Wednesday, March 26, 2025

(Nasdaq: tzup)

👉 TZUP is TODAY’S #1 ALERT 👈

Hey there, Jeff Bishop here.

Stocks were hugging the flat line in the pre-market this morning, reflecting the reduced volatility I mentioned in my email last night (the VIX is down 40% from its March 10 high).

Investors are holding their breath for the latest act in the tariff drama, with next week’s “Liberation Day” deadline looming.

As I said last night, it’s critical right now to have clear trade plans and to stick to them.

Today, I’m taking aim at one of my favorite new companies.

Take a gander at Thumzup Media Corporation (TZUP) on your trading platform.

The company uplisted to the Nasdaq in late October, and the market has been working to price it.

From its November low, the stock had a monster 129% rally into early December — playing out over less than three weeks.

Later that month, I sent a “tactical trade” alert on the stock, and it went on to climb 11% that day and 23% in the 48 hours after the alert.

The stock had its ups and downs in the months following, but beginning one month ago, the stock began a clear uptrend.

It has now enjoyed a steady, 96% rocket-ride 🚀 since February 25…

That’s right: TZUP was busy nearly doubling while the market tanked (though it has recovered a bit since Friday).

When a stock bucks a downtrend like that, it’s a sign of BIG confidence from investors.

And just this morning — hot off the presses — we TZUP revealed its plan to launch a “revolutionary patent-pending lifestyle AI agent marketplace.”

This is seemingly a brand-new vertical for TZUP that “aims to redefine lifestyle planning by introducing a suite of specialized AI agents that will be designed to assist users curate personalized experiences.”

The company has launched a website for the new platform, and has released a promotional video that shows what it’s all about.

I saw this all over the investing news sites this morning, and the stock was up in the pre-market on the news.

Folks, today could be a very big day for TZUP — so keep it at the top of your radar!

I think that once more investors discover this company, they’ll find it very compelling.

The more I look into this company, the more I’m convinced it could be a genuine market disruptor in the world of digital advertising.

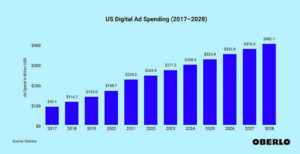

Statista expects digital ad spending to hit a whopping $324 billion this year, and to top $400 billion by 2028.

Right now, though, almost all of that money is being scooped up by industry giants like Google, Amazon, and Microsoft…

The big social media sites take in their fair share, with Meta (Facebook and Instagram), YouTube, TikTok, and SnapChat at the forefront.

A portion of that money — Statista estimates it will reach $32 billion this year — does go to individual users, but so far it has been largely limited to high-flying “influencers.”

Until now.

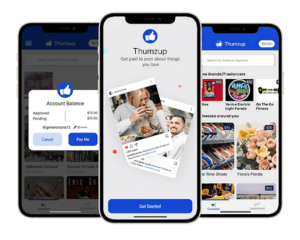

TZUP — founded in 2020 and based in Los Angeles — is “democratizing” digital advertising by enabling everyday social media users to become “micro-influencers” by paying them to post about their favorite brands and businesses.

“Democratization” has been a huge trend over the past 15 years…

Think about what Uber did for the transportation industry… what Airbnb did for lodging… or what DoorDash did for food delivery…

All these companies rapidly reached multi-billion dollar valuations because they allowed everyday people to participate in industries previously reserved for the few.

TZUP recruits local businesses — but also brands that aren’t tied to particular areas — to sign up for its app and start advertising campaigns.

The businesses then set overall campaign budgets as well as prices they’re willing to pay social media users to post about their companies.

On the other side, social media users sign up for the app and can browse businesses and brands willing to pay them to make sponsored posts.

TZUP does preliminary screening of the posts (making sure photos/videos are in focus and not pulled from somewhere on the internet, etc.), adds a few hashtags, then lets businesses know when posts are ready for approval.

If a business approves a post, it goes live, and the social media user gets paid the promised amount via Venmo, PayPal, or even Bitcoin.

It’s as simple as that.

TZUP was initially focused on Instagram, and in November it revealed video capabilities that allow integration with Instagram Reels — the hugely popular short-form video feature.

But in December, the company expanded its reach to X (formerly Twitter), in what it called “a quantum leap in Thumzup’s mission to revolutionize advertising.”

TZUP has plans to integrate on TikTok and other emerging platforms as well.

Similar to Uber, TZUP first launched in a limited area — in its case, Los Angeles — so it could reach a critical concentration of advertisers and “micro-influencers” on its app.

Over just a few years, though, the company expanded to big cities such as Seattle, Portland, New York City, and Columbus, Ohio, and it now has a presence in twelve states.

Its second major area of focus is in South Florida, particularly in Miami.

By the end of 2023, Thumzup had recruited 183 advertisers. As of October 2024, the company had reached more than 550 advertisers. Three weeks ago, it surpassed 700 advertisers — nearly quadrupling its advertisers in 15 months.

The company believes it will cross 1,000 advertisers in Q2 this year, and is aiming to 10x its advertisers over the course of 2025.

In an interview with CBS Los Angeles, the owner of a store in Marina Del Rey, Hallowed Ground, said her revenue grew by 40 percent in the first five months of using Thumzup.

“Even if [Thumzup users] don’t have as many followers, who are their followers? [They] are people who are their friends, who trust them and their opinions, and so that’s more valuable to me than an influencer,” she said.

As of November 2024, TZUP had paid out approximately $230,000 to creators.

In the CBS report, one TZUP user who uses the app as a side hustle said she “started off making about $50 to $75 a week, and I am up to about $500 a week, but potentially I haven’t even hit half the businesses [in her area].”

On November 22, TZUP rang the opening bell for the Nasdaq. You can see a great video for that here, which includes an overview of the company and some words from CEO Robert Steele.

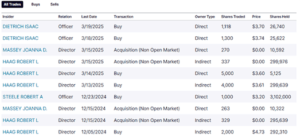

Also of note, TZUP insiders including Mr. Steele have been buying up shares, especially through the stock’s most recent rally:

I don’t see any recent insider sales.

In a sign of further confidence, the company recently initiated a stock buyback program of up to $1 million.

I’ll add that tech startups like TZUP tend to do very well during easing cycles when they can get cheap capital to rapidly grow.

I think as rates ease and the more investors learn about this truly disruptive company, we could see the stock grow by multiples.

Naturally, that’s far from guaranteed. I recommend doing your own research beginning with the company website, this January 30 shareholder letter, as well as this investor presentation updated just this month.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: TZUP is a truly innovative company that’s democratizing and revolutionizing the world of digital marketing. It has nearly quadrupled its advertiser base in just over a year.

The stock has been on a roll since February 25, nearly doubling in just one month. And that was before the big news this morning.

Pay close attention today to see if the news gives TZUP the next leg up in its already powerful rally.

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we currently have received twenty five thousand dollars (cash) from Sica Media for advertising Thumzup Media Corp for a one day marketing program on March 26, 2025. Prior to that, we received thirty five thousand dollars (cash) from Sica Media for advertising Thumzup Media Corp for a one day marketing program on January 30, 2025 and we also we received twenty five thousand dollars (cash) from Sica Media for advertising Thumzup Media Corp for a one day marketing program on December 3, 2024 and we also received twenty five thousand dollars (cash) from Sica Media for advertising Thumzup Media Corp for a one day marketing program on November 12, 2024 and before that we were paid fifteen thousand dollars by Raising Stakes to run advertisements enhancing public awareness of Thumzup Media. The owners of RagingBull are not currently invested in Thumzup Media.This was paid by someone else not connected to Thumzup Media Corp. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Thumzup Media Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.