NOW OPEN: Interactive Live Streaming Trade Room

Real time trading, detailed education on options and penny stocks available to you RIGHT NOW at no additional cost.

Enter the room and trade with us!

Good morning!

It has been a fascinating start to the trading week as news from the semiconductor world has buffeted the broader markets.

On Tuesday, Dutch semiconductor equipment maker ASML “accidentally” published its third quarter results a day early.

Its Q3 sales were solid, but its disappointing 2025 forecast was enough to send shares tumbling 17% intraday and drag global chip stocks down with it.

That was countered on Wednesday after Taiwan’s TSMC posted strong results, lifting chip stocks with it. NVDA jumped 3% on the day and is up another 2+% in the premarket.

On choppy weeks like this one, where news I can’t possibly predict is moving entire indexes, I look for stocks that are rising regardless of what’s on Bloomberg’s home page.

One such company is my “tactical trade” idea for today.

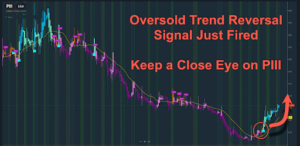

Pull up the chart for P3 Health Partners Inc. (PIII) and see what I mean.

As you can see, the stock has had some incredible rallies in the past six months.

With a 67% hike from late April into early May…

A 42% rise in two weeks in June…

Then there was the 31% bounce in July…

For all those months, the stock has had solid support around the $.46 level, but late last month into this month, it fell below there and it still hasn’t regained that support.

As you can see on the chart above, we’ve seen an impressive bottom bounce, with the stock already climbing 20% from its Friday lows.

Importantly, that climb continued despite Tuesday’s market downturn.

Investors and traders seem convinced that PIII was oversold, and the ASML news wasn’t going to convince them otherwise.

The stock gained 8% yesterday and is up another several percent in the pre-market as of this writing.

I am keeping a close eye on the $.33 level, which I think would signal a possible continuation of the recent downtrend.

On the upside, I think it is important to watch the $.40 level, which has been a resistance level. If that breaks, then that could signal a continuation of the recent uptrend that started recently.

Make sure you are watching PIII very closely today.

As far as the company itself, PIII is a health management company that sets itself apart with a patient-centered, physician-led care model that emphasizes prevention, wellness, and integrated support for managing chronic conditions, especially for Medicare Advantage patients.

The company was founded and guided by physicians since 2017 and has grown rapidly since then.

It is now serving 27 counties across five states — Arizona, Nevada, Florida, Oregon, California — and continues growing.

PIII now boasts more than 3,000 affiliated primary care providers and a 98% retention rate.

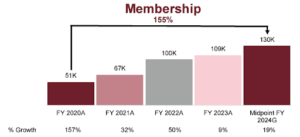

Its membership is up an impressive 155% since 2020:

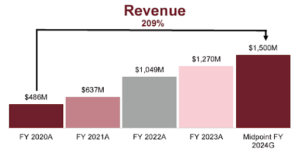

And revenues have outpaced even that:

In January 2024, co-founder and then-CEO Dr. Sherif Abdou said the company expects “to achieve meaningful profitability in 2024” and an April investor presentation said PIII had a “clear path to profitability in 2024.”

Since then, the company has acquired a new CEO and CFO.

Now-CEO Aric Coffman said in August that he had “identified several initiatives during my first 90 days as CEO that will further enhance our capabilities and help achieve sustainable profitability.”

Three analysts have placed 12-month price targets in the last 3 months — TD Cowen, BTIG, and Lake Street — and their average forecast is $2.70, more than 600% upside from yesterday’s closing price.

In its rationale for its BUY rating with a $4.50 price target, Lake Street said it believes “the fundamentals at the company are beginning to strengthen. P3 has a new CEO and CFO, both with deep experience in value-based care. The opportunity in the healthcare marketplace for a company with P3’s business model and experience remains vast.”

Here are some things PIII says characterize its model:

Patients seem to like it. I checked out several of these testimonials from the company’s YouTube channel and was impressed with how much care they said they received.

Those are some notes to get your own research started. And do be sure to survey the company in detail. As always, approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Make sure you have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: PIII has made a convincing bottom bounce with momentum carrying through the market dip on Tuesday. It’s up again in the pre-market today, and it could be making its way back toward critical support.

Investors and traders seem to agree that it was oversold, and if all goes well today, we could see more convincing gains.

Keep PIII at the top of your watchlist today as we watch this play unfold.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty thousand dollars (cash) from Legends media for advertising P3 Health Partners Inc for a one day marketing program on October 17, 2024. This was paid by someone else not connected to P3 Health Partners Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into P3 Health Partners Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.