas One Corp, though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. A portion of our business is engaged in the marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. A portion of RagingBull’s business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, SMS, push notifications. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently, companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the corporate awareness program ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https: // www. Sec. gov/ edgar/searchedgar /companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.