Wednesday, Dec 18, 2024

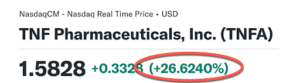

Nasdaq: TNFA

Following up on some massive winners lately, I’ve found another fresh idea that I think has huge potential right now.

Go to your favorite platform and pull up TNF Pharmaceuticals (TNFA) right now.

I brought this to your attention a couple of weeks ago, if you recall.

We saw a very nice 26%+ gain that very same day…

Right now, I am looking at a very similar chart setup, and I think it demands your attention right away.

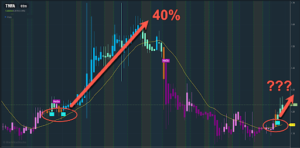

Look at the AI-powered “GO” signals that fired a couple of weeks ago when I showed it to you last time?

That led to a 40%+ rally from those levels…

If you look closely at the chart above, you will see that the algo just fired off another “GO” signal yesterday.

While you can’t ever count on history repeating itself in the stock market, this is a very powerful signal for short-term traders to consider.

This is a very time-sensitive situation with TNFA.

Make sure that you have TNFA on the top of your watchlist and start monitoring it immediately.

👉 TNFA is TODAY’S #1 ALERT 👈

TNFA is a clinical-stage pharmaceutical company focused on developing drugs to target aging and age-related diseases; autoimmune diseases; and chronic pain, anxiety, and sleep disorders.

The company — based at Johns Hopkins University in Baltimore, Maryland — has two main candidates…

Its lead candidate is MYMD-1, a synthetic plant alkaloid shown to positively impact multiple conditions related to immunometabolic dysregulation.

There’s a full breakdown on MYMD-1 as well as a helpful video on how it works on this page of the company’s website…

But in brief, the company says that with its “small molecule design, selective mechanism of action, and ability to cross the blood-brain barrier, MYMD-1® has the potential to disrupt the TNF-alpha inhibitor market and provide meaningful therapeutic solutions to patients not served by current therapies.”

The company adds that it has “demonstrated the potential to slow the aging process and extend healthy lifespan.”

TNFA completed a 40-patient, successful Phase 2 study last year for MYMD-1 evaluating its safety and efficacy as a treatment for sarcopenia, which is the loss of muscle mass and strength associated with aging.

The study “met its primary endpoints for significantly reducing chronic inflammatory markers with statistically significant results” and there were no treatment-related adverse events (AEs) or serious adverse events (SAEs) in the course of the study.

The company notes that 25% of 65+ year olds are affected by sarcopenia, and that hospitalizations associated with the condition cost an estimated $40.4 billion in the U.S.

In August, TNFA announced that it is preparing to advance MYMD-1 through “fully funded mid-stage clinical trials” for treatment of sarcopenia/frailty.

Dr. Mitchell Glass, president and CEO of TNFA, said, “In our view, MYMD-1, if approved, could be the first orally administered TNF-alpha inhibitor drug and the first and only therapy for sarcopenia, a common age-related disorder that causes a prolonged decline in physical function.”

He added that MYMD-1 has additional open INDs for Phase 2 trials to study its efficacy in rheumatoid arthritis (RA) and Hashimoto’s thyroiditis.

He concluded that “Our next steps, to be revealed soon, will extend our reach toward significant and sustainable value creation, and long-term Company growth.”

And on October 2, TNFA revealed a “strategic equity investment” from an investment fund called Prevail Partners, LLC which focuses on life sciences companies.

TNFA engaged one of Prevail’s affiliates — which it said had “recently received industry recognition as the most advanced tech-enabled [clinical research organization]” — “to provide clinical services for the next Phase 2 clinical study using our proprietary drug in sarcopenia/frailty.”

Dr. Glass commented, “The fund’s investment in TNFA points to their confidence in our potent oral synthetic TNF-alpha inhibitor MYMD-1’s potential to transform how TNFα-based diseases are treated.”

TNFA’s other main candidate is Supera-CBD, “a novel, synthetic, non-toxic cannabidiol (CBD) analog that is 8,000 times more potent as a CB2 agonist (activator) than plant-based CBD.”

Here is a page on the company’s website with details, including a helpful video, on how it works.

Because Supera-CBD is synthetic, the company says it has better bioavailability and potency than botanical CBD and, importantly, it can be patented.

The company notes that Supera-CBD “is non-toxic and approximately 7-8X more effective than plant-derived CBD in reducing MAO-A and MAO-B, which play a role in substance addiction… .”

It adds that “in studies with scientific collaborators, Supera-CBD has demonstrated antidepressant and anti-anxiety effects with much higher potency and efficacy than plant-derived CBD.”

If approved, Supera-CBD would give physicians an FDA approved drug to offer patients rather than botanicals that contain impurities.

Supera-CBD is also not contaminated by THC, the psychoactive compound in cannabis.

Right now, TNFA says it is “being developed to address anxiety, chronic pain, and seizures and is expected to begin human trials as a therapy for epilepsy, followed by chronic pain.”

For more information on this company, as well as its potentially breakthrough therapies, check out its website and this investor presentation from April 2023.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: TNFA is a promising clinical-stage pharma company with multiple promising “shots on goal.”

My favorite trading algorithm has lit up two “go” signals, and with the stock jumping 4% in the pre-market, today could be the day we see a similar rally to the one it had last month.

Nothing is guaranteed here, but this is one of the best setups I’m seeing and it makes sense to keep TNFA at the top 🔝 of your trading watchlist today.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we were paid fifteen thousand dollars from Legends Media for advertising TNF Pharmaceuticals, Inc for a one day marketing program on December 18, 2024. Previously, we received twenty five thousand dollars (cash) from Legends Media for advertising TNF Pharmaceuticals, Inc for a one day marketing program on December 9, 2024. This was paid by someone else not connected to TNF Pharmaceuticals, Inc. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into TNF Pharmaceuticals, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.