Monday, Dec 30, 2024

Stardust Power, Inc (Nasdaq: SDST)

Happy Monday, folks,

I’m rested and refreshed from the holiday break and ready to enter the New Year running as we kick off the trading week.

Stock futures are trading a bit lower this morning, but I’m not afraid…

If you’ve been following my trade ideas, you know that even on the day Powell tanked the markets earlier this month, my trade idea managed to soar 🦅

(It closed up 28% for the day).

Last week, I managed to identify another big winner, which jumped as high as 26% during the day.

Keep in mind, these are straight stock plays (no options), and they’re single day moves.

They don’t all turn out this well, but you can see what’s possible.

My “tactical trade” idea for the day is a stock at the frontier of American manufacturing and electrification…

It’s currently developing what it expects will be one of the largest battery-grade lithium refining facilities in North America.

Go ahead and pull up the chart for Stardust Power (SDST).

👉SDST is TODAY’S #1 ALERT👈

The chart is a bit confusing because the company only listed to the Nasdaq in July, via a SPAC merger

Bloomberg noted that after the merger, the firm would have a pro forma value of $490 million:

Ever since a major spike in the stock price shortly after the merger, the price has waffled, as is so often the case with these SPAC deals as investors struggle to find the equilibrium.

The price has been dipping over the past month, but as of last Monday, it seems to have found a bottom and is working its way up.

What I especially like about this stock right now is the nearly 5% gain it made after hours on Friday.

I think the stock may have reached an inflection point and if that trend continues, we could see a further breakout today.

As mentioned, SDST is attempting to develop a huge lithium refinery right in the American heartland — Muskogee, Oklahoma, to be exact.

Just two weeks ago, it announced the finalized purchase of its 66-acre site and is now cleared for construction by Oklahoma permitting authorities.

The company chose the site because it “benefits from proximity to the country’s largest inland waterway system, robust road and rail networks, and a skilled workforce rooted in the oil and gas sector.”

It’s also centrally located to a diverse supply of lithium from American brine sources as well as key battery manufacturers.

You can see a video of the site here.

The project has received considerable “strong support” from local authorities.

In the announcement, SDST CEO Roshan Pujari said the company was “deeply grateful for the ongoing support from Governor Stitt, the Department of Environmental Quality, the Oklahoma Department of Commerce, the Tulsa Chamber, and the City and Port of Muskogee.”

He noted that ”Earlier this year, the City and County of Muskogee established a $27 million Tax Increment Financing (“TIF”) district to support the project. The TIF is expected to fund key infrastructure improvements in the area, including upgrades to industrial roads, rail line rehabilitation, and the replacement of a trestle bridge, improvements that are important to the successful development of the refinery.”

“Governor of Oklahoma, J. Kevin Stitt, and Founder and CEO, Stardust Power, Roshan Pujari, met December 2, 2024, to discuss the upcoming construction of its lithium refinery.”

When the company first announced its plans to set roots in Muskogee, Oklahoma Governor Kevin Stitt commented:

“As we see more energy manufacturers moving to our state, due in part to our competitive, performance based incentives, Stardust Power’s new lithium refinery will create hundreds of new jobs while cementing Oklahoma’s place as the best state in the nation for critical mineral manufacturing. I’m proud to welcome Stardust Power to Oklahoma, and I applaud their commitment to American energy dominance.”

At capacity, SDST expects to produce up to 50,000 metric tons of battery-grade lithium annually.

To put that in perspective, there is currently only about 20,000 tons being produced domestically.

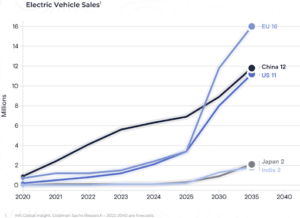

At the same time, “The demand for lithium used in electric vehicle batteries is expected to increase from 26,000 metric tons in 2020 to over 1.5 million metric tons by 2030.” That’s a 5,700% increase and an estimated CAGR of 33%.

The company anticipates the capacity to supply 10%-11% of the rapidly-growing U.S. electric vehicle market by 2032.

SDST also expects to benefit from the Inflation Reduction Act’s requirement that “50% of the value of battery components must be produced or manufactured in North America in fiscal year 2023, with the minimum percentage increasing annually” as well as its requirement that “40% of the value of critical minerals used for the vehicle must be extracted, processed, and/or recycled domestically or in a country with which the U.S. has a free trade agreement, with the minimum percentage increasing annually.”

As it stands, China has up to 66% of the total lithium market and up to 85% of the refinery capacity.

This reliance has obvious implications for national security, with President Biden declaring “that sustainable and responsible domestic mining, beneficiation, and value-added processing of strategic and critical materials [including lithium] for the production of large-capacity batteries for the automotive, e-mobility, and stationary storage sectors are essential to the national defense.“

SDST is in the process of securing financing for its project, and in October, it engaged one of the largest banks in the world, MUFG, as its lead financial advisor.

A managing director of MUFG said it is “proud to work with [SDST CEO] Roshan and the Stardust Power team to develop this critical piece of American infrastructure.”

Analyst firm B.Riley said in October that “The final investment decision for the project is anticipated by mid-2025, with the commencement of production expected in late 2027.”

It gave SDST stock a price target of $12.00 — more than 160% over its current price.

Separately, analyst firm Roth MKM reiterated an even-higher $13.00 price target earlier this month.

As you do your own research on this promising company, take a look at its many prominent media appearances as well as this investor presentation from September and the polished company website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: SDST is developing one of the largest battery-grade lithium refineries facilities in North America and has received strong support from local authorities.

It went public in July, and after a drawback in stock price over the last month, it enjoyed a bottom bounce last week culminating in a nearly 5% gain after hours on Friday.

Pay close attention to SDST for what I expect will be a very significant trading session today.

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Legends Media for advertising Stardust Power Inc for a one day marketing program on December 30, 2024. This was paid by someone else not connected to Stardust Power Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Stardust Power Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.