*Sponsored by Sica Media

We have a data-packed market this week.

I know you have a busy day ahead of you, so I’ll cut right to the chase.

This is an extremely time-sensitive stock to look at right now.

If analysts are right — and I think they’re onto something — this idea could have tremendous upside.

Here’s the one stock I think you should focus on today:

Surf Air Mobility Inc. (NYSE: SRFM)

Surf Air is a pioneer in regional aviation and is the largest commuter airline in the U.S. by scheduled departures. Its goal is to “transform regional flying through electrification.”

That’s right, electric planes 🔋🛩️.

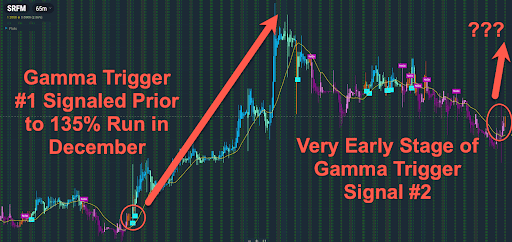

The company is fascinating, but it’s this chart that has me excited about this “Bright Idea 💡” right now.

Just look at this…

We saw a beautiful “Gamma Trigger” signal in early December last month. That led to a stunning 135% move over the next few weeks.

By the way, if you don’t know the importance of this signal or how to interpret it – make sure you attend one of my upcoming live sessions!

If you look at the chart now, you’ll see the early stages of another setup like we saw in December, with SRFM starting to trade above the 20-hour moving average and the “Go / No Go” indicator signaling a possible trend change.

I think you should really get excited about the possibility of seeing a setup like this from near the very start, but if that isn’t enough… read on.

We’re talking about electric airplanes here!

“A new mass transit solution”

Imagine arriving at a small airport close to your home just 15 minutes before your flight and stepping into a lounge like this:

Credit: Surf Air Mobility via Facebook

You walk to a plane that’s just feet away, and before you know it, you arrive at your destination without ever stepping into a crowded and congested airport.

Surf Air made that a reality for some 450,000 passengers in 2022 over 75,000 flights to 48 destinations.

The company utilizes smaller aircraft like this Cessna Grand Caravan:

Photo credit: Surf Air Mobility

The idea is to provide a genuine alternative to road travel and to major commercial flights — whether for a weekend getaway, a simple joyride, or even a traffic-hopping commute to the office.

In short, the company’s goal is to “unlock a new mass transit solution.”

In a 2021 report, NASA said that the sort of Regional Air Mobility (RAM) being furthered by companies like SRFM “will fundamentally change how we travel by bringing the convenience, speed, and safety of air travel to all Americans, regardless of their proximity to a travel hub or urban center.”

It noted that there are more than 5,000 airports available for public use, but just 30 of them serve over 70% of travelers.

SRFM plans to expand its network to premier regional airports throughout the country.

In May, McKinsey & Company wrote that “the total addressable market (TAM) for small regional flights globally could be $75 billion to $115 billion by 2035, representing 300 to 700 million passengers annually.”

Personally, I love regional airports (I just flew out of the one here in Lynchburg, Virginia, last week), and the idea of flights that bypass major airports entirely is very appealing.

Surf Air is currently bringing in three diverse sources of revenue. The first is Essential Air Service (EAS). These are recurring government-contracted flights that serve small communities.

The second is scheduled air service, which functions like typical airlines with set routes and times.

The third revenue source — and this is very cool — is on-demand chartered flights. With this website, you can charter a flight from airports around the country. You can choose the exact route and plane and see the price right there!

But Surf Air’s appeal — to consumers and investors — doesn’t stop there.

The company’s ultimate goal is “to be first to commercialize green regional air travel” through electrified aircraft.

Green Revolution taking to the skies

Based out of California, SRFM wants to bring Silicon Valley solutions to aviation as a means not only of reducing carbon emissions, but of reducing costs.

The company has partnered with some heavy hitters to make this happen. In September, it announced an exclusive relationship with Textron Aviation — makers of Cessna aircraft — to electrify ⚡ the Cessna Grand Caravan EX.

SRFM agreed to purchase up to 150 of the aircraft, and it is targeting FAA certification of the electrified versions by 2026.

The company has also partnered with firms AeroTEC and magniX to develop and certify the hybrid and all-electric planes.

According to Surf Air, the hybrid versions will reduce emissions by 50% (compared to the all-combustion version of the Grand Caravan) while reducing costs by 25%.

The all-electric versions will completely eliminate emissions while reducing costs by 50%.

Surf Air eventually wants to electrify its entire fleet — not just the new planes — and it wants to supply its proprietary electric powertrains to other airlines once it is certified.

Earlier this month, it announced an agreement with two major Kenyan Cessna Caravan airlines to do just that.

Ultimately, SRFM is trying to pioneer quick, cheap, and green ways to travel regionally.

It’s angling to do to air travel what Uber did to taxiing, or what Tesla did to automaking. I think the potential upside is incredible.

Wrapping Up

The Surf Air Mobility (SRFM) story is an incredible one.

This is an established company that brought in over $100 million in revenue in 2022.

It has raised $850 million in capital based on current funding agreements.

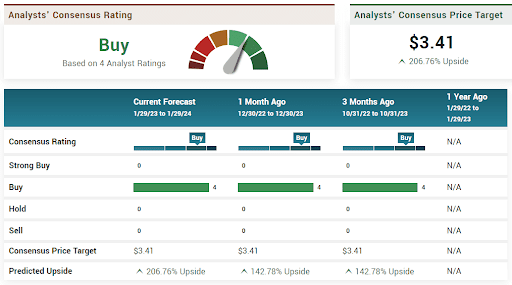

Right now, analysts have four “BUY” ratings out for SRFM with an average price target of $3.41 — representing an upside of over 200% from its current valuation.

Based on the technicals and the fundamentals, I think SRFM is a great one to take a look at right now, considering all of the recent developments and incredible stock chart I am seeing.

As always, be sure to do your own research. I found this video very cool and informative, and this investor presentation was also great.

Check out the company’s slick website and, of course, study its chart.

See if you agree that this company is the triple-digit opportunity analysts seem to think it is.

Always have a solid trade plan in place that makes sense for you and your personal risk level. I am handing out what I hope are great ideas, but it is up to you to do with it as you will!

To Your Success,

Jeff Bishop

*Sponsored content. This investment involves substantial risk. Please see full disclosure below, and detailed discussion of risks and atypical results.

DISCLAIMER

*PAID ADVERTISEMENT. Raging Bull has currently been paid twelve thousand five hundred dollars from Sica Media, who was compensated by a third party not affiliated with the Company for advertising Surf Air Mobility Inc. The third party, Company, or their affiliates may own and likely wish to liquidate shares of the Company at or near the time you receive this advertisement, which has the potential to hurt share prices. This advertisement and other marketing efforts, including alerts, may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Surf Air Mobility Inc., increased trading volume, and possibly an increased share price of Surf Air Mobility Inc.’s securities, which may or may not be temporary and decrease once the marketing arrangement has ended. As a result of this advertisement and other marketing efforts, Raging Bull may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. As of the date of the issuance of this advertisement, the owners of Raging Bull do not hold a position in Surf Air Mobility Inc., though they reserve the right to buy or sell shares in the covered company at any time following the dissemination of this communication.

FOR COMMERCIAL AND INFORMATIONAL PURPOSES ONLY; NOT INVESTMENT ADVICE. This advertisement is for commercial and informational purposes only. A portion of our business is engaged in the promotion, marketing, and advertising of companies including public companies. A portion of Raging Bull’s business model is to receive financial compensation to promote public companies, conduct investor relations advertising and marketing, and publicly disseminate information regarding public companies through our websites email, SMS, and push notifications among other methods of communication. This compensation is a major conflict of interest in our ability to provide unbiased reporting. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for. These are purely for the purpose of company awareness, and to generate subscription revenues. We have not investigated the background of the hiring third party or parties. All material information contained in this advertisement is based on information generally available to the public, including information released to the public or filed by the Company with applicable regulators which public information is believed to be reliable and accurate. Nevertheless, Raging Bull cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of any company’s financial position. This advertisement or any statements made in it is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the companies mentioned in this advertisement, nor should they be construed as a personalized recommendation to you to buy, sell, or hold any position in any security mentioned in this advertisement or in any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED. Any individual who chooses to invest in any securities of the companies mentioned in this advertisement should do so with caution. Investing or transacting in any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions and should use information from this advertisement only as a starting point for doing additional independent research in order to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments. Never invest in any stock featured in this advertisement, on our site or emails unless you can afford to lose your entire investment.

NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Raging Bull, or any of their owners, employees or independent contractors is not currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS. Our advertisements including this advertisement and related emails, reports and alerts may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information in this advertisement, related emails, reports or alerts or on our website or media webpage. This information is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct. Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Raging Bull does not undertake an obligation to update forward-looking statements in light of new information or future events. Readers can and should review all public SEC filings made by the companies profiled in the Advertisements at https:// www .sec .gov/edgar/searchedgar/company search

TRADEMARKS. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of the advertisement is made or implied.

WE MAY HOLD SECURITIES DISCUSSED. Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.