Sponsored by Momentum Media*

TODAY’S TOP ALERT!

Nasdaq SMTK

Good morning folks, Jeff Bishop here.

I don’t often wade deep into the tech/semiconductor world, but with NVDA stealing the headlines last week, now is a great time to do so.

My “tactical trade” idea of the day is a small player in the semiconductor industry that rode NVDA’s coattails last week to rocket 26%.

Take a look at the chart for Smartkem, Inc. (SMTK).

The stock had been declining gradually since mid-September, but last week, it seemingly found its bottom.

Just moments ago, SMTK announced some breakthrough news that is catching the attention of the market. The stock is up double-digits in pre-market trading, and is one of the top stocks on everyone’s radar today.

From the news release you can see why this is such a big deal…

This collaboration marks the first microLED display product in development using Smartkem’s technology. MicroLED displays provide superior brightness, efficiency and lifespan compared to existing technology. Technology is expected to run on ITRI’s Gen 2.5 assembly line.

With NVDA at the top of everyone’s mind ahead of its earnings drop last Wednesday, SMTK had a powerful bottom bounce.

If you’ve followed my “tactical” ideas for a while, you know I love finding below-the-radar stocks that are likely to outperform the headline stocks of the day.

SMTK did that big time. Its percent gain for the week was more than 15-times higher than that of NVDA.

On top of that, SMTK has already hit 25% in the pre-market as of this writing.

I think investors may have finally caught wind of the incredible potential of this company.

That’s why it’s essential to add SMTK to the top of your watchlist today.

Here’s the rundown on how SMTK fits in the semiconductor world…

Founded in 2009, Manchester, England-based Smartkem says it is “introducing a new class of organic semiconductor materials that enable display manufacturers to produce a new generation of lower-cost, higher performing displays using their existing infrastructure.”

With its 175 patents and 40 trade secrets, the company is attempting to break into a market that is expected to grow to $25 billion by 2030.

The core of its innovation is its proprietary TRUFLEX® technology — a semiconductor platform that enables the production of flexible, lightweight, and high-performance organic thin-film transistors (OTFTs).

Those transistors, in turn, can be used to make a new generation of cost-effective displays that outperform traditional models.

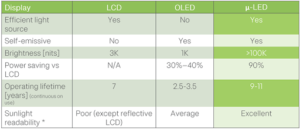

The company is especially focused on enabling microLED displays. Here are some of the advantages it points out:

As it notes, “MicroLED displays are the only solution that enables sunlight readable displays with low power consumption and long lifetimes for watches, phones, laptops, and TVs.”

The trouble with current microLED displays is they are very difficult to make. To manufacture one, “you have to put together two large sheets of glass: one covered in 24 million very small microLEDs aligned with one covered in 24 million very small and expensive transistors, and then push them together at just the right pressure and laser weld them.”

SMTK believes its TRUFLEX® technology will unlock microLED displays and take them “from being boutique to the mass market.”

You can read more about the technical details here but frankly, a lot of it is over my head. I’m mostly interested in how other companies and experts are reacting to SMTK.

In November 2023, the company published a paper on its technology in the UK’s leading peer-reviewed science journal, Nature Communications.

That’s a prestigious vote of confidence.

In addition, as you can see if you scroll through this page, the company has presented and exhibited at leading tech forums and conferences around the US, Europe, and Asia.

They’ve also entered into a number of joint agreements with outside companies, including:

- February 2024: Shanghai-based Tianma Microelectronics “to integrate Smartkem’s Organic Thin-Film Transistor (OTFT) technology with Tianma’s oxide transistors to develop OTFT-based microarray biochips.”

- March 2024: Taiwan-based RiTdisplay “for the manufacture of a new type of active-matrix OLED (AMOLED) display.”

- September 2024: Shanghai-based Chip Foundation “to co-develop a new generation of microLED-based backlight technology for Liquid Crystal Displays.”

Dr. Maosheng Hao, chairman of Chip Foundation, said:

“Smartkem is widely recognized as a leading provider of OTFT solutions, with deep expertise and extensive experience in organic dielectric materials, organic semiconductor materials, and related processes. ….

“We believe that this collaboration between our two companies has the potential to expedite the advancement and widespread adoption of this technology by the display industry.”

Those are just a handful of the companies SMTK is working with. Scroll through this page to find many more.

Without understanding the details myself, I find it encouraging that so many authorities and companies see promise in SMTK’s potentially revolutionary technology.

As you do your own research, be sure to check out this promo video for the company as well as this investor presentation.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: With semiconductor companies topping the headlines last week, SMTK soared 26%, beating NVDA’s performance more than fifteen-fold…

The stock is up another 25% in the pre-market as of this writing, strongly suggesting it will extend its rally this week.

Pay close attention to SMTK today to see if I’m right!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Momentum Media for advertising SmartKem, Inc for a one day marketing program on November 25, 2024. This was paid by someone else not connected to SmartKem, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into SmartKem, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.