Sponsored by Beyond Media SEZC*

TODAY’S TOP ALERT!

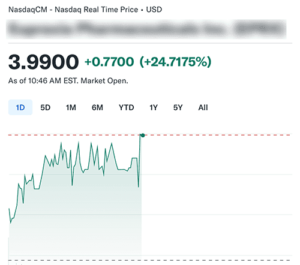

Nasdaq: SOAR

Live teaching& trading with a 20+ year seasoned trader right at your fingertips.

JW breaks down markets and some of the hottest penny stock movers today!

Happy Friday!

Stock futures are slightly down this morning, but I doubt we’ll see a red close today as traders turn their attention to Thanksgiving week and the likely Santa Rally to come.

I’ve had a great week of trading. One of the highlights was my “tactical trade” idea from Wednesday:

I took a day off from small caps yesterday, but this morning I’m back on the hunt.

Today’s “tactical trade” stock is Volato Group, Inc. (SOAR).

If you pull up a fine-grained chart on the stock, you’ll see it had a nice 20% pop on Monday after dropping its third-quarter earnings that morning.

It wound up closing the day up 6%, but what really interests me is the completely vertical move it made after the open on Tuesday.

The stock roared 260% higher by 10 am but is now trading “only” 41% higher from its opening price on Monday.

This has been one of the best performing stocks in the entire market this week.

Clearly, some investors took profits from that massive runup, but the fundamental reason for the runup stands: SOAR released impressive quarterly numbers which I’ll go into more below.

In yesterday’s trading, the stock price was largely flat after 10am, but in the 30 minutes before the bell, SOAR jumped some 7%, crossing well above its 20-day moving average.

I think that could be an inflection point headed into today’s trading, and that momentum could push the stock significantly higher today.

There’s no guarantee of that, of course, and if the stock dips below that moving average — at roughly the $.29 level — the trend might not hold, and I’d head to the sidelines to wait for a better time.

On the other hand, if it crosses above the $.34 mark, we could be off to the races.

Keep SOAR at the top of your watchlist today as we watch the action unfold.

In the meantime, here’s a rundown on the company itself…

SOAR was founded in 2021 as Covid was raging and causing travel headaches for everyone — especially air travelers.

For obvious reasons, there was a huge surge in demand for private air travel, but very few people can afford to purchase, maintain, and staff their own plane.

Many more people can afford, say, one-sixteenth of those costs, and if they fly only occasionally, it makes sense to share the burden with more people.

Enter SOAR.

The company — which has been featured in the likes of Business Insider and Forbes — facilitates fractional ownership of private jets, marketing itself as “a leader in private aviation, redefining air travel through modern, efficient, and customer-designed solutions.”

The company’s Fractional Ownership program allows customers to purchase a share of a jet, then offers a simple monthly management fee that covers everything from insurance to maintenance to crew.

In return, fractional owners get “unlimited hours, unlimited days, and a guaranteed revenue share on a new modern fleet of jets.”

That last part is important because, even when a fractional owner isn’t personally flying, the plane gets put to use generating revenue.

In fact, SOAR guarantees fractional owners a share of revenue of *at least* 650 flight hours per year.

As a result, SOAR can say with confidence that “Your revenue share [will exceed] your monthly management fee and can contribute to offsetting your hourly flight fees.”

So not only does SOAR offer private jet (partial) ownership at a literal fraction of the cost, it also has systems in place to completely offset the other costs of ownership.

An additional advantage of fractional ownership through SOAR is it guarantees “year-round access to your aircraft class, as well as priority access to our other aircraft classes for when your mission requires a more appropriate size.”

SOAR initially offered only HondaJet aircraft — which cost approximately $7 million — and today is the largest HondaJet operator in the U.S.

The company explains that “The HondaJet is optimized for 80% of all private flights in the United States – those flying for up to two hours with four or fewer passengers. The aircraft exceeds every standard in the light jet category, flying higher, faster, farther and with greater fuel efficiency than competitors, transporting you in the most luxurious, spacious cabin in class.”

Volato HondaJet

Starting this year, though, it began offering fractional ownership of the larger Gulfstream G280, which it describes as a “super midsize jet with the largest and quietest cabin of its class. With a bespoke interior and conference club configuration that seats 10 passengers, the G280 can whisk you from coast to coast and over to Europe.”

Volato G280

While the bulk of the company’s revenue comes from the fractional ownership program, it also generates revenue from “nose to tail” aircraft management for people who own their planes apart from SOAR.

Here’s the pitch: “Let us lease your jet, opening up chartering to the public. We manage the schedule, maintenance, and crew. You reap the benefits of putting your jet to work.”

This year, the company started bringing in annual recurring revenue — it’s up to $1.5 million — from its digital platform, Vaunt, that connects passengers with empty-leg private flights for a flat, $1,995 annual membership fee.

This past quarter, the company began implementing what it calls its “turnaround plan” by “focusing on operational efficiencies and cost savings to strengthen its core business.”

As a result, SOAR CFO Mark Heinen said the company, “achieved an Adjusted EBITDA positive quarter ahead of our previous forecast.”

That was part of a November 18 press release covering SOAR’s Q3 results which seems to have been the catalyst for the massive jump in the stock’s price.

The company reported total revenue for the quarter of $40.3 million, an increase of nearly 1,000% year-over-year.

In addition, “Net loss from continuing operations for the third quarter improved to $1.3 million compared to a net loss from continuing operations of $2.6 million in the prior year.”

SOAR has a great website here that you should check out as you do your own research on this stock. I also recommend perusing Vaunt’s website and this promo video.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: SOAR soared more than 260% this week after its Q3 earnings drop. It has pulled back from those highs before leveling out yesterday and accelerating into the close.

It closed above the 20-day moving average and that momentum could push the stock significantly higher.

Pay close attention to SOAR today to see if I’m right!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Beyond Media SEZC for advertising Volato Group, Inc for a one day marketing program on November 22, 2024. This was paid by someone else not connected to Volato Group, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Volato Group, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.