Sponsored by Sica Media*

TODAY’S TOP ALERT!

Nasdaq:VUZI

Live Teaching and Trading with a 20+ year seasoned trader right at your fingertips!

Join Jeff Williams in our Market Masters Room this morning from 9am to 11am ET

to watch and listen as he breaks down markets and some of the hottest penny stock movers today.

Good morning!

I hope you are ready for another fantastic trading day!

Before I get started with today’s new idea, I have to take a moment and reflect on this thing of beauty from yesterday.

They should hang this in the Louvre, it is a work of art…

This, of course, is the chart from yesterday’s latest “tactical” trade idea I shared with you.

Sadly, trading isn’t always this easy, but it sure is nice when things go better than you expected.

I think it really emphasizes the power of the AI-powered “GO” trends that I always talk about.

I mentioned that the stock had two “GO” signals on the hourly chart, and that is typically a great place to start watching a stock for a reversal higher.

That one worked perfectly.

I hope I can say the same about today’s new tactical idea – Vuzix Corp (VUZI)

Now, VUZI isn’t a “new” idea by any means.

If you have been following me for a while, you know I am a really big fan of this stock and have covered it many times in the past.

In fact, the last time I talked to you about it was last month.

Since then, VUZI has racked up well over 70% in gains. Not bad for a month, is it!?

Right now, I think the stock is sitting at the perfect spot to revisit it once again.

First, look at this chart over the last few weeks…

You just won’t find many other charts like this right now.

This is pure bullish momentum, and volume has been building as the price has gone higher.

Are we witnessing a short-squeeze, or some serious “big money” buyers coming back?

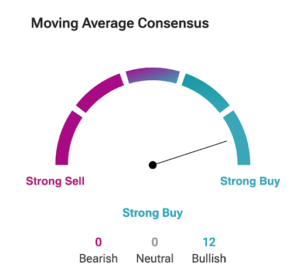

TipRanks tends agree with this trend analysis and shows nothing but “STRONG BUY” on their hourly technical analysis model right now…

Remember, VUZI was one of Kathy Wood’s favorite stocks a few years ago. Of course, she sold it near the bottom and the stock has rallied since.

Remember, she also dumped her NVDA position near the lows, and missed a nearly 500% rally afterwards… ouch!

The chart above shows the hourly price action (which is my personal favorite) but also look at the daily below. You’ll see VUZI just flipped to a powerful strong blue “GO” signal.

A big part of the rally yesterday was due to a press release they released.

VUZI received a six-figure revenue production order from a major US-based defense customer for customized waveguides to enable a lightweight heads-up display.

The order is a result of Vuzix’s development efforts with large defense contractors and demonstrates the company’s unique position as a US-based designer and manufacturer of waveguides and related technologies.

It’s obviously one more massive step ahead for this company’s rebuilding process.

I think the biggest game-changer happened on September 3rd, however.

That is when VUZI announced a $20M investment from Quanta Computer, a global Fortune 500 company with more than $35 billion in consolidated revenue in FY 2023.

$10 million of that investment arrived on September 16 in above-market share purchases, and two additional $5 million installments “will be subsequently done at the higher of $1.30 per share or a 30-day VWAP (volume-weighted average price).”

The deal marks a strategic partnership with Quanta “to jointly develop new AI smart glasses and manufacture waveguides at scale for both Vuzix’ and Quanta’s customers.”

Quanta’s vice president Frank Chuang said the investment is “a strong endorsement of our partnership.”

If you aren’t familiar, VUZI is a designer and manufacturer of smart glasses and augmented reality (AR) technologies for the enterprise, medical, defense, and consumer markets.

Unlike Meta’s gaudy Orion glasses or Apple’s new Vision Pro goggles, VUZI produces subtle, lightweight glasses that can be worn comfortably all day long, and that don’t make the user look like a cyborg.

Many of its glasses are indistinguishable from popular styles of Ray-Bans or Oakleys:

Vuzix’s Z100 smart glasses.

VUZI has been around since 1997, and it really is the “first mover” in the smart glasses space. As a result, it holds 375 patents and pending patents on critical technologies such as waveguides, mechanical packaging, and optical systems.

Waveguides are thin optics that are fully transparent but that guide light waves along specific paths so a user can see overlays on the real-world scene.

Vuzix’s waveguide-equipped glasses can pair with a cell phone via WiFi or Bluetooth, enabling limitless applications.

Already, its glasses are used in healthcare, manufacturing, and field service. They’re used by the hearing impaired and for real-time language translation.

But with the dawn of artificial intelligence, the potential of VUZI’s glasses has exploded.

As a Forbes writer put it in a December profile on VUZI, “Given enough time, something assuredly will supplant the smartphone someday… and it’s not a bad bet to believe wearables, AI, and AR will band together to lead the revolution towards a new regime.”

Over the years, the company has subcontracted for Raytheon, contracted with DARPA, received a $25 million investment from Intel, and partnered with BlackBerry.

Today, it boasts substantial investments from Cathy Wood’s Ark Investment, Blackrock, Vanguard, and Citadel.

In December, VUZI cut the ribbon on its state-of-the-art waveguide manufacturing facility in Rochester, New York, which can produce as many as one million waveguides per year in its current configuration, and there is additional room for expansion.

Unlike the expensive silicon carbide lenses that boost Meta’s Orion prototypes to about $10,000 per pair, VUZI’s lenses are vastly less expensive.

The Z100 smart glasses pictures above retail for just $799.99, for instance.

VUZI’s revenues have softened a bit in recent quarters but press releases over the last several months reveal it has many very hot irons in the fire that could ramp up revenues dramatically:

- April 4: The company received “additional orders” from two aerospace and defense firms “to further develop and deliver waveguide-based display solutions in 2024.”

- April 23: VUZI revealed orders from a Fortune 100 company for its M400™ smart glasses.

- May 14: It announced a “multi-phase development contract with Garmin for next generation nano-imprinted waveguide-based display system.”

- June 3: Vuzix received a Smart Business Innovative Research (SBIR) Phase I contract from the Air Force to “begin developing and supplying innovative waveguide and [head-mounted display] capabilities.”

- June 13: VUZI announced a “significant leap forward in display technology” with the production of large format waveguides “which can range in diagonal size from several inches to several feet or more.”

And that’s not to mention its new strategic partnership with Quanta.

In a letter to shareholders this month, VUZI CEO Paul Travers wrote that “As of mid-2024, we had $10 million in cash, with an additional $10 million from Quanta, plus $10 million more expected to follow in 2025. Combined with top-line growth and cost-saving measures, we are confident in our operational runway through at least the end of 2025.”

A February article at InvestorPlace columnist included VUZI as one of “3 Companies Ready to Beat the Odds,” reasoning that “fundamentally, as a technology enterprise focused on wearable virtual reality and augment reality display innovations, the company stands on fertile ground.”

I think there’s a great fundamental case to be made for VUZI, but as always, be sure to do your own research and approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: VUZI has been off to the races since its big September announcement, and any number of its irons in the fire — whether with DoD, Garmin, Quanta, or others — could turn into serious additional revenue.

The go/no go algo is lighting up like a Christmas tree and I think we could be in store for serious momentum today.

Be sure to keep VUZI at the very top of your radar, and let’s see where it goes!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we were paid twenty five thousand dollars (cash) from Sica Media for advertising Vuzix Corporation for a one day marketing program on November 26, 2024

Prior to that we received twenty five thousand dollars (cash) from Sica Media for advertising Vuzix Corporation for a one day marketing program on October 24, 2024, and also twenty five thousand dollars (cash) from Sica Media for advertising Vuzix Corporation for a one day marketing program on October 10, 2024 and also twenty thousand dollars (cash) from Sica Media for advertising Vuzix Corporation for a one day marketing program on August 12, 2024. Previously, we received fourteen thousand dollars by ach bank transfer by Lifewater Media for advertising Vuzix Corporation for a one day marketing program on April 27, 2023. These amounts were paid by someone else not connected to Vuzix Corporation. It might be obvious, but whoever paid for this might own shares and is likely looking to sell some or all of them at any time after we send out this information, which might affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into Vuzix Corporation might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.