TODAY’S TOP IDEA – NanoViricides, Inc. (NNVC)

I brought this stock to your attention twice back in May as it ran up more than 200%, and again after its pullback in June but before another runup into July.

I like this as a “tactical trade” idea once again right now.

Naturally, nothing is guaranteed here, but I think NNVC deserves to be at the very top of your watchlist today.

On the fundamentals side, there are great reasons to keep NNVC in mind…

The company is developing what it hopes will be the “holy grail” of antiviral therapeutics — a single drug to treat all of the “tripledemic” viruses (i.e., COVID-19, RSV, flu) as well as smallpox/mpox.

As you know, viruses are notoriously difficult to target. Antibodies and vaccines are the usual weapons of choice, but as NNVC explains, they “are easily overcome by viruses by mutating in the field.”

NNVC’s solution is what it calls “nanoviricide® technology.”

It says that this “is the only technology in the world, to the best of our knowledge, that is capable of both (a) attacking extracellular virus, thereby breaking the reinfection cycle, and simultaneously (b) disrupting intracellular production of the virus, thereby enabling complete control of a virus infection.”

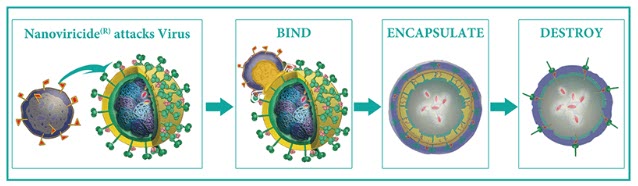

Nanoviricides are combinations of ligands and special polymers that are designed to appear to viruses like the host cells to which they typically bind.

The idea is that viruses will be tricked into binding with the nanoviricides, which then destroy them:

And since binding sites for a given virus don’t change, the company believes its drugs “will be broad-spectrum, i.e. effective against most if not all strains, types, or subtypes, of a given virus.”

NNVC’s lead candidate — its hoped-for “holy grail” — is NV-387, a “revolutionary, broad-spectrum antiviral.”

NV-387 has already proven effective in animal studies against RSV, influenza, COVID, and smallpox/mpox.

In fact, the company says it has proven “substantially superior” to Tamiflu and Xofluza in a lethal Influenza A animal trial, and to Remdesivir in a Covid animal model.

In June, NNVC said that NV-387 was “anticipated to be a strong drug candidate that would remain effective against HPAI H5N1 [bird flu] even as significant mutations occur.”

That’s especially important given ongoing news coverage of bird flu, like this from yesterday:

Just this week, NNVC noted that NV-387 “possibly completely cured the lethal RSV infection in mice, based on indefinite survival of the animals with no lung pathology.”

It added that “There is currently no treatment for RSV infection” and that “Pediatric RSV treatment itself is expected to be a multi-billion-dollar market in the USA alone.” [emphasis added]

NNVC believes NV-387 “is poised to revolutionize treatment of viral infections [just like] penicillin revolutionized treatment of bacterial infections.”

And since the binding site on NV-387 mimics one that 90% of human pathogenic viruses use, the company believes it will have a very broad application.

NV-387 has already been through a Phase I human clinical trial with no adverse events, and the company is now advancing it towards a Phase II clinical trial for the treatment of RSV infection.

The company is also exploring “design of an innovative and ambitious, adaptive Phase II clinical trial wherein the effectiveness of the single drug NV-387 can be assessed for the treatment of a number of naturally occurring virus infections in humans in a single clinical trial.”

In addition to its “holy grail,” NNVC is advancing NV-HHV-1, a nanoviricide drug designed to treat all herpes viruses.

As a skin cream, NV-HHV-1 is intended for use on shingles/chickenpox skin rashes, HSV-1 cold sores, as well as HSV-2 genital ulcers. An oral formulation is also in development for systemic treatment of herpes infections.

NNVC reports that NV-HHV-1 is now ready for Phase I clinical trials.

Those are some notes to get your own research started. You may also want to check out this Fact Sheet from November 2023 and this Investor Presentation released last month.

Always be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose. Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom Line: I like NNVC as a potential bottom-bounce play. The stock began a rebound last week only to be stymied by the news headlines yesterday.

If cooler heads prevail at the ports and in the Middle East, I wouldn’t be surprised to see this make a double-digit gap up (though I obviously can’t guarantee that).

Keep NNVC at the top of your radar today as things unfold, and I’ll be sure to be in touch if there are any important updates.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars from Interactive Offers for advertising NanoViricides, Inc for a one day marketing program on October 31, 2024. Prior to that, we received twenty two thousand five hundred dollars from Interactive Offers for advertising NanoViricides, Inc for a one day marketing program on October 2, 2024. Prior to this, we received fifteen thousand dollars from Interactive Offers for advertising NanoViricides, Inc for a one day marketing program on June 26, 2024. Before that, we also received seventeen thousand dollars (cash) from Interactive Offers for advertising NanoViricides, Inc for a one day marketing program on May 23, 2024. We also previously received seventeen thousand dollars (cash) from Interactive Offers for advertising NanoViricides, Inc for a one day marketing program on may 8, 2024. This amount was paid by someone else not connected to NanoViricides, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Above Food Ingredients Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.