Wednesday March 19, 2025

Surf Air Mobility (NYSE: SRFM)

Hey folks, Jeff Bishop here.

Investors are on edge as we await the latest from Powell and his band of merry men (and women).

It’s been a rough month for the large caps, with the S&P 500 down nearly 6% since the month began.

At the same time, there have been some real standouts among the small caps.

Six of my last seven of these “tactical trade” ideas have made double-digit moves the day I alerted them… four of them climbed 20%+.

I’m looking at some great setups right now, and one that really stands out is

👉 Surf Air Mobility Inc. (SRFM) 👈

The stock has more than doubled since early November, and it has had some great rallies in that time…

We’re talking a 150% surge in six trading days in late December… a 50% move in three trading days in January… and a 40%+ rally in three trading days earlier this month.

It released its Q4 earnings yesterday, and while its $28 million in quarterly revenue fell short of analysts’ expectations, the figure was still up 5% from the year prior.

The market’s knee-jerk pulled the stock back nearly 8%, but it’s now green in the pre-market, suggesting this was an overcorrection.

As you’ll see below, this is a solid company on a great flight trajectory, and I think it’s worth a close look at this price.

Keep it at the very top of your radar today to see where it goes!

SRFM is a pioneer in regional aviation and is one of the largest commuter airlines in the U.S. by scheduled departures. Its goal is to “transform regional flying through electrification.”

That’s right, electric planes 🔋🛩️.

“A new mass transit solution”

Imagine arriving at a small airport close to your home just 15 minutes before your flight and stepping into a lounge like this:

You walk to a plane that’s just feet away, and before you know it, you arrive at your destination without ever stepping into a crowded and congested airport.

Surf Air made that a reality for some 350,000 passengers in 2024 in more than 70,000 flights to 48 destinations.

The company utilizes smaller aircraft like this Cessna Grand Caravan:

Photo credit: Surf Air Mobility

The idea is to provide a genuine alternative to road travel and to major commercial flights — whether for a weekend getaway, a simple joyride, or even a traffic-hopping commute to the office.

In short, the company’s goal is to “unlock a new mass transit solution.”

In a 2021 report, NASA said that the sort of Regional Air Mobility (RAM) being furthered by companies like SRFM “will fundamentally change how we travel by bringing the convenience, speed, and safety of air travel to all Americans, regardless of their proximity to a travel hub or urban center.”

It noted that there were more than 5,000 airports available for public use, but just 30 of them served over 70% of travelers.

SRFM plans to expand its network to premier regional airports throughout the country.

Personally, I love regional airports (I often use the one here in Lynchburg, Virginia), and the idea of flights that bypass major airports entirely is very appealing.

Surf Air is currently bringing in three diverse sources of revenue. The first is Essential Air Service (EAS). These are recurring government-contracted flights that serve small communities.

The second is scheduled air service, which functions like typical airlines with set routes and times.

The third revenue source — and this is very cool — is on-demand chartered flights. With this website, you can charter a flight from airports around the country. You can choose the exact route and plane and see the price right there!

But SRFM’s appeal — to consumers and investors — doesn’t stop there.

The company’s ultimate goal is “to be first to commercialize green regional air travel” through electrified aircraft.

Green Revolution taking to the skies

Based out of Los Angeles, SRFM wants to bring Silicon Valley solutions to aviation as a means not only of reducing carbon emissions, but of reducing costs.

The company has partnered with some heavy hitters to make this happen. In September 2023, it announced an exclusive relationship with Textron Aviation — makers of Cessna aircraft — to electrify ⚡ the Cessna Grand Caravan EX.

SRFM agreed to purchase up to 150 of the aircraft, and it is targeting FAA certification of the electrified versions by 2026.

The company has also partnered with firms AeroTEC and magniX to develop and certify the hybrid and all-electric planes.

According to Surf Air, the hybrid versions will reduce emissions by 50% (compared to the all-combustion version of the Grand Caravan) while reducing costs by 25%.

The all-electric versions will completely eliminate emissions while reducing costs by 50%.

SRFM eventually wants to electrify its entire fleet — not just the new planes — and it wants to supply its proprietary electric powertrains to other airlines once it is certified.

Ultimately, SRFM is trying to pioneer quick, cheap, and green ways to travel regionally.

It’s angling to do to air travel what Uber did to taxiing, or what Tesla did to automaking. I think the potential upside is incredible.

Wrapping Up

The Surf Air Mobility (SRFM) story is an incredible one.

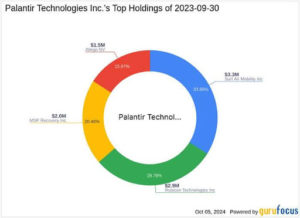

In October, Palantir Technologies — yes, that Palantir — acquired 1.2 million shares of SRFM, increasing its total stake to 2.7 million shares.

SRFM is one of only a select number of companies PLTR is invested in:

In November, SRFM unveiled a “four-phase transformation plan,” backed by a $50 million term loan, to steer the company toward profitability in its airline operations by 2025.

Then, in late December, two prominent board members scooped up shares in open-market transactions. This is a great sign of insider confidence.

In January, independent news site GuruFocus called SRFM a “Top Penny Stock with 170% Potential”:

And just yesterday, the company revealed that it brought in nearly $120 million in revenue in 2024 — up 6% from the year prior.

Right now, analysts have four “BUY” ratings out for SRFM with an consensus price target of $6.45 — representing an upside of nearly 70% from its current valuation.

Based on the technicals and the fundamentals, I think SRFM is a great one to take a look at right now, considering all of the recent developments and incredible stock chart I am seeing.

As always, be sure to do your own research. I found this video very cool and informative, and this investor presentation was also great.

Check out the company’s slick website and, of course, study its chart.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

👉 Make sure SRFM is at the top of your watchlist today!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received ten thousand dollars (cash) from Market Jar for advertising Surf Air Mobility Inc for a one day marketing program on March 19, 2025. Prior to this, we received fifteen thousand dollars (cash) from Legends Media for advertising Surf Air Mobility Inc for a one day marketing program on February 4, 2025 and we also received fifteen thousand dollars (cash) from Legends Media for advertising Surf Air Mobility Inc for a one day marketing program on January, 24, 2025 and also twelve thousand five hundred dollars (cash) from Sica Media for advertising Surf Air Mobility Inc for a one day marketing program on February 9, 2024. This was paid by someone else not connected to Surf Air Mobility Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Surf Air Mobility Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.