With the overall market looking extremely weak right now, I have zero interest in trading most large-cap stocks.

I want to see volatility drop and leading stocks start to regain momentum above the 20-hour moving averages. We are nowhere close to that right now.

In the meantime, I think it makes a lot of sense to look at smaller stocks that have shown relative strength in recent weeks.

Those small outperformers might continue to produce solid gains, even in a weak market environment.

One of the best stocks in recent weeks is a small medical device company I showed you around a month ago.

Since then, the stock moved over 90% higher from where I first alerted you to it, and right now, I think, is the perfect time to look at it once again.

Pull up Modular Medical, Inc. (MODD) on your platform right now and I’ll show you what I am seeing.

First of all, just look at the price chart since I showed it to you last time.

This is a picture-perfect move higher, especially in the face of such terrible market conditions…

There is obviously something powerful happening here, so let me share with you what I think is going on.

For starters, MODD announced a game-changing piece of news last week that caused the stock to spike.

The Company announced that the FDA cleared its pump patch for type 1 and 2 diabetes for sale in the US.

That is a truly historic milestone for any small medical company. Not many companies ever receive FDA clearance, so this piece of news puts MODD in a new category.

The market obviously reacted very enthusiastically to this news, though the stock has pulled back a little since the peak.

I don’t like chasing stocks as they are surging on day-one events. I think a healthy pullback makes a much better spot.

That is precisely where we are right now with MODD.

I think it is crucial that you get this stock back on your radar – immediately.

For perspective on this market’s size, consider that $100 billion Medtronic (MDT) pursued a $738 million acquisition of a small Korean insulin patch pump maker just last year.

While the deal ultimately didn’t go through, I think you can see the potential out there, especially when you consider that Yahoo reports MODD’s market cap is still under $75 million right now.

That is probably why TipRanks reports that the key analyst who covers MODD, recently increased his price target from $5 to $8, which would be over a 250% gain from current levels.

This is a very exciting story right now, and you need to look into MODD right away.

As you get started with your research, here are some notes to help you get started…

California-based Modular Medical, Inc. is a development-stage medical device company working on a next-generation, affordable insulin pump.

You’re probably aware that diabetes is a big deal in the medical industry—it affects a lot of people and costs a lot of money. But let’s look at some of the numbers…

The American Diabetes Association says that “In 2021, 38.4 million Americans, or 11.6% of the population, had diabetes.” It released a report in 2022 that estimated the annual cost of diabetes to be $412.9 billion.

“People with diagnosed diabetes now account for one of every four healthcare dollars spent in the U.S.,” the report noted.

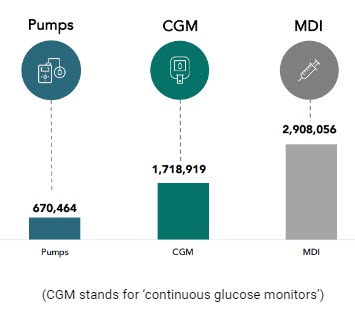

Citing 2020 data from the Centers for Disease Control and Prevention, MODD points out that 3.6 million Americans require daily insulin — that includes 2.9 million who use multiple daily injections (MDI) and 670,000 who use insulin pumps:

Of those who use MDI, research firm Seagrove Partners has found that about 25% are “almost pumpers” — “meaning that they have considered going on a pump, understand pump therapy benefits, but want something simpler that doesn’t have all the ‘bells and whistles’.”

That’s where MODD expects to come in. The company believes that existing insulin pumps are geared toward “superusers” and are “prohibitive for many to learn and manage.”

Existing pumps have too many complicated features that most diabetics don’t need. This increases costs and puts them out of reach for many.

That hit home with me because my Mom really needed daily insulin, she just couldn’t get over the thought of needles and insulin pumps weren’t on her radar. An affordable and intuitive pump could possibly have made a real difference for her.

Great Timeline and Vision

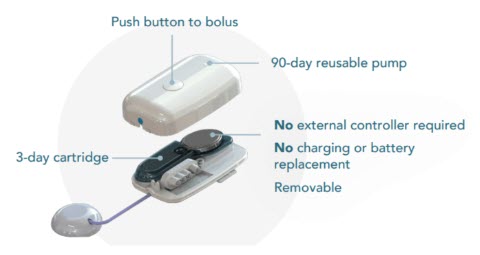

Modular Medical calls its candidate device “MODD1” and says it will provide “insulin delivery for Almost Pumpers.” Here is a diagram:

MODD says this simple design will enable “automated, high volume manufacturing” at a fraction of competitors’ costs. It will also be simple and easy to learn for providers and their patients.

In the recent FDA approval announcement, MODD signaled that the pump should be available for sale early next year.

And the company doesn’t plan to stop there…

It’s already 50% through the development phase of “MODD1+” which will be a cellphone-controlled version of the device that can integrate with CGMs for algorithm-adjusted dosages.

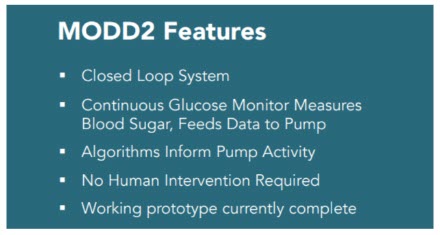

After that, it plans to launch what it calls the “future of care”: MODD2. Here’s how the investor presentation describes it:

The goal is for the device to effectively be an “artificial pancreas.”

No human intervention required? Ask anyone who uses regular insulin, and they’ll tell you this: It would completely revolutionize their treatment and dramatically improve their lives.

Leadership Team

Modular Medical was founded by Paul DiPerna, who now serves as the company’s chairman and CTO.

Mr. DiPerna has led over 10 projects to FDA approval, including the t:slim insulin pump — a leading pump for type 1 diabetes — which he designed and took the lead in developing.

The t:slim pump is produced by Tandem Diabetes — a company Mr. DiPerna founded and served as CEO of. It currently has a market cap of nearly $2.9 billion.

I guess you could say Mr. DiPerna knows a thing or two about starting a successful company!

In July 2023, the company announced another all-star, Duane DeSisto, would be joining its lineup:

Mr. DeSisto served as President and CEO of Insulet from 2001 to 2014, where he led the creation and commercial adoption of the Company’s debut product, OmniPod, the world’s first tubing-free disposable insulin pump. Under Mr. DeSisto, Insulet grew from an early-stage company to a market cap of more than $2 billion and was nationally recognized for its technology design and rapid growth, including being listed fourth on Forbes’ “Most Innovative Growth Companies” in 2014 with five-year average sales growth of 47 percent.

Mr. DeSisto retired in 2014 but is now serving on MODD’s board.

I have to say: It inspires a lot of confidence that two long-time industry leaders who developed billion-dollar insulin pump companies are serving at the helm of MODD.

Spend time right now doing your own research on the stock, and of course, always approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose. Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

This has been one of the hottest small stocks over the last year.

MODD has crushed the broad market’s return, and I don’t see why that would stop anytime soon.

Today could be a very big day for MODD. Make sure it is on the top of your watchlist right now!

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Sica Media for advertising Modular Medical, Inc for a one-day marketing program on September 9, 2024. Before this, we received fifteen thousand dollars (cash) from Sica Media for advertising Modular Medical, Inc for a one day marketing program on August 7, 2024. We also received twelve thousand five hundred dollars from Sica Media who was compensated by a third party not affiliated with the Company for advertising Modular Medical, Inc. from a period beginning on January 19, 2024. These amounts were paid by someone else not connected to Modular Medical, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Modular Medical, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.