Thursday Mar 20, 2025

(Nyse: maia)

👉 MAIA is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here.

There’s an urgent “tactical trade” idea I need to bring to your attention.

If you have followed me for a while, then you have seen this stock several times.

At one point, it was one of my biggest alerts from last year gaining over 300% from where I first showed it to you.

When I last alerted it in January, it ramped as high as 24% that day.

Right now, I think it is sitting at a spectacular level to revisit it if you have not been watching it lately.

Go to your favorite platform and pull up…

MAIA Biotechnology, Inc. (MAIA)

The stock has been rallying since last week, and is up 20% since its low from last Tuesday.

It jumped 5% yesterday, and it was up over 10% at one point during today’s trading session.

It definitely looks like things are heating up for MAIA right now – make sure you don’t miss out on watching it.

Here are some details about the company itself…

MAIA is a clinical-stage biopharmaceutical company exploring genuinely groundbreaking cancer treatments.

Here are some highlights you should consider as you do your own homework on the company right now…

1. A Potential Game-Changer in Cancer Treatment

MAIA’s flagship product, THIO (christened “ateganosine” just yesterday), is turning heads in oncology. THIO targets telomeres, which are like the protective caps at the ends of chromosomes that cancer cells exploit to keep dividing endlessly. THIO breaks down these caps, triggering rapid cancer cell death while activating the immune system to keep fighting even after treatment stops.

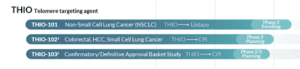

MAIA announced last month its plans “to initiate a Phase 3 pivotal trial in 2025, named THIO-104, to evaluate the efficacy of THIO administered in sequence with a checkpoint inhibitor (CPI) in third-line non-small cell lung cancer (NSCLC).”

🧬 Why It Matters: This dual-action approach could revolutionize how we think about cancer therapies. Most existing treatments target the immune system or the cancer cells — not both.

MAIA’s pipeline

2. FDA Orphan Drug Designations

In the world of biotech, exclusivity is king. MAIA’s THIO has Orphan Drug Designations from the FDA for small cell lung cancer, hepatocellular carcinoma, and glioblastoma. This means 7 years of market exclusivity post-approval plus tax credits for clinical trial costs.

🩺 Why It Matters: SCLC alone kills nearly 125,000 people in the U.S. yearly. If MAIA’s drug proves effective, it could dominate a potentially lucrative market.

3. Strong Early Data is Turning Heads

Preliminary results from Phase 2 trials are incredibly promising. THIO achieved “unprecedented disease control, response, and survival results” in NSCLC patients, and the treatment has been generally well-tolerated in a heavily pre-treated population.

📊 Why It Matters: Results like these can attract big pharma partnerships and investor interest. This isn’t just another drug — it’s showing real potential to disrupt the market.

4. Leadership with Proven Success

MAIA’s CEO, Vlad Vitoc, isn’t new to the game. With over 20 years in biotech and a track record of shepherding promising therapies through development, he’s positioned the company for success.

🌍 Why It Matters: In biotech, leadership is half the battle. A seasoned team reduces the odds of costly missteps.

5. Strong Insider Confidence 💼

Company insiders are putting their money where their mouth is, scooping up MAIA shares hand over fist lately, with director Stan Smith purchasing $250k worth, director Steven Chaouki buying $55k worth, and director Ramiro Guerrero grabbing $222k worth.

Why It Stands Out:

MAIA isn’t your typical biotech. With a truly novel approach to cancer, strong early data, and a strategy to streamline approval, the company could be on the verge of something game-changing. Investors looking for exposure to next-gen cancer therapies should keep this one on their radar.

Beyond that, in February, Noble Financial reiterated a $14.00 12-month price target on the stock, marking a 700% increase from its current price, as you can see from this chart:

Folks, you need to do your homework on MAIA immediately, beginning with the company website and this investor presentation.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we currently have received fifteen thousand dollars (cash) from Sica Media for advertising MAIA Biotechnology, Inc for a one day marketing program on March 20, 2025. Before this, we received fifteen thousand dollars (cash) from Sica Media for advertising MAIA Biotechnology, Inc for a one day marketing program on February 27, 2025. Prior to that, we received thirty five thousand dollars (cash) from Sica Media for advertising MAIA Biotechnology, Inc for a one day marketing program on January 7, 2025, and we also received fifteen thousand dollars (cash) from Legends Media for advertising MAIA Biotechnology, Inc for a one day marketing program on December 16, 2024, and we received twenty-five thousand dollars (cash) from Sica Media for advertising MAIA Biotechnology, Inc for a one day marketing program on November 7, 2024, and also twenty-five thousand dollars (cash) from Sica Media for advertising MAIA Biotechnology, Inc for a one day marketing program on July 9, 2024 and also fifteen thousand dollars (cash) from Sica Media for advertising MAIA Biotechnology, Inc for a one day marketing program on June 13, 2024. Previously, we received twelve thousand five hundred dollars (cash) from Sica Media for advertising MAIA Biotechnology, Inc for a one day marketing program on June 7, 2024. Also, we were paid fifteen thousand dollars from Sica Media who was compensated by a third party not affiliated with the Company for advertising MAIA Biotechnology, Inc for a one day marketing program on March 6, 2024. We were also previously paid fourteen thousand dollars from Sica Media who was compensated by a third party not affiliated with the Company for advertising MAIA Biotechnology, Inc from a period beginning on November 15 through November 18, 2023, and also fifteen thousand dollars from Sica Media who was compensated by a third party not affiliated with the Company for advertising MAIA Biotechnology, Inc from a period beginning on October 12 through October 13, 2023. These amounts were paid by someone else not connected to MAIA Biotechnology, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into MAIA Biotechnology, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.