Yesterday morning, I wrote to you about how it was the “Super Bowl of earnings” with NVDA releasing its numbers after market close.

I said that “Projections are that the company’s second-quarter revenue more than doubled, but even that may not be enough to satisfy investors accustomed to its gravity-defying results.”

Well, the company did more than double its sales and earnings year-over-year, but that wasn’t enough to stop its share price from turning red.

It is so hard to make money on a trade that the whole world is already bullish on… who is left to buy it?

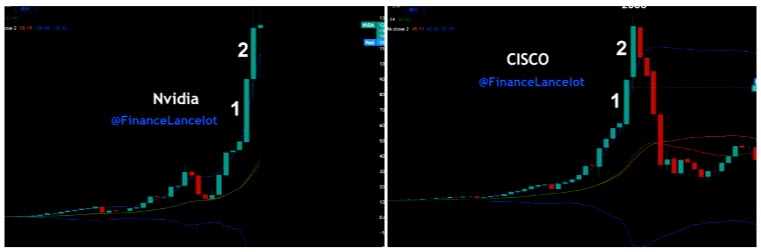

If you’re old enough to remember the first “tech bubble,” CSCO was the NVDA of the day. They were growing like a wildfire for years, and then the valuation finally caught up to them.

I hate to make this comparison, but here is what that looked like…

Hopefully, history won’t repeat itself!

That’s why I think it makes a lot of sense to focus on smaller stocks that are driven by great news, or strong price charts. They seem much more predictable to me.

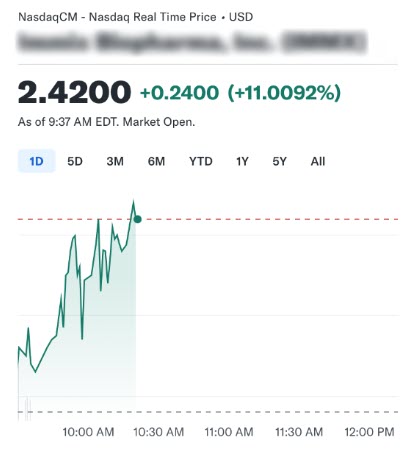

Like yesterday, when I wrote about a small biotech company that was setting up nicely. You saw it launch higher shortly after…

I’m looking right now at another small biotech stock that has attracted considerable attention.

Go ahead and pull up Nuvectis Pharma (NVCT) on your favorite trading platform.

You’ll see that the stock has done well in the last two weeks, up over 11% since August 16.

Right now, it’s hovering around a recent high it has struggled to break since June.

The big driver today is going to be a big news item they just dropped on the market minutes ago.

After a long wait, NVCT just announced that one of their drug candidates has been granted an “Orphan Drug Designation” by the FDA.

This has very big implications for the company, since it provides certain financial incentives to support clinical development, and the potential for up to seven years of marketing exclusivity for the product, if is approved.

This stock is already on the move in pre-market trading today.

Make sure you get NVCT on your radar right away. This could be a big one.

The company itself is a clinical-stage biopharmaceutical company, and it’s trading at a fairly high price for a pre-revenue firm…

I think that reflects the high regard investors have for its therapeutic pipeline, and its collaboration with the prestigious Mayo Clinic which I’ll get into.

In May, a writer for InvestorPlace even included NVCT as one of “7 Penny Biotech Stocks to Triple Your Investment” (it was trading for $6.50 at the time).

Analyst Aydin Huseynov of Ladenburg Thalmann & Co. agrees, with a 12-month price target of $21.00 — nearly triple its current price.

The excitement is about NVCT’s promising cancer-drug candidates, NXP800 and NXP900.

NXP800 was discovered at the Institute of Cancer Research in London, and NVCT licensed the worldwide rights to it. The company describes it as an “oral, small molecule, potentially first-in-class GCN2 kinase activator.”

Right now, NXP800 has two primary indications…

The first is for ovarian cancer that is resistant to platinum-based chemotherapy and that is characterized by a mutation in the ARID1a tumor-suppressor gene.

The FDA had already granted this development program a Fast Track Designation, which is “designed to facilitate the development, and expedite the review of drugs to treat serious conditions and fill an unmet medical need.”

This morning, the company announced it received Orphan Drug Designation — reserved for “a drug or biological product to prevent, diagnose or treat a rare disease or condition” — for the same cancer.

NXP800 is currently going through a Phase 1b clinical trial for this cancer, and is enrolling at approximately 15 clinical sites in the U.S. and U.K.

Preliminary data released in March revealed a “33% response rate and 100% disease control rate” in the four treated patients, and the company expects to provide an update from the study this fall.

The second indication for NXP800 is in cholangiocarcinoma, a rare and lethal bile-duct cancer of the liver that has approximately 10,000 new cases per year in the U.S.

The FDA granted this program an Orphan Drug Designation as well.

This indication has caught the attention of the Mayo Clinic — the top-ranked hospital in the nation — which is researching it in an investigator-sponsored clinical trial.

NVCT says that it plans to provide an update from this trial by the end of 2024.

The company has also licensed the worldwide rights to NXP900, which was discovered at the University of Edinburgh, Scotland.

NXP900 is an “oral small molecule inhibitor of the SRC Family of Kinases (SFK), including SRC and YES1” that’s intended for squamous cancers including cervical and esophageal.

It’s currently being investigated in a Phase 1a dose escalation clinical trial and its first potential indications are for “YES1/SRC-driven solid tumors.”

In April, NVCT announced that NXP900 “demonstrated robust activity in non-small cell lung cancer [NSCLC] cell lines” in combination with osimertinib, a targeted therapy approved for the treatment of NSCLC.

The company independently confirmed that finding, which was initially reported by a research team at AstraZeneca.

It also found that NXP900 “demonstrated potent, single agent, antiproliferative activity in anaplastic lymphoma kinase (ALK)-resistant NSCLC cells and synergistic effects in combination with alectinib in alectinib sensitive cells. Alectinib is the active ingredient in AlecensaTM, an ALK inhibitor approved for the treatment of NSCLC.”

As NVCT CEO Ron Bentsur commented, “EGFR and ALK inhibitors, especially osimertinib and alectinib, have revolutionized the treatment paradigm in NSCLC. However, treatment resistance remains a major challenge in a considerable number of patients, and therefore inhibiting the key pathways associated with the development of EGFR and ALK resistance to restore cancer sensitivity to treatment represents significant potential in this disease.”

The takeaway is that NXP900 is showing promise both as a single agent and as a combination therapy with market-leading anti-cancer drugs.

NVCT has been making its mark in the cancer pharmacology field, with Ron Bentsur speaking at the 42nd Annual J.P. Morgan Healthcare Conference in January and presenting at the American Association for Cancer Research Meeting in March.

The company had $18.1 million in cash on hand as of June 30, giving it a runway into the second half of 2025 that it expects “can take us through the key milestones for both development programs.”

Insiders have considerable faith in the company, drawing the attention of Entrepreneur Magazine in May:

The article noted that “few signals of confidence are as compelling as insiders buying up their own company’s stock” and that NVCT’s three founders put their money where their mouth is, collectively owning approximately 35% of the company.

Ron Bentsur said in the article that “Our continued investment in Nuvectis reflects our unwavering belief in the transformative potential of our pipeline.”

Spend time right now doing your own research on the stock, and of course, always approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: NVCT is a promising biopharma company that has drawn considerable interest both from investors and the likes of the Mayo Clinic and AstraZeneca. With the big news out today, it could surge past its recent highs.

Make sure you look into NVCT immediately.

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

👊 Make sure you are getting my mobile text alerts – text “RAGE” to 1-(888) 404-5747 to get all of my latest HOT STOCK ideas delivered right to your phone (make sure you put the “1” at the front!). Don’t miss out!

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received seventeen thousand five hundred dollars (cash) from Shore Thing Media for advertising Nuvectis Pharma, Inc for a one day marketing program on August 29, 2024. This was paid by someone else not connected to Nuvectis Pharma, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Nuvectis Pharma, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.