*Sponsored by IA Media. Please see disclosures below

If you’ve followed my work for even a week, you know I love a good momentum play.

There’s nothing quite as satisfying as seeing a swell in a stock price form, hopping on your board, and taking a ride.🏄

I’m going to get right to the point today. You need to pull up this ticker and look into it immediately…

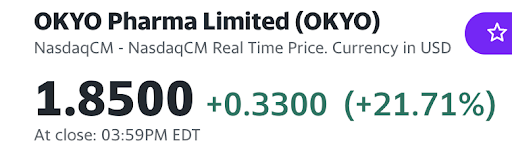

OKYO Pharma Ltd. (NASDAQ: OKYO)

Here’s the deal. This small biopharma company took a beating in June, losing about 30% of its value in that time.

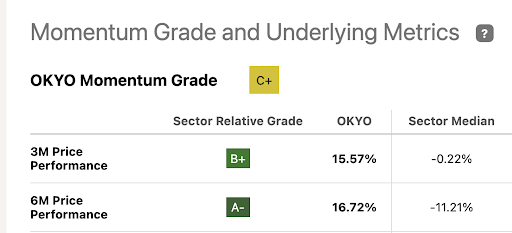

But get this. Since bottoming out a few weeks ago, OKYO has been an amazing rebound, jumping over 80% from the lows!

As I was digging around stats for the month, I found that little-known OKYO has quietly been one the best performers in the entire market during that time.

When I see something like this, I know I need to do some more research on it.

OKYO is a company that specializes in treatments for “Dry Eye Disease” — a multibillion-dollar market (who knew? 🤷) — but it’s the price action on the stock that most interests me.

It started the month at $1.15, then dropped as low as $0.92 a week later. At this point, I am sure most traders bailed on it for a loss.

This is the exact thing that algos in the market love to see happen. Sellers bail on a stock for a big loss, and then the market carries the stock much higher.

Maybe a short squeeze is pushing it higher?

I don’t know exactly how big the short interest is, but I am guessing that it is huge based on what I see over at iBorrowdesk, which is a site that tracks the fee for borrows on stocks.

Just look at how ridiculous it is to try to borrow shares to short on OKYO right now:

You would need to pay a small ransom to try to borrow shares. That suggests to me that shorts might be “on the ropes” with this one.

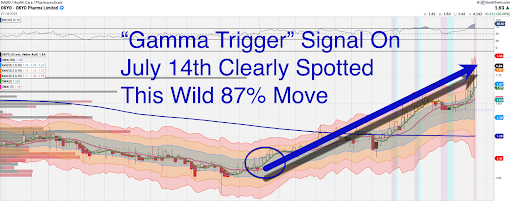

Now, fast-forward two weeks later and OKYO is sitting at $1.85 — meaning it’s surged 87% from this month’s lows…

Yesterday alone, OKYO was up over 21%.

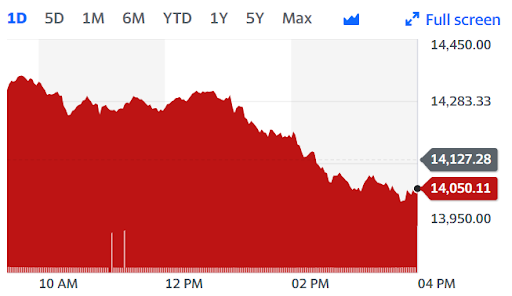

I know you were probably too busy watching the markets drop like a rock (I hope your portfolio didn’t look like this!)

While OKYO was busy making investors happy 📈, here’s what the S&P delivered to us 💩:

And here’s the NASDAQ:

The question now is where does OKYO go from here? (spoiler alert: “I don’t know!)

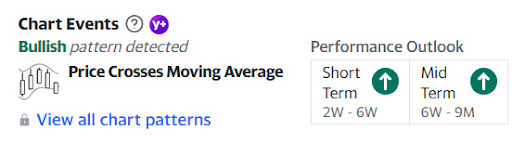

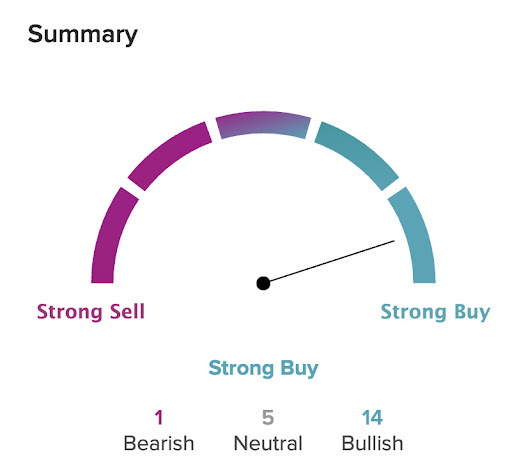

But, Yahoo! Finance has its opinion:

As does TipRanks:

… aaand Seeking Alpha:

For my part, I’m seeing strong signs of a continued run in the daily and hourly charts:

Since the “gamma trigger” was fired on July 14th, we have seen a stunning move higher for OKYO.

Keep this in mind: I think this is a lightning-quick idea. I like this especially in light of the stock bucking the market yesterday…

Just because I like a stock doesn’t mean it is going to work out like I think it could, it might do better, or worse. If you decide to trade it, make sure you understand all the risks involved and have your own game plan in place. I am simply showing you something that I think is an amazing stock right now.

Check out the charts, do your homework (its NASDAQ ticker is OKYO) and see what you think. Let’s see if this trend will continue even further!

*PAID ADVERTISEMENT. RagingBull has been paid fifteen thousand dollars by ach bank transfer by IA Media for advertising OKYO Pharma Ltd. from a period beginning on July 28, 2023 through July 28 of the same year. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, the owners of RagingBull do not hold a position in OKYO Pharma Ltd. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of OKYO Pharma Ltd, increased trading volume, and possibly an increased share price of the OKYO Pharma Ltd securities, which may or may not be temporary and decrease once the marketing arrangement has ended.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Raging Bull can guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions, and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. A portion of our business is engaged in the marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. A portion of RagingBull’s business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, SMS, push notifications. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently, companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the corporate awareness program ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at

https://www.sec.gov/edgar/searchedgar/companysearch

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.